When Ray Dalio issued a public warning last week that in the coming “new paradigm” investors will be forced to buy gold while selling stocks, which “are unlikely to be good real returning investments and that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold”, many accused the manager of the world’s largest hedge fund of hypocrisy at worst, and talking his book at best, namely that he was pitching gold even as he was going ever longer stocks.

It turns out he wasn’t, and in fact Dalio appears to have been putting his money where his skeptical mouth was; 4.9% less money than he had at the start of the year to be precise, because according to the FT, Bridgewater’s flagship (non risk-parity) “Pure Alpha” fund suffered one of its worst first-half performances in two decades this year after being whipsawed and wrong-footed by rebounding markets.

The $150 billion Bridgewater saw its Pure Alpha fund, which is the discretionary fund whose returns are linked to macroeconomic forecasts and trades, lost a whopping 4.9% in the six months to June even as global equity and bond markets soared on hopes of looser monetary policy, with the S&P posting one of its best first half returns in history; Bridgewater not only underperformed the FTSE All-World index, which up 15% by the end of June, but also its peer group, as the average macro hedge fund returned 5.2% over the same period according to HFR.

The startling underperformance followed a strong year for Pure Alpha in 2018, when the clearly bearish biased fund delivered a net 14.6% return, even as most other hedge funds lost money.

Still, as the FT notes citing a source, Bridgewater has reportedly pared some of its earlier losses, and was down 1.45% cent in the year to mid-July, implying a solid rebound in the first two weeks of the month.

While it is unclear which trades hit Bridgewater, the FT notes the fund’s particularly poor performance in January when Pure Alpha declined by 4.5%, suggesting it went into the new year expecting further turbulence and instead suffered as the market recovered on the back of a shocking reversal by central banks.

Some have also suggested that Bridgewater was one of the whales hit by the stunning reversal in the Eurodollar market in recent months, as rate cut odds soared in the past two months.

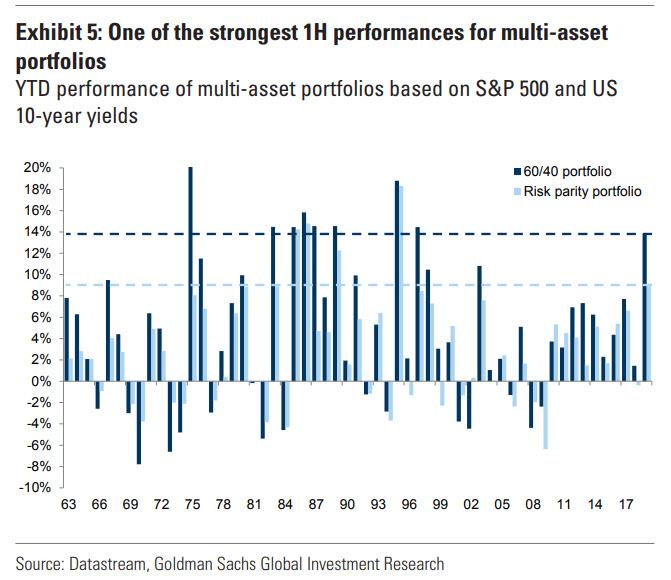

Meanwhile, offsetting much of the Pure Alpha losses, Bridgewater’s passively managed All-Weather fund, which unlike Pure Alpha is immune from macro-economic shifts and is instead a risk-parity, “balanced” fund, returned 13% through June, which was to be expected in a year where both stocks and bonds have soared, resulting in the best returns for risk parity funds in over two decades.

As the FT reminds us, Pure Alpha also had a difficult start to the year in 2009 and in 2016, according to data seen by the FT, but managed to claw back its losses in the second halves of those years. It was unclear if the Pure Alpha fund was still positioned bearishly as of this moment.

via ZeroHedge News https://ift.tt/2YkRJwN Tyler Durden