Patrick Hill: Persistent Inflation Threatens The Recovery

Authored by Patrick Hill via RealInvestmentAdvice.com,

“Our company has had to deal with import delays due to backlogged West Coast ports, higher domestic freight costs, and a labor shortage at distribution centers that has prompted wage increases. Earlier this year, we thought, or maybe we hoped, that some of the industrywide supply-chain issues would have started to settle down by now. But that clearly hasn’t happened. In fact, the whole global supply situation seems to have gotten maybe even a little bit worse.”

John Crimmins, chief financial officer of Burlington Stores Inc., 5/27/21

Crimmins’s observation summarizes how business costs are driving persistent inflation due to multiple factors. Labor shortages are severe in the manufacturing, warehousing, retail, leisure, and hospitality sectors. Lack of workers drives wages up across thousands of businesses forcing management to raise prices to end customers and consumers. Leasing and rent costs have skyrocketed for warehousing-dependent manufacturers, e-commerce, and transportation companies. Container cargo from Asia to the U.S. has been bottlenecked since the pandemic began in the spring of 2020. Analysts think a mismatch of demand in Asia and the U.S. has caused too many empty containers in low-demand ports. Shipping bottlenecks forced manufacturers to buy more inventory than they needed to maintain sales. The hoarding is triggering price increases for many raw materials and finished goods.

Federal Reserve Forecast of Transitory Inflation Seems More Unlikely

At the June FOMC meeting, Federal Reserve Chairman Jerome Powell repeated his forecast that inflation is rising but will be ‘transitory’ as supply systems meet demand. Demand from workers returning to the office, shoppers returning to buying, and people traveling will ensure companies add production capabilities. Yet, supply bottlenecks and commodity shortages are causing long-term inflation. Sales are increasing dramatically in pandemic impacted sectors like hotels and restaurants as consumers resume traveling and eating out. Labor shortages are forcing many restaurant and hotel operators to open partially until they achieve full staffing. The shift to remote work has empowered workers to seek jobs from home at present or higher wages in other sectors. Plus, consumers are reeling from new and used car prices rapidly rising. Regardless of Fed forecasts of transitory inflation, executives and consumers in the real economy are experiencing persistent inflationary pressures.

In this post, we will examine these labor and supply-side trends embedding inflation into the economy. We’ll start by reviewing labor shortages in several industries.

Labor Shortages Drive Wage Gains

Wage gains can lead to embedded inflation. Workers will not settle for salary cuts. During a recession, executives may cut salaries to hold onto workers. Management hoping the pandemic would be short-lived furloughed workers. But the pandemic continued through 2020, forcing worker layoffs.

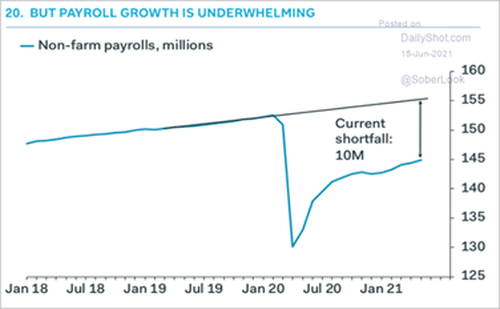

The fast vaccination rollout has jump-started consumer spending and economic growth. However, payroll growth and hiring have not kept up with hiring demand. The following chart shows a projection of baseline of payroll growth pre-pandemic versus where hiring is today. About 4.5M workers have been rehired though there is still a 10M worker gap versus baseline levels.

Source: The Daily Shot – 6/15/21

In May, Indeed reported that job openings have increased by 25% from February of 2020. But there are still 14.5M workers receiving continuing unemployment. There is a vast gap of hundreds of thousands of unemployed workers to jobs in hospitality in part due to hiring by Amazon, Federal Express, and UPS totaling 500k positions last year. In addition, there is a significant mismatch between thousands of unemployed worker skills and new jobs in high-growth sectors like software systems. Other reasons for lack of hiring are worker hesitancy related to COVID infection risk, lack of childcare, and poor wages.

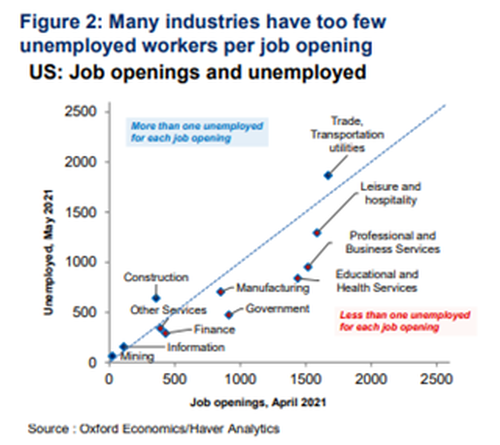

Many Sectors Have Fewer Than One Unemployed Worker Per Job

The labor shortage is exemplified by the unusually few number of workers unemployed per job. This situation is made worse because 2.5M workers retired from the work force and about 1.7M women have not returned due to career changes and lack of childcare. The worst imbalance of jobs to unemployed people in the following chart is seen in leisure – hospitality, professional services, education – health and manufacturing.

