HFT Giant To Challenge Citadel’s Dominance Of Retail Stock Trading

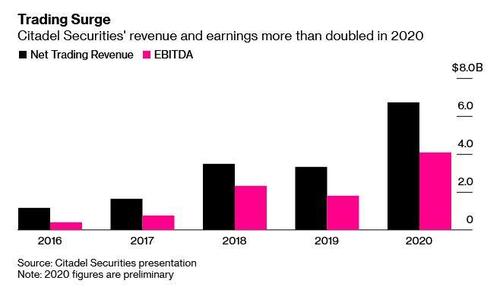

By now it’s common knowledge that the golden goose that powers the tremendous revenue and cash flow juggernaut of HFT giant Citadel, which resulted in record EBITDA of $4 billion last year, more than doubling the prior year results…

… not to mention the driving force behind Ken Griffen’s mansion and artwork collection, is Citadel’s near monopoly when it comes to controlling retail orderflow in the US: Citadel Securities estimates that it commands 27% of equity volume market share in the U.S., up from 21% in 2017 a recent loan private presentation revealed; the company is especially dominant in retail order flow, with 46% of the market.

There’s more: according to Bloomberg, Citadel’s EBITDA for Q4 was $1 billion and a whopping $4.1 billion for the year, also a record. It also means that Citadel has an EBITDA margin of more than 60%, an unprecedented number even for a high-margin brokerage.

So seeing how Citadel’s near-monopoly of this particular corner of the market had led to such staggering monetary gains, we were always confused why there is so little competition in the retail orderflow business.

Well, that’s finally changing.

According to WSJ, Hudson River Trading, one of the biggest high-frequency trading firms, is planning to enter the business of executing stock trades for retail investors. By doing so, the New York-based Hudson River sets its sights on two huge rivals: Citadel Securities and Virtu Financial, which combined handle more than 70% of individual investors’ stock orders.

The firm – which handles 8% of daily U.S. stock-trading volume, or about a third of Citadel’s market share – has been building out a so-called retail wholesaler business. It aims to launch later this year or in early 2022, an executive at the firm told The Wall Street Journal. Wholesalers – such as Citadel and Virtu – execute orders to buy and sell stocks submitted by people using online brokerages such as Robinhood Markets Inc. and TD Ameritrade. In fact, Citadel has long been the single biggest paying client to Robinhood…

… and what it gets in exchange for these orderflow payments, is a first look at what everyone in the retail space is buying and selling, both en masse and at the individual level. Which of course is known as frontrunning, but because “everyone does it”, payment for orderflow is viewed as perfectly legal in the US.

Why? Because of the universal “get out of jail” card – namely that wholesalers “provide liquidity” which of course is bullshit – liquidity collapses once these wholesalers have no more retail trades to frontrun or when volatility surges, resulting in numerous flash crashes, as for bid/ask spreads, these shrink simply because the HFTs position themselves inbetween the natural buyers and sellers in hopes of getting the trade ahead of everyone else.

“We have a lot of respect for Citadel Securities and Virtu and their ability to provide great execution for retail investors,” Adam Nunes, Hudson River’s head of business development, told the WSJ. “We do see demand from retail brokers for an additional wholesaler. We are confident that we can compete with Citadel Securities and Virtu in providing liquidity to retail investors, the same way we do on exchanges.”

This too, is a joke: as even the WSJ admits, “most retail traders would be unlikely to notice the effect of increased competition from Hudson River. Investors typically save a small amount of money, often just a fraction of a penny per share, by having their orders routed to wholesalers.” However, it does mean that there will be one more shark swimming in the waters, hoping to frontrun their orders away.

What Hudson River’s involvement really means is that Citadel’s market share of retail orderflow is about to drop as competition ramps up, while the money firms like Robinhood who sell retail traffic, will pocket from HFTs should rise as there is more competition for the same limited universe of orders.

That said, it’s unclear how much longer such a clearly manipulative practice will remain legal. The SEC recently launched a broad review of payment for order flow and related practices, while Chairman Gary Gensler, who announced the review earlier this month, has also voiced concerns that the wholesaler business is too concentrated.

Besides Citadel Securities and Virtu, several other wholesalers compete to execute individual investors’ stock orders. Most are units of high-speed trading firms, for the simple reason that only an HFT can benefit from frontrunning odd lot retail orders.

Unlike Citadel, Hudson River maintains a low profile, even though it has grown into a huge competitor in global financial markets since its founding in 2002. The firm employs more than 500 people around the world, and is active in stocks, options, futures, currencies, bonds and cryptocurrencies. Like many HFT firms, Hudson River is a proprietary trading firm that manages its own money and doesn’t take outside capital. It too operates under the flawed umbrella that is “provides liquidity.”

Nunes said Hudson still needed to clear some final regulatory and technology hurdles before it could begin executing trades for individual investors. The firm decided to enter the wholesaler business several years ago, well before the recent meme-stock frenzy, he said.

Tyler Durden

Wed, 06/30/2021 – 14:41

via ZeroHedge News https://ift.tt/2Tny2Uv Tyler Durden