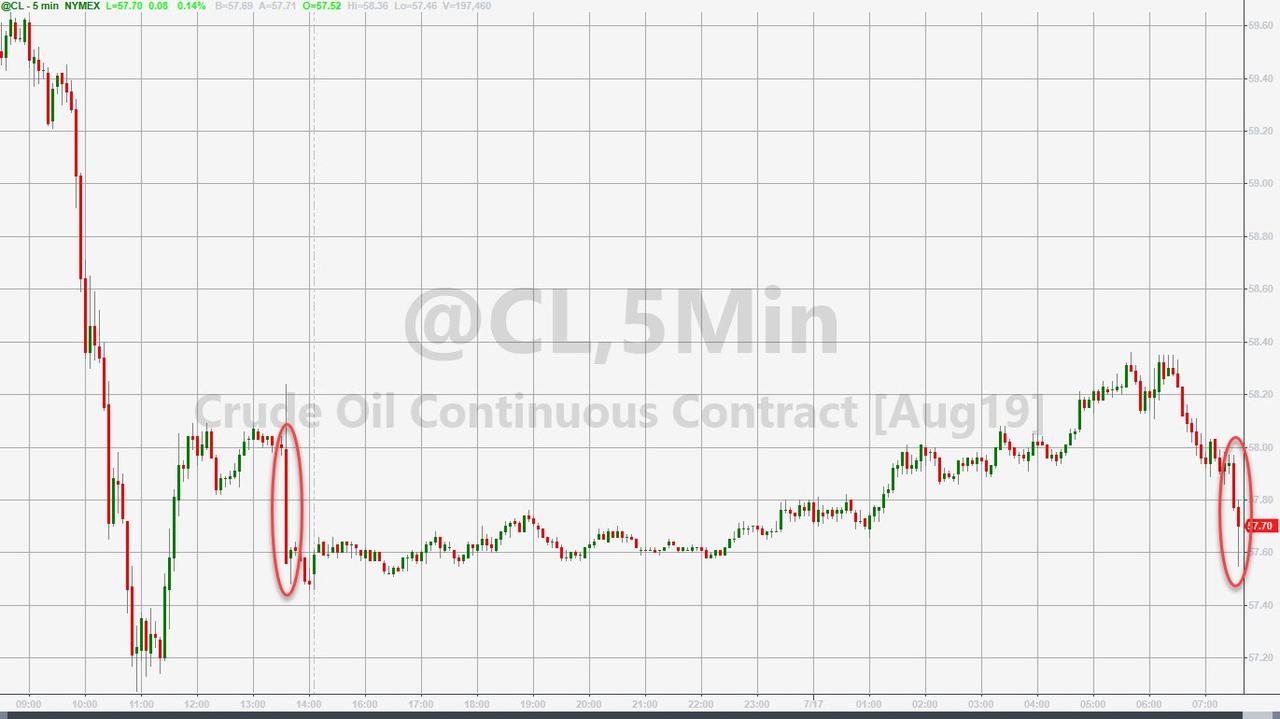

Oil prices reversed some of the losses from yesterday (geopolitical risk reduction and a surprisingly small crude draw from API), pushing WTI back above $58 briefly ahead of this morning’s official inventory data.

“Crude oil has clawed back a small part of what was lost yesterday when the White House created uncertainty on both the supply and demand side,” said Ole Hansen, head of commodities strategy at Saxo Bank.

“The API number from yesterday points towards a limited amount of fireworks later with focus turning to product stocks with a big jump in distillate stocks expected.”

API

-

Crude -1.401mm (-3mm exp)

-

Cushing -1.115mm

-

Gasoline -476k

-

Distillates +6.226mm – biggest build since Jan 2019

DOE

-

Crude -3.12mm (-3mm exp)

-

Cushing -1.351mm

-

Gasoline +3.57mm

-

Distillates +5.686mm – biggest build since Jan 2019

Crude inventories fell for the 5th week in a row but investors were surprised by massive product builds (biggest Distillates build since January)…

US Crude Production slowed to its lowest since March (the surge has stalled) as oil rig counts have tumbled…

WTI was fading below $58 ahead of the official inventory data and pushed lower after the big product builds…

“Bullish catalysts are in short supply,” analysts at London-based broker PVM Oil Associates Ltd. said in a note to clients.

“The Gulf Coast of Mexico hurricane premium is fading as offshore operations in the region resume. At the same time, the U.S. shale engine continues to give oil bulls a sleepless night.”

via ZeroHedge News https://ift.tt/2xSQeHw Tyler Durden