Oil Climbs As Blinken Says “Hundreds Of Sanctions” On Iran To Remain

After earlier this week US Secretary of State Antony Blinken somewhat pessimistically portrayed that it remains “unclear” whether Iran is actually willing to restore the nuclear deal, prompting angry words from Foreign Minister Javad Zarif who again pointed out that it’s only Washington not in compliance due to Trump-era sanctions which the Biden White House refused to “bury” in order to make a renewed deal possible, Blinken’s newest statements are pouring more cold water on all the recent speculation that prematurely hailed a Vienna agreement as imminent.

During a Tuesday hearing before a US Senate committee the US top diplomat was asked about his assessment of progress at Vienna, to which he frankly replied that hundreds of sanctions targeting Iran are likely to remain in place even if Iran and the United States return to compliance. “He said he would anticipate some sanctions would remain in place, including ones imposed by the Trump administration,” according to his words in RFE/RL.

“If they are not inconsistent with the JCPOA, they will remain unless and until Iran’s behavior changes,” Blinken testified before the Senate Appropriations Committee.

Lately the more enthusiastic and optimistic accounts of how things are going in Vienna have tended to come only from the Iranian side, as well as in some instances Russia. For example Iranian chief negotiator Abbas Araqchi indicated last week that this current round of talks could be “conclusive” and lead to a final agreement. Yet at the same time State Department spokesman Ned Price had said, “There are some hurdles that remain that we haven’t been able to overcome in those five rounds.” At sixth round is expected to start Thursday.

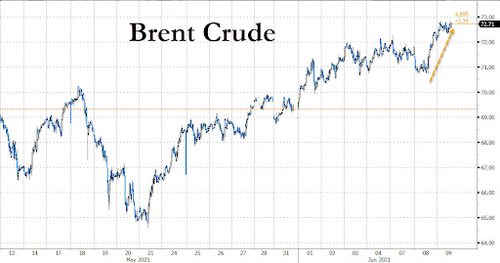

Upon Blinken’s Tuesday comments, and with the Iran deal now looking more elusive, oil prices have continued to climb this week, after at the start of the month US crude futures had reached their highest in over two-and-a-half years after the OPEC+ alliance forecast a tightening global market, coupled with the increasingly cautious statements out of US negotiators in Vienna over reaching a deal.

It was on Sunday that US oil prices hit $70 a barrel for the first time in almost three years, and have inched higher since, also amid predictions of $80 oil this summer – assuming no breakthroughs in Vienna.

As Goldman in analysis published last month forecast:

“…despite the global market deficit coming in line with our forecasts in recent months, we under-estimated the weight of such demand and Iran uncertainties, keeping prices trading below our $75/bbl 2Q21 fair value”… “With growing evidence of the demand rebound, and imminent clarification on the likelihood of an Iranian return, we now see a clearer path for the next leg higher in oil prices, with the sell-off offering opportunities to position for the rally to $80/bbl.”

It remains unclear whether @POTUS and @SecBlinken are ready to bury the failed “maximum pressure” policy of Trump and @mikepompeo, and cease using #EconomicTerrorism as bargaining “leverage”.

Iran is in compliance with the #JCPOA. Just read paragraph 36.

Time to change course.

— Javad Zarif (@JZarif) June 7, 2021

It should be recalled that it was an explicit strategy of the prior Trump administration to try and “box-in” Biden on Iran. During the final months of the Trump White House, the Republic administration had on a weekly and almost daily basis rolled out a “mine field” of sanctions and punitive actions slapped on over 700 Iranian entities and officials.

The idea was to create immense hurdles for any rapid rollback of those sanctions, no matter how willing a future administration – and that seems to now be showing its effects.

Tyler Durden

Wed, 06/09/2021 – 10:20

via ZeroHedge News https://ift.tt/3zcqcNN Tyler Durden