Authored by David Robertson via RealInvestmentAdvice.com,

How to survive the market’s ups and downs. This is what everyone wants.

In normal circumstances it is common to do a lot of things with little conscious thought or effort — almost as if on autopilot. When something disturbs that normalcy, however, we need to start paying attention in order to navigate the new situation successfully.

The recent turbulence in the market, then, creates an excellent opportunity for investors to start paying attention and freshly assess the situation. That effort can certainly be advanced by learning more about the investment landscape, but it also helps to incorporate some principles for managing adversity in general.

While the path for stocks since 2009 can be characterized as a fairly smooth recovery, that path has included considerably more volatile swings over the last year and a half. A dismal fourth quarter in 2018 led to a rapid and persistent recovery through 2019 and then a punishing selloff in the first quarter of 2020.

It’s Only Natural

It’s only natural that investors might try to understand what is going on. Indeed, John Authers reports in his “Points of Return” note for Bloomberg Opinion from April 27, 2020 that interest in the keyword “investment book” rocketed higher over the last couple of months to a level that is double that of last year.

While it is certainly healthy to want to learn about investing, it takes a lot of time and experience to develop meaningful expertise. Alternatively, investors can learn some extremely useful principles from Laurence Gonzales in his book, Deep Survival. I have had it on my shelf for years and regularly refer to it. Further, Michael Mauboussin recently highlighted it on Twitter as “an awesome book” and one that is “especially relevant in these times.”

Gonzales wrote the book because he was fascinated by cases of “otherwise rational people doing inexplicable things to get themselves killed — against all advice, against all reason.” After a great deal of research, he found a number of principles that “apply to wilderness survival,” but that also “apply to any stressful, demanding situation …” As a result, his lessons are also extremely useful for investors as well.

Gonzales introduces us to his research with an interesting notion. He declares, “What we call ‘accidents’ do not just happen. There is not some vector of pain that causes them.” In other words, not only do we often play a key role in facilitating our accidents, such situations often have identifiable signatures that mark them as dangerous situations to be avoided.

Iffy Environments

Much of this starts with how we try to make sense of the complicated world around us. One of the key strategies is that we construct mental models. Gonzales describes these as “stripped down schematics of the world.”

While mental models help us manage complexity, we also routinely make mistakes with them. A common mistake is to falsely attribute success to skill. Gonzales describes:

“If you’ve tallied a lot of experience in dangerous, iffy environments without significant calamity, the mental path of least resistance is to assume it was your skill and savvy that told the tale.”

Many investors today have succeeded in the stock market by ignoring or downplaying evident risks. Not only have they avoided significant calamity, but they have been rewarded by impressively appreciating stocks. Such an extremely benign investment environment conditions investors and makes it easy to attribute skill as the primary cause of success.

Lack of experience also presents its own set of hazards for constructing appropriate mental maps. If we have no experiences with bear markets or avalanches or whatever the hazard may be, we don’t know what markers to keep an eye out for. Gonzales points out, “for most people who are raised in modern civilization, the wilderness is novel, and full of unfamiliar hazards.” True enough. And the investment world is full of unfamiliar hazards as well.

It is also important for mental models to change with the circumstances in order to be useful. Part of this is simply recognizing when things change. Gonzales describes a working definition of being lost as “the inability to make the mental map to match the environment”. If you aren’t paying attention, it is easy to wander astray.

When You’re Lost

It also matters what you do when you’re lost. The best thing to do is to recognize that you are lost, stop, and reassess. Some people refuse to accept the reality in front of them, however, and instead try to “make reality conform to their expectations.”

In short, mental models must be kept up to date. On this point, Gonzales pulls no punches: “Some people update their models better than others. They’re called survivors.”

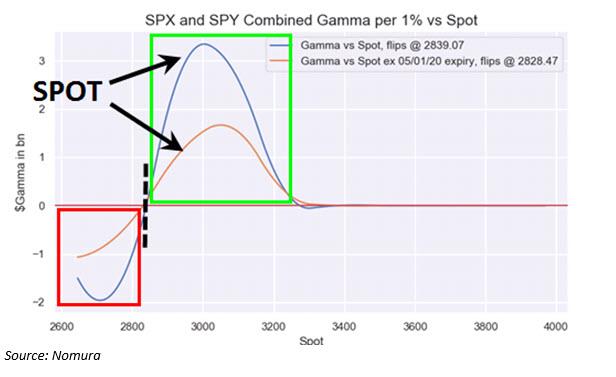

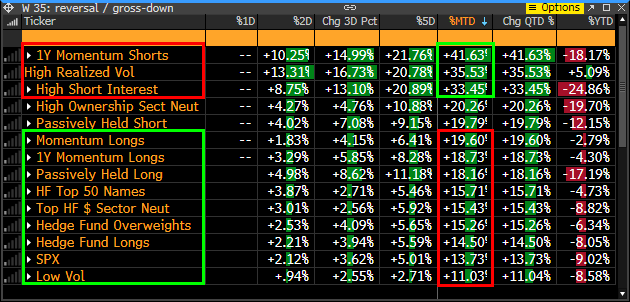

It is easy to see how many of these lessons can be applied to the investment landscape. Investors who were not tracking the divergence between stock prices and economic reality didn’t recognize the fragility of market conditions earlier this year. Investors who were not following shadow banking and the eurodollar system didn’t see important warning signals in the fall of 2018 and the fall of 2019. The Fed has repeatedly resisted acknowledging model failures and instead has tried to make reality conform to its expectations.

