In the chaos over Powell’s unexpectedly less dovish comments which hit the tape at exactly 1pm, when sent stocks lower, and the dollar and bond yields sharply higher, the primary market had no time to react as it had already submitted its indications for today’s $40 billion 2 Year auction when Powell suddenly pulled the rug from under the bond market, sending 2Y yields higher and yet since there was solid demand for the auction before Powell’s commentary, the sale of 2Y bonds was a smashing success, stopping at a high yield of 1.695%, 1bp inside the 1.705% When Issued, the 6th consecutive 2Y auction that did not tail. This was the lowest 2Y yield since October 2017, and 43bps below May’s 2.2125%.

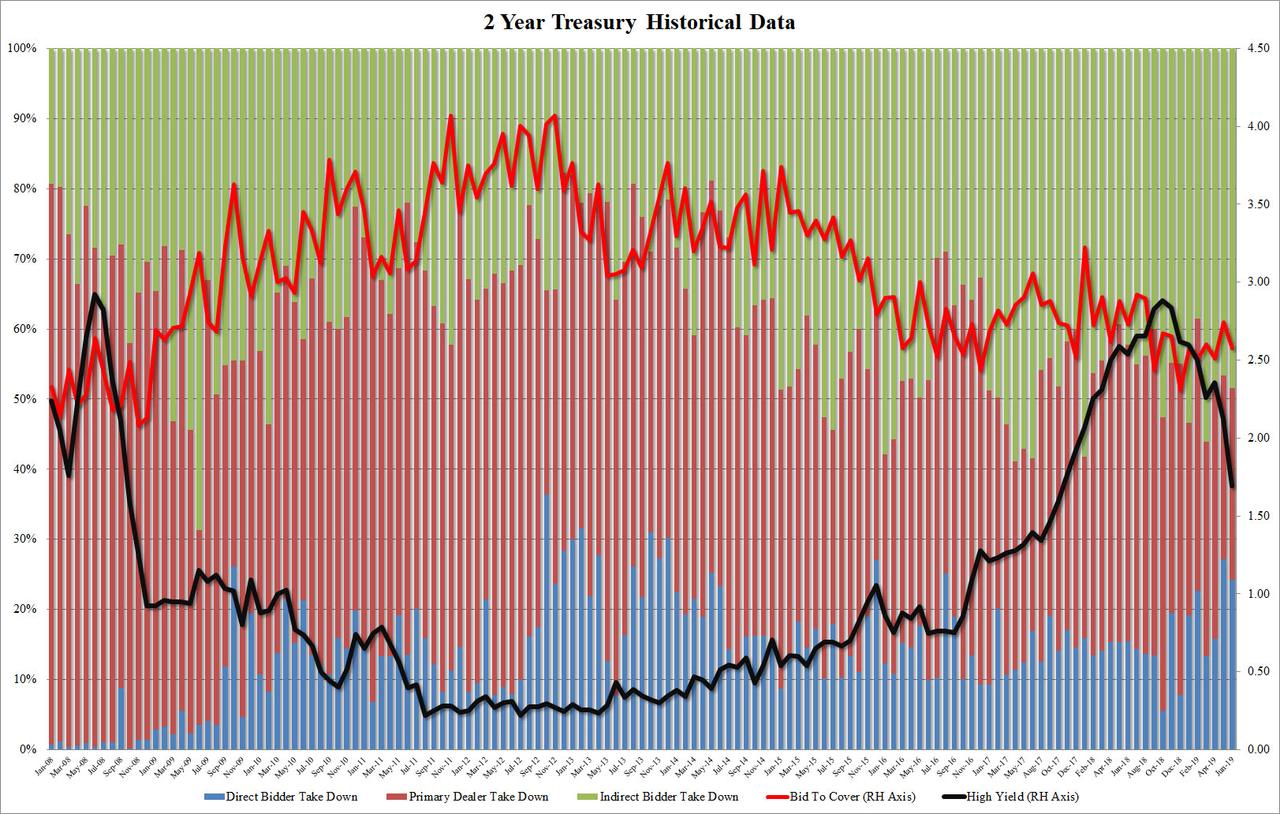

The bid to cover came in at 2.576, modestly lower than May’s 2.745, if just above the 2.54 six auction average.

Finally, the internals were unremarkable with foreign buyers, i.e. Indirects taking 48.5% up from 46.6% last month, and on top of the 47.9% average. And with Directs taking down 24.2%, well above the 17.7% average, Dealers were tstuck with 27.3%, modestly above May’s 26.2 but only the second lowest print of 2019.

Overall, a very strong auction which could have had a far different outcome if Powell’s prepared remarks had hit just an hour earlier.

via ZeroHedge News http://bit.ly/2FAi8MG Tyler Durden