Chinese Banks Buy Dollars To Weaken Yuan In Latest Intervention

Just days after senior PBOC officials spoke up about moving to stabilize the yuan as it continued to strengthen against the dollar, Chinese banks have reportedly stepped in to buy dollars and sell the yuan in the open market, the latest in a series of interventions that are seemingly stretching the limits of Beijing’s authoritarian capability to control markets

Over the past month, reports about another crackdown on crypto trading and mining by Beijing sent prices of digital currencies reeling, while senior CCP officials have stepped in to forcibly cool speculation driving up commodity prices.

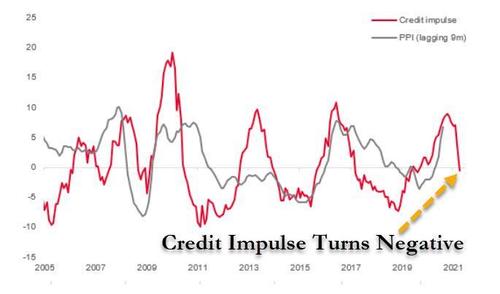

On top of all this, the weakening greenback has driven the yuan to its strongest level in nearly three years, hurting China’s competitiveness at a time when an ongoing state-ordered deleveraging has sent China’s all-important credit impulse into negative territory, limiting the outlook for growth just as the outlook for China’s economy is becoming increasingly important to the global narrative.

As for the interventions, a handful of traders told Bloomberg that large Chinese state-owned banks were selling yuan in the open market Tuesday. Despite this, and a weaker-than-expected yuan fixing, USD/CNY fell 0.3% to 6.4030, the yuan’s strongest level since June 2018.

Reports noted possible intervention in both USD/CNY and USD/CNH pairs at around the 6.4000 level in order to stem the yuan’s appreciation.

With month-end pressures building, driving the yuan higher, the intervention comes as the Chinese currency arrives at an important technical level that highlights just how much the yuan has strengthened during the dollar’s recent bear run.

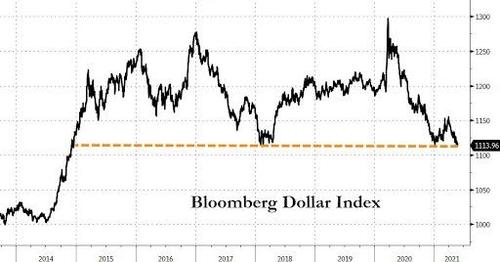

The dollar is also at a critical level…

…and looking ahead, a renewed currency war pitting China against the US and the dollar against the yuan could represent a fresh threat to market stability, as any reversal of the greenback’s recent weakness (which has, much to Beijing’s delight, sparked renewed talk of the greenback shedding its global reserve status) could upset several consensus trades (sell-side analysts have been writing about how “short dollar” is perhaps the biggest global ‘consensus trade’ for almost a year).

All this is happening as the impact of the credit tsunami unleashed in 2020 by Beijing to combat the COVID pandemic is fading fast as China’s credit impulse officially turned negative, threatening to send a deflationary shockwave across the globe.

The direct intervention comes just days after the PBOC signaled that it wouldn’t allow the yuan to strengthen too much, too quickly.

In a statement released Sunday, the deputy governor of the PBOC said the yuan would remain “basically stable,” while another central bank official wrote that the yuan should appreciate to offset the higher costs of commodity imports. However, that second essay, published in a state-backed magazine on Friday, has since been deleted, according to Bloomberg.

That Beijing is having trouble reconciling this is hardly a surprise. China’s economic nabobs now once again find themselves in the unenviable task of trying to control everything – fighting commodity speculation, a currency at a nearly three-year high, a crypto market that serves as a backdoor for wealth fleeing the country – and even the dominance of Chinese tech firms that have become so economically powerful, they have made President Xi and the rest of the senior leadership uncomfortable. And ultimately, Beijing is doing all this as it tries to pull a literal rabbit out of a hat: trying to spur economic growth while continuing to deleverage, while hampering the international competitiveness of its biggest tech companies.

Tyler Durden

Tue, 05/25/2021 – 10:45

via ZeroHedge News https://ift.tt/34dS7ib Tyler Durden