Authored by Charles Hugh Smith via OfTwoMinds blog,

When the top 10%’s bubble pops in 2021, the loss of illusions/delusions of security and wealth will be shattering to all those who believed artifice and illusory “wealth” were real.

A great many people are living in bubbles that are about to pop. The largest bubble is the one inhabited by people who complacently believe in time travel, i.e. that the world of 2019 is about to replace the nightmare of 2020 and we can all go back to our carefree debt-funded consumption frenzy and illusions of ever-greater wealth forever and ever.

The greater one’s sense of security, the more durable the bubble. Those in America’s top 10% who have reaped virtually all the gains in income and wealth of the past 20 years live in a bubble that they view as unbreakable: no matter what problems arise, their personal income and wealth is secured by the government, central bank, etc.

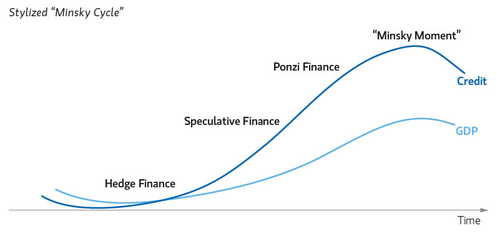

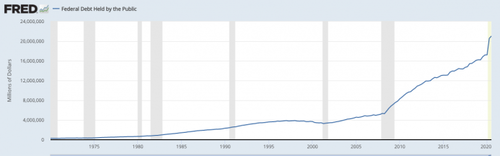

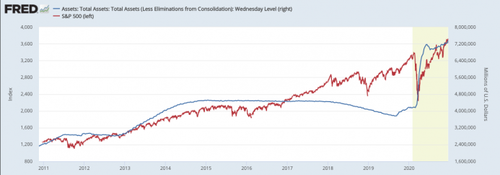

Put another way, the top 10% are confident their position atop the wealth-power pyramid is secure no matter what happens. Any dip in stocks, bonds, real estate, bat guano futures, etc. that causes their personal wealth to decline (horrors!) will be instantly bought because the Federal Reserve will print another couple trillion dollars and funnel it into risk assets, as it has done for the past 20 years.

Any spot of bother in the gravy trains that fund the top 10%–local and state government, universities, Big Tech, Big Pharma, Department of Defense, Wall Street, hedge funds, venture capital, etc.– will be doused with trillions of dollars borrowed or printed into existence by the Treasury or Fed. No matter what spot of bother arises, the solution–more trillions–is just a few keystrokes away.

The top 10% are supremely confident in the godlike powers of these agencies and solutions: the idea that these “solutions” become insoluble problems does not compute, just as a decline in asset valuations that doesn’t rebound within three weeks thanks to Fed intervention is firmly outside the realm of possibility.

The top 10% are also supremely confident in the rightness of their position atop the heap. That their position atop the heap is largely the result of a web of privilege and a long run of extraordinarily good fortune does not enter their bubble at all; in their bubble, their wealth, status, prestige and income are all the result of hard work and merit.

While this is certainly true for some, it is not true for all, and even those who scraped their way to the top the hard way do not recognize that their success over the past 20 years (and arguably the past 50 years) has been largely the result of a financialized rising tide raising all boats. In a Bull Market in virtually everything (except commodities), everyone is a hard-working genius who got it all via merit.

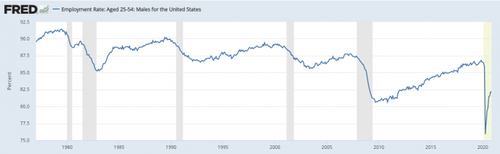

On top of this myopic belief that their success is all the result of their own endeavors rather than a tide of financialization, the top 10% are equally blind to the toxic consequences of the wealth/income inequality that has so richly benefited the few at the expense of the many. The idea that the bottom 90% might rebel against the financial / political system that has favored the already-wealthy for a generation is outside the top 10%’s realm of possibility.

But tides do not run in one direction forever, and a revolt against the unprecedented inequality that heavily favors the top 10% is not “impossible,” it’s a certainty. The top 10% are accustomed to being admired and respected for their accomplishments, expertise, wise investing and professional acumen. They are accustomed to viewing themselves as the essential technocrat class that keeps the U.S. system functioning.

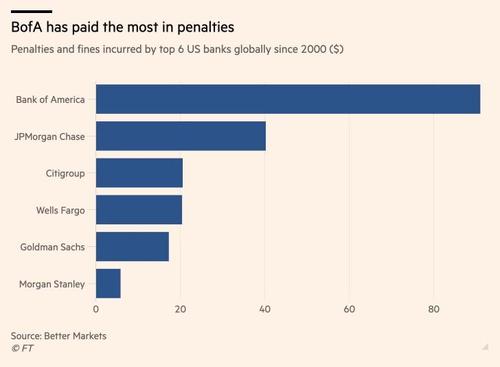

The problem with this self-congratulatory perspective is the U.S. system is now in thrall to process rather than results. The technocrat class has been trained to follow needlessly complex procedures and compliance processes as the path to professional advancement while avoiding accountability for the increasingly dismal results of America’s bloated, sclerotic, insider-dominated systems.

All this needless complexity will be jettisoned once printing/borrowing trillions become the problem rather than the solution. The bottom 90% will demand not just a fairer distribution of income and wealth, they will also demand a system that actually functions for the greater social good rather than for insiders, parasites, leeches and technocrat processors who declare victory not from results but from their success in following approved processes / narratives.

Once costs must be cut and results take precedence over process, much of the technocrat class will find itself replaced by automated software. Those that remain will be valued for getting results by whatever means are available, up to and including ignoring all compliance procedures and bureaucratic box-ticking.

The top 10%–the rentier-technocrat class–will find the bottom 90% can no longer pay their rent, insurance, etc.–all the “services” that employ and enrich the top 10%. In other words, the losses as unproductive complexity unravels will finally fall on the top 10%, many of whom have been protected from exposure to market forces and risk.

Lastly, the top 10%’s ownership of assets will be crushed by asset deflation as insolvency can no longer be papered over by liquidity. Assets that are the foundation of top 10% wealth (that the bottom 90% own very little of) will go bidless as phantom wealth dissipates into the thin air from whence it came.

The top 10% reckon they’re untouchable, safe and protected in their asset lifeboats, and the sinking of the 90% won’t affect them. The top 10%’s bubble is about to burst. Not only will their lifeboats prove unstable, every level of government will come after whatever is left as taxes will soar on virtually every form of income and wealth.

Unlike the bottom 60%, who have few illusions about the rampant unfairness and predation of real-world America, the top 10%’s bubble is 90% illusion seasoned with 10% absolute delusion. The comfortable are about to experience some of the discomfort that is everyday life for the bottom 60%, and an increasing percentage of the next 30% who still aspire to fantasies of middle-class security will find social mobility is an escalator down.

We cannot print wealth, or borrow it into existence. All we can print/borrow is artifice, phantom representations of illusory “wealth” that will vanish into thin air, in a reverse of how the “money” was created–out of thin air.

When the top 10%’s bubble pops in 2021, the loss of illusions/delusions of security and wealth will be shattering to all those who believed artifice and illusory “wealth” were real. What’s real is the tide of financialization and globalization reversed over a year ago. The tide is now running out, but few loading their “wealth” into lifeboats have noticed…yet.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).