Futures Rise Toward Fresh Record High As PMIs Confirm Global Economy Slowing

After a somewhat soggy end to the otherwise spectacular month of August which saw 12 new all time highs in the S&P500, global stocks and US futures are solidly green to start the month of September despite another round of dismal global PMIs confirming the global economy is slowing, and especially China where the Caixin China manufacturing PMI came in at 49.2, missing expectations of 50.3, and the first contraction since April 2020. Of course, the coming global slowdown is great news for stocks as it means more stimmies in China, and a potential taper delay in the West (where hyperinflation is “transitory” after all) meanwhile the Fed’s QE cannon continues to blast billions in daily liquidity and naturally futures were solidly in the green, higher by 15 points to 0.34% to 4,536, Dow e-minis were up 106 points, while Nasdaq 100 e-minis were up 33.75 points, or 0.22%.ahead of U.S. ISM manufacturing data and ADP employment change.

Energy stocks led Wednesday’s gains, with oil majors Chevron Corp, Exxon Mobil and Schlumberger NV rising between 0.5% and 1.1% in premarket trading as crude prices rose ahead of today’s OPEC+ meeting. Rate-sensitive banks also rose with J.P.Morgan, Goldman Sachs and Citigroup up about 0.6% on support from higher bond yields. U.S-listed shares of the world’s biggest miner BHP Group dropped 1.7%, while those in China-focused mining giant Rio Tinto fell 1.2% after tepid China factory data dented copper and iron ore prices. Shares of Calvin Klein and Tommy Hilfiger owner PVH Corp surged 7.8% after it raised its full-year earnings forecast. Here are some other notable movers:

- Baudax Bio (BXRX) surges 19% after a director of the company bought 100,000 of the pharmaceutical company’s shares.

- Crowdstrike (CRWD) shares fall 3.2% in premarket trading with analysts suggesting its 2Q results didn’t meet the most bullish expectations, but that the stock remains a top pick in the cybersecurity sector.

- Focus Universal (FCUV) shares surge 38% following a share offering and the company’s listing on the Nasdaq Capital Market.

- Luxury EV startup Lucid Group (LCID) drops 8% on the lock-up expiry date that allows some shareholders to sell stock for the first time since the SPAC deal closed.

- Riot Blockchain (RIOT) is down 0.2% after filing for an at-the-market offering via Cantor Fitzgerald, B. Riley, BTIG, Roth.

- Skillz (SKLZ) and AMC Entertainment (AMC) are among meme stocks gaining in premarket trading, rising 6.8% and 1.9% respectively, extending rallies fueled by retail investors in chatrooms like StockTwits, and on Reddit.

- XPeng (XPEV) and Li Auto (LI) shares fall 1.7% and 0.1% respectively in U.S. premarket trading after Chinese EV peer Nio cut its delivery outlook. Nio drops 4.9%.

- Wells Fargo (WFC) shares edge 0.7% higher in premarket trading after a 5.6% decline on Tuesday following a report that the bank could face regulatory action over the pace at which it is compensating victims of past scandals and shoring up its controls.

Still, while corporate results are strong, concerns about the delta variant, inflation spikes, supply bottlenecks and stimulus tapering could easily trigger a 10%-20% drop in stock prices, said Ipek Ozkardeskaya, senior analyst at Swissquote. “The markets are on path for more gains,” she wrote in a report. “Nobody can tell how healthy the trend is, where it will end, or how it will end.”

The ADP report, published ahead of the government’s more comprehensive and closely watched employment report on Friday, is expected to show private payrolls rose by 613,000 in August after 330,000 gain in July. The number is due at 8:15 a.m. ET. Separately, the Institute for Supply Management’s gauge of manufacturing sector activity is expected to have moderated to 58.6 in August from 59.5 in the previous month.

