Why Goldman Sees Oil Hitting New Highs After Recent Rout

Over the weekend, we presented one explanation behind the recent plunge in the price of oil which dragged it close to a bear market from its post-covid highs just one month earlier: as Rabobank’s Ryan Fitzmaurice said, it was the short-term momentum and some trend signals that turned bearish this week. Furthermore, medium-term momentum signals are also at risk of flipping from “long” to “short” over the coming days should prices continue to weaken, which could bring another wave of aggressive systematic selling to the oil market before the pressure subsides. As such, the Rabo strategist said “we are attributing a large portion of the recent fall in oil prices to the herd-like behavior of systematic funds rather than to any material shift in the fundamental outlook for oil markets.”

Overnight, Goldman’s commodity head Jeffrey Currie expanded on this, including fundamental drivers and writing that for the past 9 months, commodities have been driven by strong macro trends, with significant cross-commodity correlations that pushed the entire complex higher through June. But more recent macro trends – reflation unwind, Delta variant concerns and caution over China – have generated headwinds, driving all markets lower. Furthermore, “key markets remain in deficit with inventories in oil and base metals continuing to fall sharply” and while “peak growth is clearly behind” the Goldman strategist again emphasizes that “commodities are driven by demand levels not growth rates “

Currie then also observes the technicals, noting that “combined with low liquidity and fresh shorts from momentum investors the move has been swift and large.”

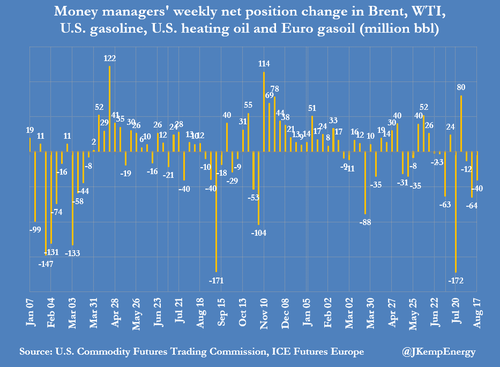

Quantifying the technical downside further, Reuters’ John Kemp writes that hedge funds sold petroleum for the seventh time in nine weeks: Hedge funds and other money managers sold the equivalent of 40 million barrels in the six most important futures and options contracts in the week to Aug. 17, taking total sales to 253 million barrels since June 15. In the most recent week, funds were sellers across the board of Brent (-25 million barrels), NYMEX and ICE WTI (-9 million), U.S. gasoline (-3 million), U.S. diesel (-1 million) and European gas oil (-3 million).

So what happens next? According to Goldman, while liquidity will likely remain low and the trend is not our friend right now, “the micro – steadily tightening commodity fundamentals – will trump these macro trends as we move towards autumn, pushing many markets like oil and base metals to new highs for this cycle.”

Below we excerpt from his note which describes why in Currie’s view, the bullish micro will soon trump the bearish macro:

Shifting gears to a micro driven bull market. Indeed, we see these macro trends drawing attention away from increasingly constructive micro data across the complex. On the back of this data we maintain our bullish view. Even those markets like steel and iron ore where micro fundamentals have weakened, there are very specific idiosyncratic reasons for the weakness. While the demand for oil has clearly weakened in Asia, it has weakened less than we expected. Further, both base metal and agriculture demand remains strong. Although US shale output has surprised to the upside recently, it is in line with our expectations while supply elsewhere for oil and all other markets remains structurally weak. As a result, key markets remain in deficit with inventories in oil and base metals continuing to fall sharply. While peak growth is clearly behind us we once again emphasize that commodities are driven by demand levels not growth rates and once we pass through this Delta variant – China cases are already declining – even oil demand levels should recover into year-end. Accordingly, we maintain our 4Q price targets — $80/bbl oil and $10,620/t copper and now forecast 17.1% returns for the S&P GSCI into year-end.

