“An Absolute Shocker”: Core CPI To Hit 4% In Two Weeks?

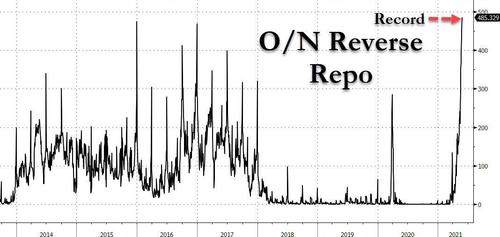

While pundits debate whether the record usage on the Fed’s reverse repo facility, which last week hit a record $485BN before easing back modestly…

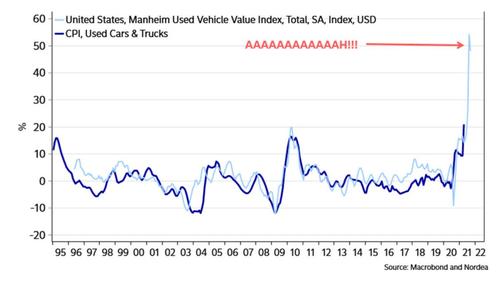

… will be the technical catalyst that forces the Fed to finally hike the IOER by 5bps at the June meeting (a move which Powell will repeat several hundred times is not indicative of the Fed’s broader monetary policy to avoid a panic puke), a bigger threat to the Fed’s overall (and overly dovish) monetary posture is that as Nordea wrote last week, there is a clear risk that the May inflation report published on June 10, “will prove to be an absolute shocker with used cars and trucks up by 50% year over year, and a potential further increase in the yearly increase in the rent of shelter component.”

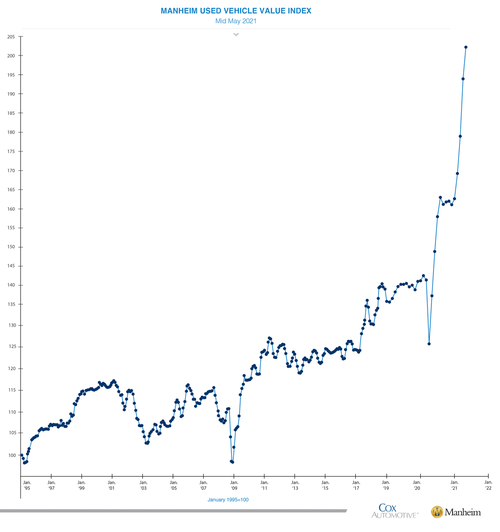

For those who haven’t seen what is going on in the used car space, here is a chart of the Mannheim used car index:

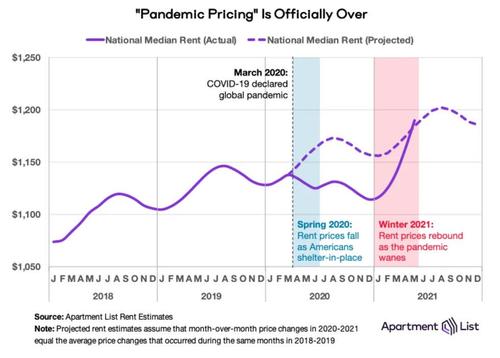

… and according to Apartment List, after a period of decline, nationwide median rents just surged by the most on record as this key component of the CPI and PCE basket suddenly explodes higher.

And here is the chart which prompts Nordea “not to rule out >4% core CPI inflation” in May, which will see the Fed’s “transitory inflation” world cave in as even Democrats politicians demand the Fed to start tapering.

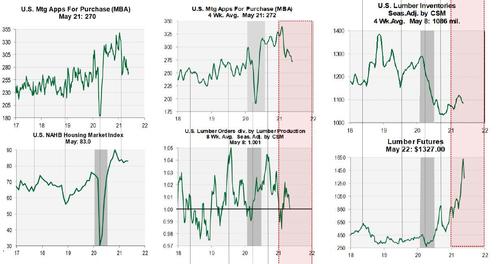

Or maybe not, because while by now it is all too clear that we will have at least several months of residual surges in most prices which according to the Fed are “transitory”, some are already focusing on the next leg lower in prices which has manifested itself in certain commodity prices as well as the broader housing sector, with analysts pointing to early signs that demand is moderating, and supply is starting to catch up, helping explain some cooling commodity prices, followed by a similar sequence in goods inflation. Two frequently cited example of the above include US mortgage apps/lumber, and China’s recent direct intervention impacting soaring prices in iron ore and copper.

Take lumber and housing for example: housing led the way in the broad virus-demand boom/virus-supply constraint pattern the economy experienced over the past year. This was confirmed by the data: lumber new orders surged above production, collapsing inventories and igniting a price surge reflecting lumber new orders increasing faster than supply. But now, production has caught up with orders, and lumber inventories have stabilized. Many economists – and certainly the Fed – expect this pattern to repeat elsewhere in the economy, as supply catches up with demand, and price spikes roll over.

Meanwhile, as discussed over the past two weeks, commodities have been under sharp pressure from Beijing’s heavy hand – particularly iron ore, and also copper – with Beijing repeatedly warning that commodity prices are too frothy. Indeed, China’s banking regulator has asked lenders to stop selling commodity-linked investment products to mom-and-pop buyers

It’s not just commodities, however: Beijing is also making it increasingly clear that it demands the Fed end its dovish ways (which are leading to soaring commodity price inflation in China) by the recent surge in the yuan. Indeed, while Beijing is publicly pretending to jawbone the yuan lower, the Chinese currency rose to a new cycle high, and on Friday the official Shanghai Securities News said the CNY “may gain past 6.2,” supported by the weakening dollar, and China’s strong domestic economic recovery, citing analysts.

So while the Fed is pretending that inflation is transitory, China – where commodity inflation has sparked widespread and very much non-transitory public anger in recent months – is taking matters into its own hands and is strenghtening the CNY to make imports cheaper, helping cool inflation, while making exports less competitive. Yet paradoxically, this action will also weigh on the USD, as China adds to its own price pressures.

Ultimately, the current untenable situation will necessitate another Shanghai Accord-type agreement between the world’s biggest economies, or the growing divergence in policy responses will end in chaos.

Tyler Durden

Tue, 06/01/2021 – 05:45

via ZeroHedge News https://ift.tt/3i4OqmP Tyler Durden