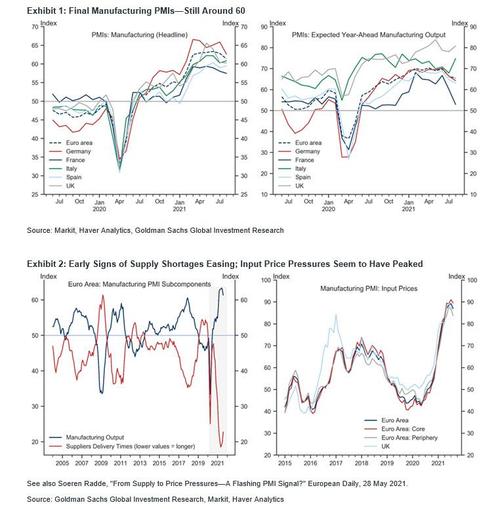

Earlier, surveys showed Asian and European factory activity lost momentum in August as the ongoing coronavirus pandemic-disrupted supply chains. Many firms reported logistical troubles, product shortages and a labor crunch which have made it a sellers’ market of the goods factories need, driving up prices. Here is a snapshot of the overnight PMIs:

- China Caixin Mfg PMI (August): 49.2, Exp. 50.2, previous 50.3

- Euro Area Manufacturing PMI (Final, August): 61.4, flash 61.5, previous 62.8

- Germany Manufacturing PMI (Final, August): 62.6, flash 62.7, previous 65.9

- France Manufacturing PMI (Final, August): 57.5, flash 57.3, previous 58.0

- Italy Manufacturing PMI (August): 60.9, GS 60.0, consensus 60.1, previous 60.3

- Spain Manufacturing PMI (August): 59.5, GS 58.8, consensus 59.0, previous 59.0

- UK Manufacturing PMI (Final, August): 60.3 flash 60.1, previous 60.4

While factory activity remained strong in the euro zone, IHS Markit’s final manufacturing Purchasing Managers’ Index (PMI) fell to 61.4 in August from July’s 62.8, below an initial 61.5 “flash” estimate. “Despite the strong PMI figures, we think that lingering supply-side issues and related producer price pressures might take longer to resolve than previously expected, increasing the downside risk to our forecast,” said Mateusz Urban at Oxford Economics. In Britain, where factories also faced disruptions, manufacturing output grew in August at the weakest rate for six months. The United States likely suffered a similar slowdown, data is expected to show later on Wednesday.

“We’re moving past the point of peak growth. The strongest period of the recovery now looks to be behind us, we’re seeing that in the economic data,” said Hugh Gimber, global market strategist at JP Morgan Asset Management. “The recovery is slowing, but it remains on track. And so that I think is what’s underpinning markets.”

Nothing like new all time highs to celebrate the slowdown.

European stocks also rose in the first trading session of September (because like the Fed, the ECB will be injecting billions in liquidity for a long, long time) after seven straight months of gains. The Stoxx 600 is up ~0.5%, led higher by travel, retail and banking industries. DAX took back some earlier gains, but was still up 0.1% on the day, while the FTSE 100 is up 0.6%. French spirits maker Pernod Ricard gained 3.3% after reporting better-than-expected results. Carrefour slumped 4.4% in Paris as billionaire Bernard Arnault sold his remaining holding in the supermarket chain. European luxury shares rose after Bernstein says stock market movements in August have priced in the risk of potentially higher taxation in China, “at least in its milder form.” Among the gainers were Richemont +2.2%, LVMH +2.2%, Kering +2%, Burberry +1.8%, Hermes +1.3%, and Swatch +0.9%. While new taxation would prompt rich consumers to momentarily rein in their discretionary spending, it’s unlikely that there will be “highly disruptive action” from the Chinese authorities, analyst Luca Solca writes in a note. Here are some of the biggest European movers today:

- Pernod Ricard shares rise as much as 3.9% after the French distiller’s FY results, which analysts say show a strong recovery with positive medium-term guidance.

- Fluidra shares jump as much as 4.1%, after it acquired U.S. pool deck equipment manufacturer S.R. Smith in a deal valued at $240m.

- EDP shares rise as much 4.3% as Berenberg raises its PT and says it remains a buy on upside from renewables growth and carbon prices.

