SEC Launches Review Of High-Frequency Traders’ Market Abuses

Nearly 8 years have passed since Michael Lewis published “Flash Boys”, raising awareness of the relatively new practice of high-frequency trading and its transformative impact on markets, allowing the most technologically-advanced traders to effectively see a picture of the market that’s nanoseconds ahead of what their non-NFT peers see, giving them a massive advantage.

Now, the SEC is finally considering changing the rules of how stocks are priced and traded to stop exchanges from incentivizing brokers (nowadays, particularly retail trading brokerages that have seen an explosion of activity in the past couple of years).

The news has slammed shares of HFT market-makers including those of Virtu, the biggest electronic market-maker. Citadel, the hedge fund that has a separate market-making business that purchases order flow from Robinhood, also could be hurt by the new rules.

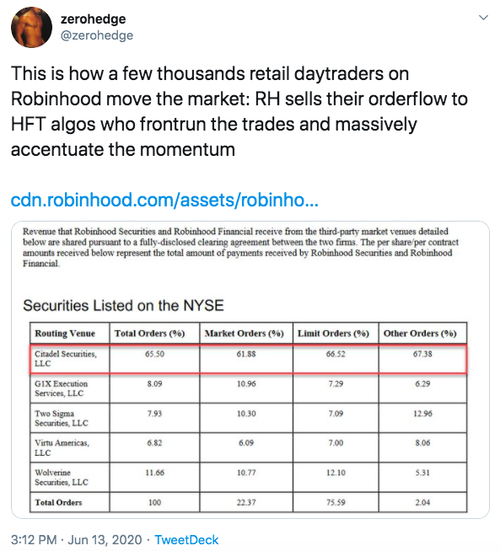

A few months ago, after Robinhood and its rivals cut off trading in Gamestop, prompting the stock to crater (as thousands of furious GME bulls claimed), we explained how Robinhood receives payment from Citadel and a handful of other major HFT market makers allowing them to front-run retail order flow and guarantee profits. In fact, one could argue that Robinhood is a de facto subsidiary of Citadel, whose entire business model is to sell retail orders to a handful of HFT market makers first and foremost… Citadel. During the surge in meme stocks, Robinhood has benefited by pocketing millions more from selling orderflow to Citadel, Virtu, Two Sigma, Wolverine and other HFT frontrunning “market-making” venues, as well as Citadel which made billions by having an advance look at the biggest surge in retail stock and option orders flow in history, and being able to trade ahead of and around it.

But longtime readers of Zero Hedge should remember that our coverage of the SEC’s efforts to rein in HFT’s abusive market practices dates back a decade.

In 2014, SEC Commission Chairman Mary Jo White unveiled a sweeping set of initiatives Thursday to address mounting concerns about the impact of computer-driven trading on the stock market, including proposals that would extend oversight of high-frequency traders and dark pools.

Little came of this, and the efforts were shelved during the Trump Administration, until today, when Biden’s SEC chairman Gary Gensler revealed that the agency is planning to propose new rules during an industry conference on Wednesday. During his talk, Gensler offered a broader explanation of market structure than he had previously described. Gensler, who took over the SEC in April, has previously questioned the system that results in many individual investors’ orders being routed to large broker-dealers known as wholesalers, such as Citadel Securities and Virtu Financial instead of first being reported to public exchanges, where the orders are recorded and made public.

“The question is whether our equity markets are as efficient as they could be, in light of the technological changes and recent developments,” Mr. Gensler told the Piper Sandler Global Exchange and FinTech conference.

Traders who are curious to learn more about these pitfalls should try consulting this classic report from ConvergEx about its all-encompassing “Traders Guide to Global Equity Markets”.

Tyler Durden

Wed, 06/09/2021 – 13:34

via ZeroHedge News https://ift.tt/2TiXgmU Tyler Durden