Surge In Foreign Demand Sparks Stellar 10Y Treasury Auction Ahead Of Tomorrow’s CPI

Having seen yields in the secondary market plunge to 3-month lows during the morning, Treasuries were sold ahead of the $38 billion reopening 10-year sale (backup to a When Issued yield of 1.507% – from 1.4705% intraday lows).

Demand was stellar with the bid-to-cover (2.58x) surging to its highest since July 2020…

Source: Bloomberg

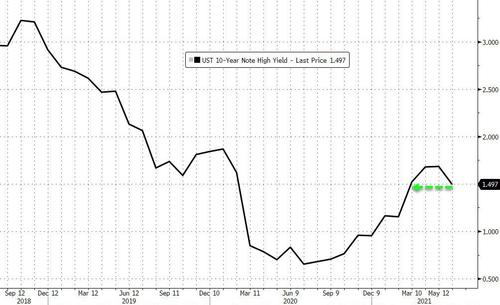

Today’s high yield was 1.497% (almost 20bps below the 1.684% at the last auction), trading through the WI yield by a very significant 1bps

Source: Bloomberg

Indirect demand (65%) surged to its highest since mid 2020…

Source: Bloomberg

Due to the surge in indirect demand, dealers were allocated the lowest amount since May 2016…

Source: Bloomberg

And bonds were well bid after the auction, with 10Y back below 1.50%…

Source: Bloomberg

That is a very aggressive auction ahead of tomorrow’s CPI print.

Tyler Durden

Wed, 06/09/2021 – 13:15

via ZeroHedge News https://ift.tt/354HIG0 Tyler Durden