- BioMerieux’s shares gain as much as 7.7% after 1H earnings, which Jefferies analyst Peter Welford says beat consensus as costs declined.

- WH Smith shares fall by as much as 7.2% after its FY results, with RBC saying that its outlook for a further recovery in its travel retail business seems “relatively cautious”

- Carrefour shares drop by as much as 5.3% after billionaire Bernard Arnault, the world’s third-richest person, sold his remaining holding in the company, ending a 14- year largely unsuccessful investment in the French supermarket chain.

Earlier in the session, Asian stocks climbed for a fourth straight day as Chinese technology heavyweights extended their rebound from the massive rout seen earlier this year. The MSCI Asia Pacific Index rose as much as 0.5%, with Tencent and Meituan the biggest individual contributors to the gauge’s advance. The financials sector gave the biggest boost, helped by Ping An Insurance’s bounce back from Tuesday’s losses. Equity benchmarks in China, Singapore and Japan were among the region’s biggest gainers. The Hang Seng Tech Index rallied for a third day as more investors grow confident that a bottom may have been reached following the selloff sparked by Beijing’s regulatory crackdown on private industry. A gauge of Asia’s software technology firms including Tencent also rose after capping its first monthly advance since April. Asia’s stock benchmark is extending gains after rising 2.3% in August in what was its best monthly performance since December. Still, the rout in China and Hong Kong has meant that regional shares continue to underperform peers in the U.S. and Europe so far this year. “Many are starting to realize that the regulatory crackdown on large Internet platforms is becoming quite targeted in nature and isn’t creating existential threats to their business,” said Bloomberg Intelligence analyst Matthew Kanterman. “Coupled with relatively strong sector results the last few weeks and what appears to be a slowing cadence of bad regulatory developments vs July, sentiment may be starting to turn the corner for the sector.” Japan’s Topix closed at its highest level since April, while China’s CSI 300 Index climbed more than 1%.

Australian stocks pared declines after GDP beat expectations; the country’s S&P/ASX 200 index fell 0.1% to close at 7,527.10, trimming a loss of as much as 1% after Australia’s GDP report. The economy grew faster than expected last quarter as household’s tapped their savings to boost spending, underscoring the central bank’s view that the nation entered a renewed lockdown with solid momentum. Mesoblast was among the worst performers after Jefferies lowered its rating on the stock to “hold.” Alumina was among the top performers, extending its winning streak to a fourth day. In New Zealand, the S&P/NZX 50 index rose 0.2% to 13,243.49

In FX, the Euro trades around session high after the ECB’s Yannis Stournaras said inflation jump is temporary and the central bank should be cautious. Dollar was little changed for a third day. Commodity-linked currencies led gains while havens slipped; the euro and the pound were steady. The Aussie rallied amid short covering of AUD/USD and AUD/JPY positions after a strong close in Japanese stocks; bond yields in Australia and New Zealand jumped after hawkish comments from ECB officials spurred losses in global debt markets. The yen weakened a third day amid risk-positive sentiment and higher Treasury yields as traders positioned before the U.S. data.

In rates, 10-year Treasury yields are little changed at 1.31%. Treasuries were steady, off session lows, after facing slight pressure following block sale in Ultra 10-year note futures shortly after 6am ET. In Europe, bunds continue to underperform amid heavy debt sales in Germany. U.S. stock futures advance, still inside Tuesday’s range. Yields were cheaper across belly, remain broadly within a basis point of Tuesday’s close; in 10-year sector bunds lag by 1bp vs Treasuries while gilts trade broadly in line.

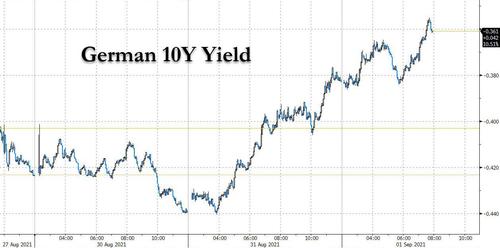

Government bond yields across the euro area touched their highest levels in around six weeks, pushed up by unease over the future pace of European Central Bank bond purchase after two ECB officials said the central bank needs to begin tapering soon. Germany’s 10-year Bund yield touched its highest level in just over six weeks, briefly rising above -0.36%.