Sources: Oxford Economics, Bloomberg – 6-30-21

To resolve the mismatch will require investments in job training, career development, and counseling on a significant scale. The process of matching workers to jobs is likely to take years, not months. Many workers are not going back to their old jobs after having a good experience working from home.

Workers Feel Empowered After Working from Home

When the pandemic hit, workers examined their jobs, family life, and tradeoffs with the income and hassle of commutes. We noted in a recent post on massive job churn that 37% of all workers changed jobs. Of that total, 26% of job changers moved to new employers. Many people changed industries to be able to work from home or have more family time. Newly empowered workers are driving a new set of job expectations with management. The rise in the quits rate reveals newfound confidence in workers’ ability to find the job they want on their terms. Lockdowns forced implementation of remote work on 70% of the workforce, providing them with the opportunity to explore new job options. The high number of job openings supports their reluctance to accept any job, not on their terms.

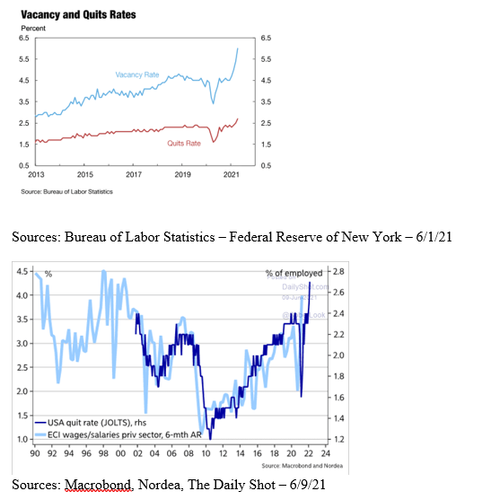

Quits Rate Indicates Higher Employer Costs Are Coming

The Department of Labor reports that the quits rate is the highest it has been in 20 years. The following two charts show how the quits rate is a leading indicator of a rise in the Employer Cost Index (ECI). The ECI leads to price increases that companies expect to pass along to customers.

Job seekers rejecting job offers forces employers into a hiring bind. To close the job search, companies sweeten their offers. Sweetened job offers may include increased wages, benefits, bonuses, and remote or hybrid work arrangements. Hard-pressed recruiters are dangling remote work as a sign-on bonus. Bret Taylor, COO of Salesforce, says employees are calling the shots, “There’s like a free market of the future of work, and employees are choosing which path that they want to go on.”

Labor Shortages Create Supply Bottlenecks Resulting in Price Increases

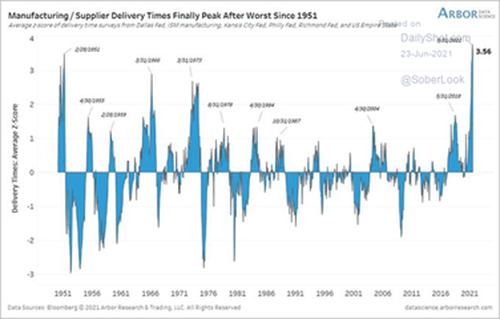

Supply shortages that economists are calling transitory maybe actually turn into persistent inflation. Supplier delivery times are at the worst level since 1951!

Sources: Arbor Research, Bloomberg, The Daily Shot – 6/23/21

Supply bottlenecks are in part caused by two, three, four steps or more in manufacturing processes to the final product. Companies selling to successive businesses face delays due to materials. Often, they are short on labor to fabricate, assemble, and deliver their product to the next-level manufacturer. Much of the increase in prices is due to input ‘upfront’ loading of inventories by manufacturers to have supplies available as materials continue to be scarce. The scarcity of intermediate goods causes input price increases that manufacturers pass along to customers.

Commodities Price Increases Drive Inflation

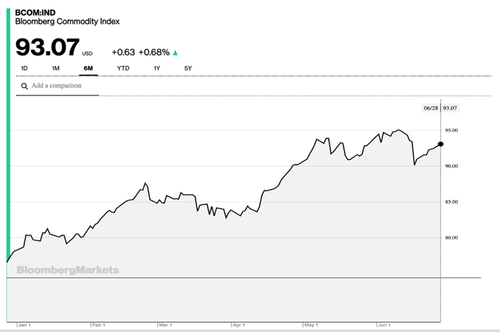

Prices for raw materials needed for manufacturing, processed goods, and energy are rising to record levels in the commodities price chart below. The Bloomberg Commodity Index includes prices for 23 futures contracts of physical commodities in energy, agriculture, and metals. Some commodity prices have declined due to consumer demand easing, yet the index has bounced back recently.

