Earlier today, Austria priced only its second 100-year bond in history at a shocking yield of just over 1.00%, prompting financial commentators to ask “what fresh madness is this.” Alas, it’s no madness, and is in fact perfectly rational behavior by investors in a world where central banks have pushed $13 trillion in debt to negative yields, forcing investors to buy anything that still yields above zero (or zero, as is the case of gold and cryptos).

Alas, this forced herding of investors into the clutches of debt at any cost will end up with catastrophic consequences – as Bloomberg cautions today, with investors scrambling to pick up any last trace of yield in response to idiotic easy-money policies, a trillion-dollar monster is foming in the bond market, “the likes of which has never been seen in decades of history.”

The reason: so much debt has been sold at low yields that even a modest bump in yields near record lows “could inflict a world of pain for traders the world over.”

The technical terms for all this, of course, is “duration – the measure of sensitivity to interest-rate changes – and specifically duration which is now at never before seen highs for sovereign debt.

This means that even the smallest inflationary or growth impulse – like a favorable outcome from Saturday’s G-20 meeting – could send long-end yields surging, resulting in the mother of all VaR shocks, as banks take record mark-to-market losses on their portfolios.

It’s also why for some investors, buying duration – i.e., long-maturity debt – is now recipe for career suicide. Some, such as Thomas Graff, say that “buying duration isn’t a great trade anymore.” The head of fixed-income at Brown Advisory said that curbing exposures to longer-dated risk since big bets are already priced into markets, including U.S. rate cuts. “Even if we are heading toward a place of lower rates – or even if the current range is a kind of normal – it’s not going to be a one-way train.”

Well, it has been a one-way train for now, the question is what happens when it reverses, and how quickly will the “weak hands” puke, resulting in the biggest MTM losses in bond history.

That said, not everyone is a skeptic: bond giants such as Pimco, Amundi and Lombard Odier Investment Managers don’t see longer-term premiums awakening from their slumber anytime soon… or rather, they are just talking their books.

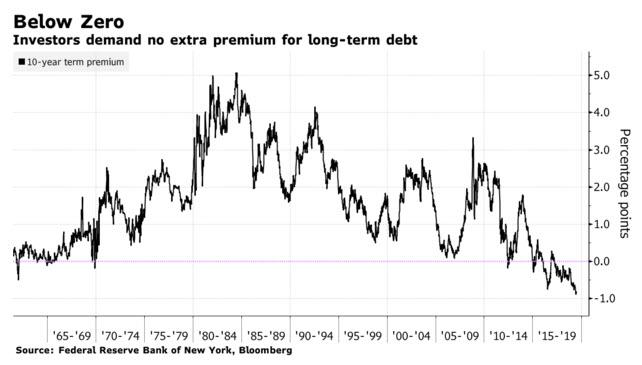

Meanwhile, as duration hits all time highs, the index of compensation investors demand to hold longer-term Treasuries versus rolling over short-dated obligations, known as the term premium, is near record lows “underscoring the intense conviction in the low-rate, lowflation era in markets” according to Bloomberg. The situation is so insane that the asking yield on Swiss bonds due 2064 even fell below zero percent last week.

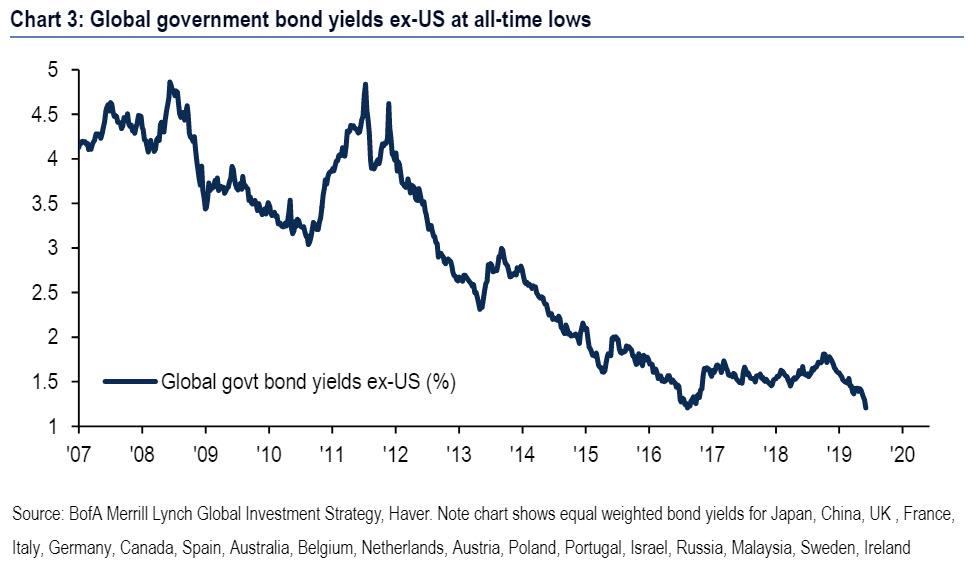

Meanwhile, as global yields have plunged to the lowest on record, rate shorts have gotten pulverized.