In commodities, crude maintained a zigzag-trading pattern ahead of the upcoming OPEC ministers and allies meeting later Wednesday. Brent and WTI are little changed, with the global crude benchmark holding above $71/bbl. LME copper extends decline, down 2% after China released its third batch of metals from state reserves, vowing to sell more based on the market. The rest of the base metals complex is in red. In fixed income, bund yields gives back some gains, trading at the -0.38-handle, while peripheral spreads move wider to the core, the steepest at the longest end of the curve.

Market Snapshot

- S&P 500 futures up 0.4% to 4,537.50

- STOXX Europe 600 up 0.8% to 474.73

- MXAP up 0.3% to 202.44

- MXAPJ up 0.2% to 666.43

- Nikkei up 1.3% to 28,451.02

- Topix up 1.0% to 1,980.79

- Hang Seng Index up 0.6% to 26,028.29

- Shanghai Composite up 0.7% to 3,567.10

- Sensex little changed at 57,564.08

- Australia S&P/ASX 200 down 0.1% to 7,527.13

- Kospi up 0.2% to 3,207.02

- Brent Futures up 0.5% to $72.01/bbl

- Gold spot down 0.1% to $1,811.06

- U.S. Dollar Index little changed at 92.68

- German 10Y yield rose 0.5 bps to -0.377%

- Euro little changed at $1.1810

Top Overnight News from Bloomberg

- Short-term funding costs in the U.K are diverging from those in Europe as traders grow increasingly confident the Bank of England will deliver an interest-rate hike within the next year.

- European factories saw unfilled orders rise to an unprecedented level in August as companies struggled to meet demand amid widespread bottlenecks in the global supply chain.There were “clear signs of strong capacity constraints,” according to an IHS Markit survey of purchasing managers

- Manufacturing managers across Southeast Asia reported a heavy blow in August from one of the world’s worst Covid-19 outbreaks, while producers in North Asia continued to enjoy robust output, PMIs showed

- Australia’s economy grew faster than expected last quarter as household’s tapped their savings to boost spending, underscoring the central bank’s view that the nation entered a renewed lockdown with solid momentum

A more detailed look at global markets courtesy of Newsquawk

Asian stocks traded somewhat cautiously after further disappointing Chinese PMI data and following a soft handover from the US where sentiment was mired by disappointing Chicago PMI and US Consumer Confidence data, although the losses on Wall Street were only marginal and all major indices registered a seventh consecutive monthly gain for August. ASX 200 (-0.1%) was pressured as daily COVID-19 infections continued to ramp up in Australia’s most-populous states and with better-than-expected GDP doing little to brighten the mood, given that the strong economic growth for Q2 was made somewhat stale by the lockdowns throughout the entirety of Q3 so far. Nikkei 225 (+1.3%) outperformed amid reports PM Suga is to order the compiling of an economic package and additional budget within the week, while data also showed Japanese companies’ recurring profits nearly doubled Y/Y during the prior quarter. Hang Seng (+0.6%) and Shanghai Comp. (+0.7%) eventually weathered the miss on Chinese Caixin PMI data which slipped into contraction territory for the first time since April last year and effectively supported the argument for PBoC easing. However, price action was choppy as crackdown concerns also lingered amid the continued tightening of Beijing’s regulatory grip with China to curb overly fast growth in medicine expenses and the PBoC is to implement new disclosure measures for Chinese non-bank payment apps when they make new products or conduct foreign stock market listings. Finally, 10yr JGBs declined amid spillover selling from global counterparts including the bear steepening stateside and pressure in European bonds following the firm Eurozone inflation data, while the outperformance in Japanese stocks and lack of BoJ purchases in the market today also contributed to the headwinds for JGBs.

