Powell Pumps Stocks, Dumps Dollar In Dovish Doublespeak

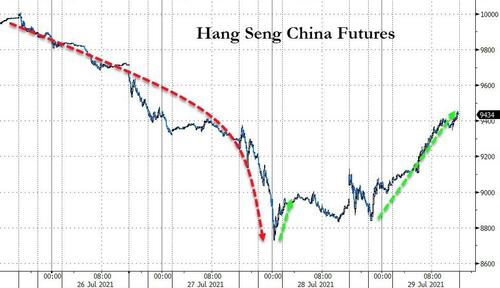

At the start of the day, Chinese stocks roared back after Beijing called in The National Team to save the day. After 3 straight days of carnage, Beijing’s PPT plugged the holes and China Futures soared almost 10% off their lows…

Source: Bloomberg

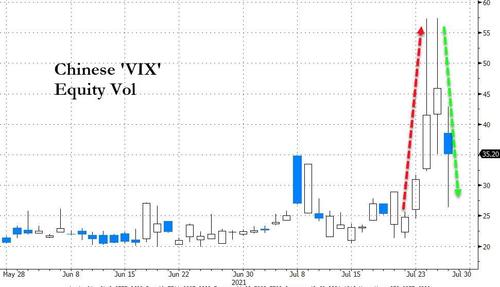

And The National Team stomped on the throat of Chinese equity vol…

Source: Bloomberg

Stocks soared after Powell raised questions about “Delta”s impact on the economy and mentioned the lack of “substantial further progress” on jobs. That was obviously taken as great news because it was an excuse to delay any tapering. However, stocks then came off session highs as Powell suggested (although he still sees it all as transitory), inflation concerns remained to the upside.

As Mohamed A. El-Erian tweeted, it was full of doublspeak:

“I suspect that many may agree that this was one of the most confusing #Fed press conferences. Where there may be disagreement is why—particularly, the balance between genuine economic uncertainties and what behavioral scientists call “active inertia”/too deeply wired convictions.”

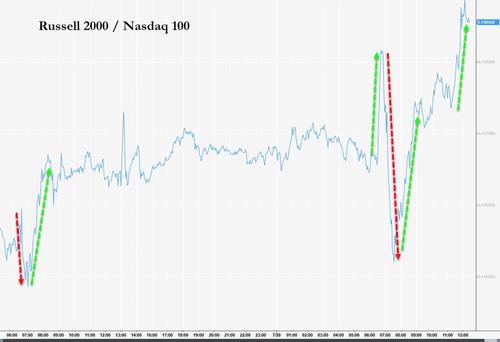

By the close, Small Caps were the biggest gainers among this chaos, the S&P was unchanged, but The Dow ended lower…

Small Caps and Nasdaq swung wildly around each other…

Boeing added 70pts to The Dow so things could have been worse as AAPL closed lower after huge earnings…

Another day, another short squeeze to get us back from yesterday’s tumble…

Source: Bloomberg

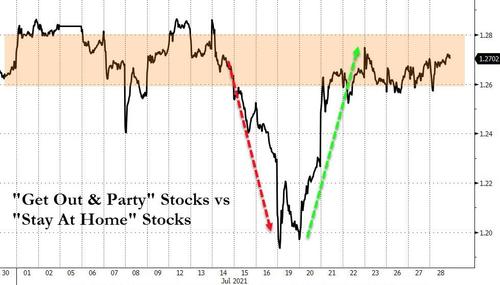

Notably the relative performance rebound of “get out and party” stocks vs “stay at home” stocks amid the Delta debacle has stalled…

Source: Bloomberg

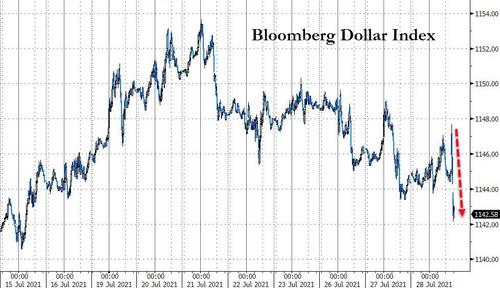

The dollar was clubbed like a baby seal on this (after spiking initially on what seemed slightly more hawkish a statement) and ended back at its weakest in two weeks…

Source: Bloomberg

Interestingly, 10Y Treasury yields went nowhere fast amid all this volatility in stocks and the dollar, ending back below 1.25% again…

Source: Bloomberg

The belly of the curve was the worst hit on the day with 5Y +1bps (rallying back from a 6bps spike on the initial ‘hawkish’ statement)…

Source: Bloomberg

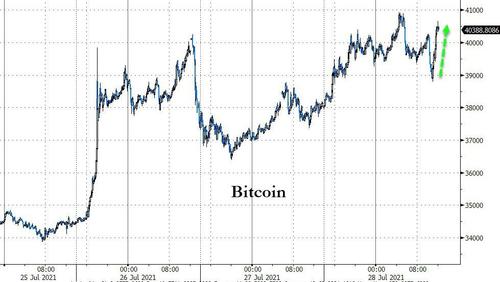

As the dollar dropped on Powell’s dovishness, bitcoin rallied back above $40,000,

Source: Bloomberg

Gold rallied on the dollar drop, bouncing back above $1800 again…

Oil prices closed higher after big draws on inventories (and a weak dollar)…

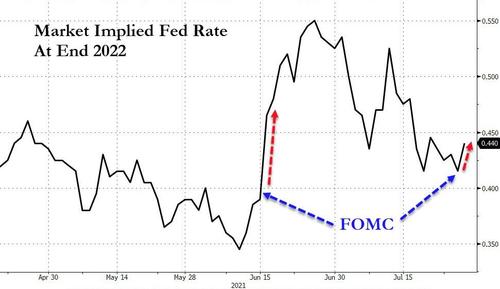

Finally, amid all this “dovish” chatter, the market actually shifted slightly more hawkish in rates land with expectations rising from 41bps to 44bps by the end of 2022…

Source: Bloomberg

And bear in mind the post-FOMC pump pattern…

Source: Bloomberg

Tyler Durden

Wed, 07/28/2021 – 16:01

via ZeroHedge News https://ift.tt/2UXEdzy Tyler Durden