Further, our physiological reaction to stress often makes difficult challenges even more so. Gonzales highlights that “most people are incapable of performing any but the simplest tasks under stress”. The reason is that stress impairs our capacities of “perception, cognition, memory, and emotion.” As a result, it is often when we are in most need of all our faculties that they are the least accessible. Gonzales describes:

“But it’s easy to demonstrate that many people (estimates run as high as 90 percent), when put under stress, are unable to think clearly or solve simple problems. They get rattled. They panic. They freeze.”

In a sense, then, the selloff in February and March may have done investors a favor. The stress induced by such a selloff simply can’t be replicated by abstract discussions or by questionnaires on risk tolerance. As a result, the selloff may have provided something like a stress simulator.

Getting Rattled

Did you get rattled? Did you panic? If that happens, it is important to realize that “you’re not all there.” It is a terrible time to try to figure things out. Because investors can’t be all there in a moment of stress, it is all the more important to plan ahead and prepare.

As it turns out, Deep Survival also serves as an extremely useful guide for such preparation by sharing tips for staying out of trouble and for dealing with trouble when it comes.

One important thing to do is “Get the information” about “hazard zones”. Knowing where trouble is especially likely to crop up is an important part of the battle. Gonzales adds, “Avoiding accidents, avoiding survival situations, is all about being smart.” He continues, “A deep knowledge of the world around you may save your life.”

When trouble does arrive, it is extremely important to “Take correct, decisive action”. As Gonzales explains, “Survivors are able to transform thought into action. They are willing to take risks to save themselves and others.” Obviously, this is difficult to impossible for people who have a tendency to panic or freeze in stressful situations.

While it is important to “Do whatever is necessary”, it is also important to be realistic. Gonzales notes: “Survivors have meta-knowledge: They know their abilities and do not over- or underestimate them.”

Another point that is important in surviving adversity is that it is critical to let go of the past. This can be especially hard for investors who savor paper investment gains (and everything they imply) but cannot accept when those gains become losses. Gonzales notes, “The best survivors spend almost no time … getting upset about what has been lost, or feeling distressed about things going badly.”

An important silver lining in these studies of survival, and one that should hearten investors, is that making it through difficult situations normally does not require absurdly high skill sets:

“You don’t have to be an elite performer [to survive]. You don’t have to be perfect. You just have to get on with it and do the next right thing.”

Key Tips

Helpfully, there are a couple of key tips for successfully navigating any potentially hazardous situation. One is, “Be here now. It’s a good survival rule. It means to pay attention …” In other words, be actively engaged in assessing and evaluating your environment. Many investors only check in periodically, if at all, and miss fundamental changes to the landscape that happen gradually over time.

Another useful insight is that the “greatest skill [of people with strong navigational abilities] lay in keeping an up-to-date mental map of their environment.” This is something I always try to do with my blog posts and there are several commentators who also regularly provide useful updates and insights. It is all designed to help keep mental models up to date.

Needless to say, the insights from Deep Survival have some broader implications for investors. One is that a number of investors are probably “lost” in this investment environment and need to get reoriented in order to avoid trouble. Many people were surprised at the violence and depth of the selloff in March and they shouldn’t have been. In addition, John Hussman observed recently, “My sense is that investors remain disoriented about where they actually are in the cycle.”

Another implication is that investors should be thoughtful in drawing on resources to orient, or re-orient, themselves. After the financial crisis in 2008, several investors shunned Wall Street research as being far too conflicted to be useful. As a result, many investors embraced new and independent research services and used them to inform a DIY approach to investing. Other investors stuck with very conventional asset allocations constructed with passive funds.

Conclusion

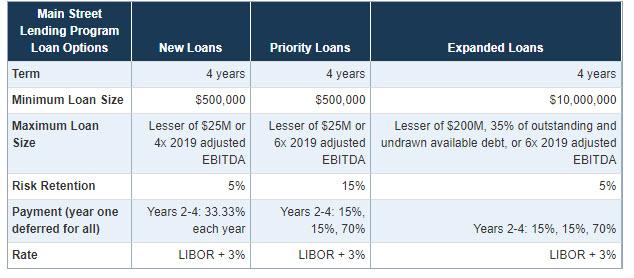

Both approaches worked fairly well for as long as the market kept going up. With far more problematic challenges for stocks in the context of Covid-19 lockdowns, investors face greater challenges than they have for over ten years.

Interestingly, Mike Green made a point to highlight the concept of “adult swim” in an April 8, 2020 interview on Realvision. He meant that there are certain investment vehicles that should only be employed if you have an excellent understanding of the risks. The same is true of the environment for stocks right now – this is adult swim – and a lot of investors and advisors will find out the hard way.

Finally, there are ups and downs in markets and then there are events that can really cause investors harm. The best course is to avoid trouble from the start but that requires effort, knowledge and awareness. The recent turbulence creates an excellent opportunity to freshly assess the situation and get models up to date.