Top Asian News

- India to Offer Indemnity to Flag Carrier Bidder Over Cairn Claim

- China Bonds Shrug Off PBOC Cash Drainage to Jump on Weak PMI

- Stocks, U.S. Futures Gain on Reopening Optimism: Markets Wrap

- China Quants Pay $300,000 to Beat Wall Street to Graduates

Stocks in Europe trade with respectable gains across the board (Euro Stoxx 50 +1.2%; Stoxx 600 +0.9%), despite a somewhat mixed APAC lead and with little in terms of fresh fundamentals to sour risk appetite. US equity futures see gains of a lesser magnitude and have been waning off best levels, with the RTY (+0.6%) outpacing the ES (+0.3%), YM (+0.3%) and NQ (+0.2%), ahead of the ADP and ISM Manufacturing PMI later today before Friday’s pivotal jobs report. Back to Europe and sticking with PMIs where we have had the manufacturing finals across Europe – with the resonating theme being ongoing supply chain issues. The DAX (+0.7%) narrowly underperforms the region after the German manufacturing metric was slightly revised lower, deviating from the revision higher seen in France and the forecast beats printed in Italy and Spain – with the IBEX (+2.2%) the clear European outperformer at the time of writing, although more-so on the back of solid sectorial performances seen in Retail, Travel & Leisure and Banks. Sectors across Europe are predominantly in the green, with the only laggards the Basic Resources and Chemicals sectors. Sectors do not portray a clear theme nor bias. In terms of individual movers, Pernod Ricard (+3.5%) is firmer post-earnings where it announced the resumption of its EUR 500mln share buyback programme. Carrefour meanwhile trades at the foot of the Stoxx 600 after Billionaire Bernard Arnault’s Agache group announced the sale of its 5.7% stake in the Co. via accelerated bookbuilding. Meanwhile, Stoxx will announce the results of its annual review of the Euro Stoxx 50 Index at the close of business on 1 September, to be effective Friday, 17 September – JPM expects BBVA (+2.2%) and Stellantis (+0.3%) to replace Engie (+2.0%) and Amadeus (+2.6%).

Top European News

- Billionaire Arnault Sells Carrefour Stake for $854 Million

- KPMG Accused of Giving Regulator ‘False and Misleading’ Data

- U.K. House Prices Surge in August Despite Ending of Tax Cut

- EDF Slips as Path to Fresh France-EU Reform Talks Still Unclear

In FX, a marked change in fortunes for the Yen following its fleeting breach of 100 DMA resistance vs the Dollar yesterday, as Usd/Jpy rebounds sharply through 110.00 and the 50 DMA (110.10) towards 110.50 alongside US Treasury yields amidst further bear-steepening and renewed risk appetite. The Yen may also be factoring in reports that Japanese PM Suga is preparing an economic package and supplementary budget, plus pretty dovish/downbeat from BoJ’s Wakatabe, and the same could be said for the Franc in wake of SNB’s Zurbruegg saying that he expects low global interest rates will remain unchanged for some time to come, while noting vulnerabilities on the Swiss mortgage and real estate markets currently at a high level. Furthermore, the Bank sees clear signs of unsustainable mortgage lending on the one hand and heightened risks of a price correction on the other. Usd/Chf is back in the high 0.9100 area following its flirt with the round number on Monday, and with little downside reaction to a firmer Swiss manufacturing PMI. Conversely, Gold is coping relatively well with the rise in UST yields and risk-on environment on the Usd 1800/oz handle, albeit back below 100 and 200 DMAs after hurdling both and closing above yesterday, as the Greenback grinds higher and DXY attempts to form a base beyond 92.500 having bounced from a 92.395 low on Tuesday. The index is now hovering within a 92.790-640 band awaiting ADP, Markit’s final US manufacturing PMI, ISM and comments from Fed’s Bostic.