And while the bulls are gloating, even a modest increase in rates would result in catastrophic losses: with the Macaulay duration on the Bloomberg Barclays sovereign-debt index at a record high of 8.32 years, this translates into a DV01 of $24BN, meaning just a one-percentage-point increase in yields would translate into a $2.4 trillion loss – enough to launch a new financial crisis if banks are forced by their regulators to make good for the paper shortfall.

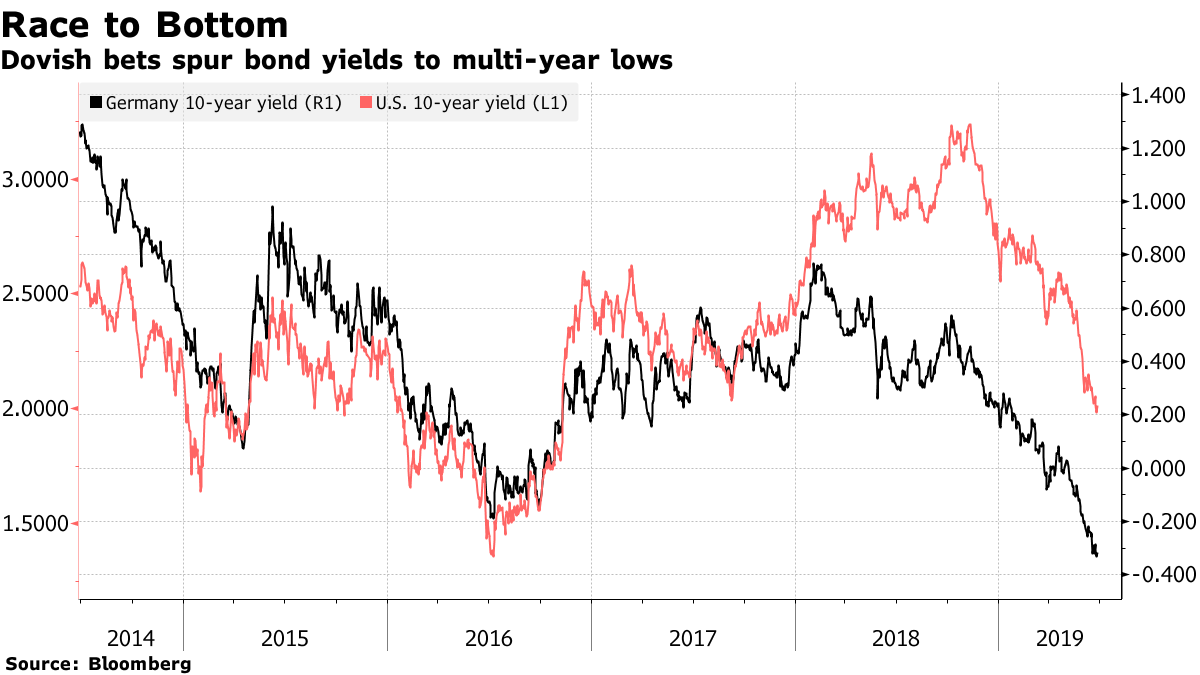

For now, however, there are no gray swans in sight, as the world continues to slowdown, perversely because the world has too much debt to grow at historical rates. In fact, the more debt there is, the lower the interest rates have to be. And that’s exactly what we have been seeing across 10Y yields in the US and Germany.

That said, there is one risk on the horizon as the world slides into Albert Edwards’ deflationary ice age, that may reverse the latest dovish tsunami by the world’s central banks: The prospect of easing tensions in global commerce; that’s what is keeping Pimco from duration overweights, despite the firm’s conviction that the Federal Reserve is at the peak of its hiking cycle.

“We are broadly neutral in the near term as there’s still a lot of uncertainty,” Nicola Mai, a portfolio manager at Pimco in London, told Bloomberg. “The Fed might stay on hold if there is positive development.”

Lombard Odier, however is more pragmatic, seeing any brief inflationary spikes as just a detour from a deflationary singularity and will trade any rise in yields as a buying opportunity.

“Rates sell-offs are a bigger risk when we get tightening,” said Salman Ahmed, the firm’s chief global strategist. “In the next few months, we are likely to see almost every central bank easing.”

Meanwhile, Bloomberg notes that at Amundi Asset Management in London, extended duration in the market isn’t keeping Laurent Crosnier awake at night. But he’s pondering a longer-term tail risk: Central-bank impotence in boosting growth could even spark a sell off one day.

“At one point the market may start challenging central banks about the effectiveness of their monetary policy,” said the chief investment officer. “They may start pricing in credit risk, and that’s going to push yields higher.”

Ah yes, but as JPMorgan said over the weekend, central banks losing control would result in a far greater plunge in stocks, and where will investors park their proceeds? Why in bonds of course (as well as gold and, increasingly cryptos).

via ZeroHedge News https://ift.tt/2YlrRhi Tyler Durden