Delta a transient event to oil demand, supply losses are persistent. Both oil prices and timespreads have sold off over the last three weeks as Delta concerns have darkened the outlook for demand; however, flat prices have overshot timespreads to the downside, suggesting an oversold market. So far the demand hit has remained within our conservative expectations in China (0.7 mb/d vs 1 mb/d base case), and overall demand continues to track near 98 mb/d as regional mobility indicators remain robust ex-APAC. The c.1.5mb/d deficit over the last month has been focused in EM, where storage levels ex-China are now precariously low, and we expect DM stocks will have to take the brunt of future drawdowns. Cash markets have weakened substantially, partly due to the post-Covid biannual storage play unwinds, nevertheless refining margins have remained supported and, in fact, a simple average of Brent and Dubai prompt timespreads remain near post-Covid highs. In addition, supply data points continue to disappoint versus our below-consensus expectations; the IEA has now revised down non-OPEC+ ex US/Canada supply by almost 1 mb/d each of the last two quarters, with growth increasingly back-loaded. The latest leg of the sell-off has been more parallel in nature, with the market reflecting anxiety over medium-term growth, China stimulus, and the possibility that US shale may be inflecting higher. Nevertheless, we expect Delta will prove to be a transient event, and that US producers will retain their newfound discipline, as the drivers of our bullish view shift from cyclical demand impulses to the structural binding constraints of under-investment in supply that were only accelerated by Covid-19.

China steel weakness in Q3 is no canary in the coal mine. There is no doubt that China’s steel data has deteriorated since mid-year. After a strong H1 with apparent onshore steel demand rising nearly 6% y/y, the data since then has pointed to a 4% y/y decline so far in Q3. Coupled with a softening trend in early cycle construction activity, investors are concerned over rising headwinds to onshore demand. We think such concerns are over-emphasized. First, there have been transitory yet material distortions to steel apparent demand from mid-year. Flooding in several provinces alongside Delta lockdowns has exacerbated the seasonal slowdown in construction activity, which should reverse into Autumn. In addition, policy led steel supply cuts and resultant higher steel prices have contributed to downstream destocking which has, just as with copper in Q2 generated a negative adjustment to apparent demand. Second, it is also clear that Beijing is shifting to a more pro-growth policy setting which should generate a boost to infrastructure investment over the next 2-3 quarters, whilst also limiting further tightening measures on the property sector. In this context, we expect an improvement in China’s steel demand trends in Q4 (vs Q3) though the trend will be closer to flat y/y into next year. In this context we also see iron ore as oversold after a near 30% fall. A combination of improving steel demand, policy developments and a stabilizing physical market should act as upside catalysts for iron ore.

Sustained deficits across base metals supports higher prices. There is no evidence that the current weaker micro trends in China’s ferrous sector are feeding into base metals markets. Onshore inventories across all the base metals have drawn over Q3 and for the majority are falling at the fastest pace seen year-to-date. In particular, we would note that onshore copper stocks (social and bonded) are now c.30% lower than their mid-Q2 peak, whilst high frequency indicators such as physical premiums and the import arb all point to a material tightening trend onshore. We think this reflects so far solid demand conditions through the summer period with evidence of y/y apparent demand growth rates inflecting higher after the negative downstream destocking distortions in Q2 (due to high prices). At the same time, supply side constraints via both scrap (Delta lockdowns impacting SE Asian processing flows) and power supply on smelting/refining (cutting refined output across a number of base metals) have supported the call on inventories. As demand improves seasonally from September, aided by reduced lockdown effects and some probable supportive policy adjustments, we expect continued tightness onshore into Q4 and support for higher import volumes of refined metal. This fundamental setup will offer support for a trend higher in both copper and aluminium prices in particular.

Gold searching for a catalyst: Despite the recent spike in growth concerns, gold has largely remained range bound, closely correlated with the dollar. In our view this is because growth worries were actually quite contained and inflows into equity market funds have remained strong indicating that investors still prefer riskier assets. Inflation concerns were also moderate leaving little catalyst for gold investment demand. Nevertheless, at current prices gold is attractive to long term buyers looking to diversify their portfolio. Central Bank demand for gold has picked up materially with large purchases from Brazil, Thailand, India and Hungary. Moreover, unlike 2017-18 when Central Bank gold demand was coming primarily from countries with political tensions with the US (Russia, Turkey, China), the current spike in demand appears to be driven more by diversification motives. At the same time, Shanghai gold premium remains positive reflecting strong demand onshore and Indian imports have rebounded from their May-June slump. Overall our view remains that gold will continue to trade moderately higher on weaker dollar and recovery in EM demand. For gold to move materially higher though there has to be general risk off event which will trigger demand for defensive inflation hedges such as return of inflation worries.

Tyler Durden

Mon, 08/23/2021 – 21:00

via ZeroHedge News https://ift.tt/3grJZkF Tyler Durden