- AUD/NZD/CAD – All firmer against their US counterpart, with the Aussie establishing a firmer platform over 0.7300 to stage another assault on 0.7350. Better than expected Q2 GDP did not really boost Aud/Usd overnight as COVID lockdowns have subsequently scuppered the economic recovery and China’s Caixin manufacturing PMI fell below the 50.0 growth/contraction threshold. However, the technical backdrop looks more constructive above a Fib retracement level at 0.7319 and Aud/Nzd crosswinds have turned in the run up to NZ terms of trade, import and export prices on a further bounce from 1.0350 to top 1.0400 again. Nevertheless, the Kiwi has reclaimed 0.7050+ status vs its US peer and the Loonie is paring more post-Canadian GDP declines with some traction from crude in advance of Markit’s manufacturing PMI, JMMC and OPEC+ meetings, with Usd/Cad probing 1.2600 compared to peaks just above 1.2650 yesterday.

- EUR/GBP – Both narrowly mixed against the Greenback, but the Euro marginally outpacing the Pound as Eur/Gbp eyes 0.8600 irrespective of final Eurozone and UK manufacturing PMIs that were somewhat contrasting, but probably all too close to consensus or preliminary prints to prompt much reaction. Eur/Usd has regained 1.1800+ status, while Cable is straddling 1.3750.

In commodities, Crude futures have largely retraced their overnight gains, with WTI and Brent both back towards the bottom end of today’s ranges. The choppiness comes in the run-up to the JMMC meeting at 15:00BST/10:00EDT and the decision-making OPEC+ confab at 16:00BST/11:00EDT – subject to delays. Expectations have solidified around a 400k BPD hike, i.e., a continuation of the current plan, with all sources thus far pointing in that direction. That being said, it’s worth keeping in mind that OPEC+ has a tendency to massage expectations and then surprise markets. The full Newsquawk preview can be accessed here, and the exclusive Twitterdeck is available here. Elsewhere, spot gold and silver are uneventful and contained to recent ranges awaiting Tier 1 US data. Industrial metals are slightly more interesting following later-confirmed reports that China is releasing a third batch of metals totalling 150k tonnes, comprised of 30k tonnes of copper (prev. 30k), 70k tonnes of aluminium (prev. 90k) and 50k tonnes of zinc (prev. 50k). LME copper slumped back under USD 9,500/t and resides near session lows at the time of writing – with the disappointing Chinese Caixin manufacturing PMI also weighing on the red metal.

US Event Calendar

- 7am: Aug. MBA Mortgage Applications, prior 1.6%

- 8:15am: Aug. ADP Employment Change, est. 638,000, prior 330,000

- 9:45am: Aug. Markit US Manufacturing PMI, est. 61.2, prior 61.2

- 10am: July Construction Spending MoM, est. 0.2%, prior 0.1%

- 10am: Aug. ISM Manufacturing, est. 58.5, prior 59.5

- 10am: Aug. ISM Employment, prior 52.9

- 10am: Aug. ISM New Orders, est. 61.0, prior 64.9

- 10am: Aug. ISM Prices Paid, est. 84.0, prior 85.7

DB’s Jim Reid concludes the overnight wrap

So I now have 16 weeks holiday from looking after the kids which is a nice relief. After 2 weeks non stop with them that’s the bare minimum required. They are all lovely individually but together they are awful, especially the twins. A graph of the amount of fights I had to break up over the last couple of weeks would require a log scale. The biggest problem is they don’t bear grudges so this increases the number of fights. The pattern is a major bust up, five minutes of hysteria, move on, forget about it, play for a few minutes until the next conflict and then the loop starts up again.

So holidays are coming to an end and dark September mornings writing the EMR are well and truly here. Given it’s the start of the month today, Henry will shortly be releasing our monthly performance review for August. Normally the summer holidays are a relatively quiet period for markets, and last month very much fit into that pattern, but that didn’t stop equities powering ahead to fresh all-time highs as they advanced for a 7th successive month. In fact, both the S&P 500 and the STOXX 600 are now up by over +20% YTD on a total returns basis, with a third of the year still remaining. At the other end of the leaderboard however, oil prices saw their biggest decline so far this year in August, as fears of weakening economic demand and concerns about the delta variant of Covid took their toll. More details in the report out shortly.

