Authored by Matthew Hornbach, head of interest rate strategy at Morgan Stanley

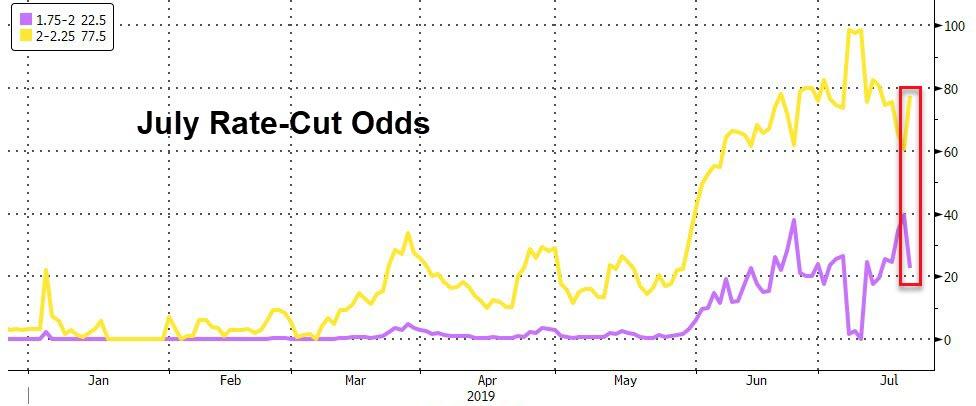

The Fed won’t be enjoying a lazy summer this year. Chair Powell has teed up monetary policy easing at the conclusion of the FOMC meeting on July 31. The consensus expectation among economists calls for a 25bp cut in the target interest rate, while we expect the Fed to deliver 50bp. The market is pricing an outcome somewhere in between, with fed funds futures implying around 30bp.

The debate over the size/cost of an insurance cut remains active, thanks to a spate of strong data (nonfarm payrolls, inflation, retail sales) that have been perceived, at least at the margin, as increasing the risk that the Fed under-delivers at its July meeting relative to our expectation. For those FOMC participants who are less inclined to act aggressively against downside risks, these data points could also argue against delivering more than 25bp.

The minutes from the June FOMC meeting revealed that 14 of the 17 participants saw downside risks to the growth and inflation outlooks. What’s more, in their assessment of downside risks to the economic outlook, participants noted factors including “recent weak indicators for business confidence, business spending and manufacturing activity; trade developments; and signs of slowing global economic growth”. Thus, the case for concern does not hinge on the labor market or the consumer, but more on external conditions, trade policy, and manufacturing.

Chair Powell also underscored this point in his most recent remarks in Paris on Tuesday, expressing concern about “trade developments and global growth”. It’s important to note that our US public policy strategists, led by Mike Zezas, have characterized the post-G20 environment for trade escalation as an ‘uncertain pause’, while our global economists, led by Chetan Ahya, see global growth slowing through 4Q19 with risks to the downside.

In June, FOMC participants were also increasingly concerned about the inflation outlook, based on recent low inflation readings, downside growth risks, and lower inflation expectations. The June CPI print then surprised to the upside, with positive implications for core PCE (where we expect an increase in the year-over-year reading to 1.66% from 1.60%). So inflation has moved higher, but does the June data point alter the fact that inflation has fallen short of the Fed’s 2%Y goal for two decades, let alone put a measurable dent in that shortfall – or even the decline over the past four months? Recall that the Fed’s goal is to create enough inflationary pressure that inflation stays above its 2%Y goal for a sustained period. That means running the economy hot.

While these factors easily support a rate cut at the July meeting, they don’t necessarily justify the magnitude we expect. We’d point out that in June seven FOMC participants suggested the need for 50bp of accommodation this year, even before the FOMC judged that global uncertainty had persisted beyond the G20 meeting. Based on recent comments from policy-makers, we believe this number has grown. As such, we think the FOMC will be debating when to deliver 50bp of accommodation, as opposed to whether circumstances call for only 25bp.

Will the Committee cut by 50bp all at once, or in a gradual fashion reminiscent of the recent tightening cycle? In this regard, we note a deeply held view among monetary policy-makers that near the zero lower bound the Fed must act aggressively when low inflation or a downturn threatens. The message to policy-makers today? Don’t keep your powder dry. In addition, our own simulations have shown that, in terms of a positive impact on the economy, 25bp in cuts is a rounding error, while 50bp might be enough to mitigate the downside risks we face today.

Putting to one side their desire for aggressive action, current market pricing indicates that market participants won’t see a 25bp cut as aggressive. And that could result in tighter financial conditions than those in place today. To date, such conditions have helped to “sustain the economic expansion, with a strong job market and stable prices, for the benefit of the American people”. The recent labor market and inflation reports and retail sales data confirm this. Would policy-makers want to put those accommodative financial conditions at risk by delivering the 50bp they deem appropriate gradually? We doubt it.

via ZeroHedge News https://ift.tt/2O9FG1A Tyler Durden