Source: Bloomberg – 6/28/21

Oil prices have risen to the highest level since 2018 as drivers return to traveling and go on summer vacations. Limited supplies of raw materials are due to pre-pandemic tariffs, extraction company worker layoffs during the pandemic, and shipping bottlenecks. Last year lumber prices rose 75% from pre-pandemic levels but are still about 60% above February 2020. New home prices rose 20% in the previous year in part due to the high rise in lumber prices. Adding to the demand for homes is the 5.5M lack of housing inventory. However, housing demand has slowed over the past few months due to increasing interest rates and surging prices.

Reopening Drives Consumer Demand & Commodity Prices

Reopening economies worldwide have triggered a surge in demand for a variety of consumer goods. Diverse consumer products companies like Sherwin-Williams, Masonite International, Levi Strauss, and Conagra Brands have announced price increases. As high prices reduce demand, commodity prices may decline, though it is unclear if they will return to pre-pandemic levels. The planned $1T in infrastructure spending bill now before Congress will add to demand for commodities as well.

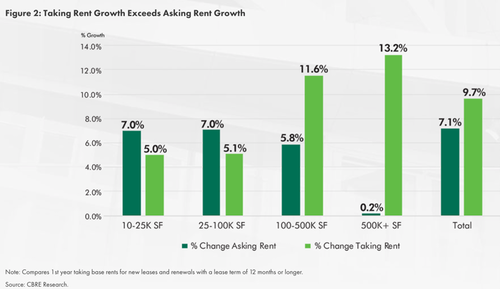

Warehouse Rents Soar

Ecommerce demand for more warehouse space is driving the cost of large warehouses, particularly near coastal metro centers. The most significant increases are for 500k sq. ft warehouses as noted in the following chart at 13.2% in the last 12 months.

Source: CBRE – 6/25/21

Tenants taking rent prices surge due to multiple offers. Base rents are rising above asking rent prices in areas like Northern New Jersey, where prices jumped 33%, and Southern California at 27%. Coastal locations are in hot demand to deploy same-day delivery services in major markets.

The concern with soaring rent increases is that leases are set of 3 – 5 years and establish a baseline fixed cost for retail and distribution companies. Building leases are unlikely to be re-negotiated unless there is a significant recession. So, these rent increases are likely to drive persistent inflation for several years. Consumers are seeing major rent increases as well.

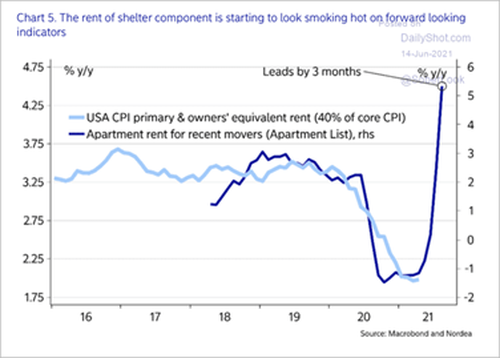

CPI Housing Component Is Forecast to Rise Significantly

Rent costs comprise about 40% and owner equivalent house prices of the Consumer Price Index (CPI). CoreLogic-Case-Shiller reported a 14.5% year-over-year price increase for homes in April. Due to the significant component housing plays in CPI, it is helpful to monitor the direction of inflation for the next several years. Here is a chart noting the CPI impact of housing and rent costs for recent movers.

Sources: Macrobond, Nordea, The Daily Shot – 6/14/21

Erica Brescia, an economist at Fannie Mae, comments on the impact of housing on CPI into 2022:

“Due to the heavy weight given to shelter, housing could contribute more than 2 percentage points to core CPI inflation by the end of 2022 and about 1 percentage point to the core PCE. Both would be the strongest contributions since 1990.”

In her estimate, housing will drive inflation into 2022, that trend seems to be long-term inflation. House prices may moderate in a slowing economy, but they rarely come down. Rents are rising across the country as well.

Rent Prices Rise Across the U.S.

Rents are rising in suburban, exurban, and spread-out cities like Denver, Dallas, and Los Angeles. These rent increases are primarily due to landlords looking to recoup losses from unpaid rent debts totaling about $70B during the pandemic. Offsetting the expected rise in rents across most households are rent declines of 11-14% in commuter-oriented cities like New York, Chicago, and San Francisco. States like California are planning on reimbursing landlords for 100% of their debt incurred during the pandemic using federal funding. Federal agencies in charge of the reimbursement process have been slow in delivering the funds. If funding delays continue, landlords will be forced to raise rents on lease price options. New move-in renters will experience higher rent prices as well.

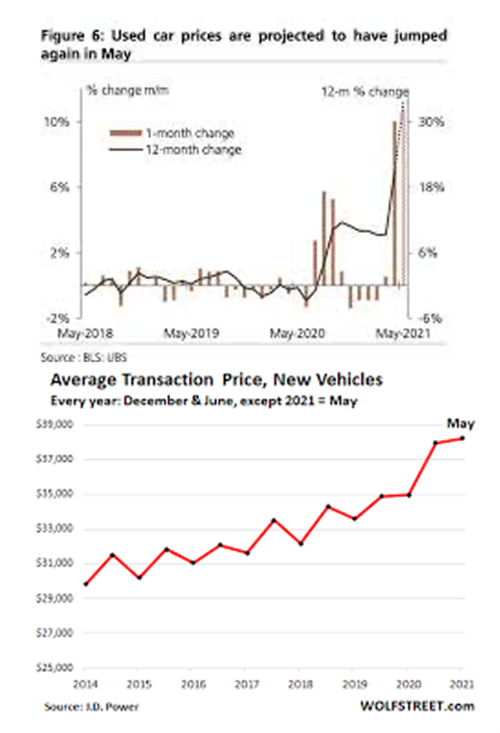

New & Used Car Sales Prices Skyrocket

Workers from cities moving to suburbs and exurbs need cars. These relocated workers are buying cars at a quick pace. Used car prices rocketed up 27% in April, with forecasts to rise by 30% in May. J.D. Power reports that in 2021 75% of all new car sales were at MSRP or above. The following charts show the dramatic climb in prices.

Sources: BLS, UBS, J.D. Power, Wolfstreet – 6/28/21

A key reason used car prices have soared is the declining inventory of new cars. Computer chip shortages caused car manufacturers to reduce production. Dealers chose to raise prices on existing inventories and used vehicles on their lots. Computer chip shipments to auto manufacturers have fallen due to a shift in chip deliveries to electronic and computer system firms. Semiconductor chip manufacturers responded to pandemic lockdowns by closing plans. Then as the economy reopened, they are finding fewer job applicants.

Before the pandemic, U.S. tariffs on Chinese imports implemented by the Trump administration caused chip supply disruptions. Meantime, China has focused on building its semiconductor manufacturing capability to control innovation and boost its domestic car market. U.S. chip manufacturers are investing in new plants. But it will take years to balance chip supplies with auto industry demand. Chip prices will continue to rise for several years due to shortages.

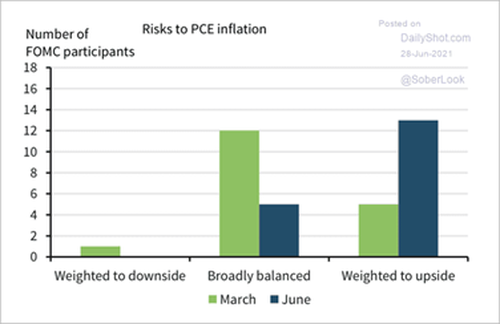

FOMC Begins to See Increasing Inflation

We have reviewed how significant labor shortages, commodity price increases, chip shortages for cars, industrial and consumer rent increases are becoming embedded into the economy. While Fed Chairman Jerome Powell reiterated his forecast for transitory inflation, the Federal Open Market Committee (FOMC) sees persistent inflation emerging. At that meeting, FOMC participants’ inflation forecast shows their concern about rising inflation.

Sources: Federal Reserve, The Daily Shot – 6/28/21

Also, the FOMC saw an increasing level of uncertainty on whether inflation will rise or fall. If interest rates are kept extremely low, and liquidity is maintained, inflation is likely to build combined with possible further infrastructure spending. Already, monetary injections and fiscal spending combined are at the highest level since WWII as a percentage of GDP. The Federal Reserve’s characterization of inflation as ‘transitory’ is becoming less likely. In an op-ed article, Mohammed El-Erian, economic advisor at Allianz S.E., noted the FOMC participants’ weakening forecast for transitory inflation. Data trends continue to show persistent inflation factors building putting the recovery at risk. El- Erian advocates tightening monetary policies sooner and concludes:

“Most important, however, relative to what is needed, the Fed continues to fall further behind the curve, compounding an unnecessary risk facing a recovery that needs to be strong, long, inclusive, sustainable and not vulnerable to unsettling financial market instability.”

Tyler Durden

Tue, 07/06/2021 – 15:45

via ZeroHedge News https://ift.tt/3xlgyHa Tyler Durden