It might be the start of September today, but investors will be grappling with a number of familiar themes this morning. The tapering and inflation debate was a hot topic yesterday but more from Europe for once rather than the US. This coupled with weak data served to dampen sentiment and spark a selloff across various asset classes. The most significant data yesterday came from the Euro Area, where the flash CPI estimate for August came in at a far stronger-than-expected +3.0% (vs. +2.7% expected), which is the highest since November 2011, and was also above every economists’ estimate on Bloomberg. Then we had some weak consumer confidence data from the US Conference Board, which backed up the weak reading from the University of Michigan earlier in the month.And both the European inflation reading and US consumer sentiment data came against the backdrop of weak PMIs out of China heading into yesterday’s session.

Looking at yesterday’s developments, that strong Euro Area inflation print was by some way the most impactful on markets, and gave further ammunition to the ECB’s hawks who’ve been calling for a withdrawal of emergency support. Although core inflation only exceeded expectations by 0.1%, the +1.6% reading marked the highest core inflation since July 2012, which was the month that former ECB President (and now Italian PM) Mario Draghi made his “whatever it takes” pledge. At a similar time to the inflation release, Dutch central bank governor Knot said that he believes in an immediate slowdown in ECB purchases and supports ending their pandemic emergency purchase programme in March. Furthermore, Austrian governor Holzmann said that he was in favour of reducing the pace of purchases in Q4. With both the strong inflation reading and the hawkish comments, European sovereign bonds witnessed a significant selloff, with yields on 10yr bunds climbing +5.6bps to -0.38%, which is their biggest one-day move since March, whilst those on 10yr BTPs (+9.9bps) saw their biggest one-day move higher since February.

With sovereign bond yields moving sharply higher in Europe, equities indices lost ground with the STOXX 600 closing the session -0.38% lower. In the US the S&P 500 similarly fell back, with the index down -0.13% from the previous day’s record highs after drifting lower in the US afternoon. This occurred as macroeconomic data continues to surprise to the downside as the Conference Board’s consumer confidence reading came in at a 6-month low of 113.8 in August (vs. 123.0 expected). Looking at the sectoral breakdowns, the FANG+ index of megacap tech stocks was an outperformer, managing to close +0.36% higher to just about achieve a new all-time closing high, its first since mid-February. Meanwhile, yields on 10yr US Treasuries were up +3.0bps to 1.309%, however US banks (-0.58%) reversed earlier gains as cyclicals largely lagged.

Asian markets are generally trading higher this morning with the Nikkei (+1.17%), Hang Seng (+0.62%), Shanghai Comp (+0.86%) and Kospi (+0.25%) all advancing. Meanwhile, yields on 10y USTs are up +2.2 bps to 1.332% and those on Australia and New Zealand’s 10y sovereign bonds are up +9.2bps and +9.3bps respectively after the global sell-off yesterday. Futures on the S&P 500 are up +0.29% and those on the Stoxx 50 are +0.65%. Elsewhere, oil prices are up c.+0.70% ahead of today’s OPEC+ meeting.

Overnight China’s Caixin manufacturing PMI came in at 49.2 (vs. 50.1 expected and 50.2 last month). This was in contrast to yesterday’s official manufacturing PMI reading of 50.1 which was relatively stable. The Caixin PMI is more representative of smaller and private companies while the official PMI covers larger, state owned enterprises. Given the weakness in the PMIs, our China economist Yi Xiong is of the view that the PBoC should soon cut the MLF rate to support growth (to read more click the link here). Looking at other Asian manufacturing PMIs, Japan’s final manufacturing reading got revised up +0.3pts from the flash to 52.7 while Australia’s final manufacturing PMI also saw a similar upward revision of 0.3pts to 52.0. Taiwan’s continued to remain well in expansionary territory with a reading of 58.5 (vs. 59.7 last month). Meanwhile, Vietnam’s dropped substantially to 40.2 from 45.1 last month and South Korea’s reading softened to 51.2 from 53.0 but Indonesia’s improved to 43.7 (vs. 40. 1 last month). These readings generally point to a slightly softer manufacturing activity in the region during the month as most countries imposed restrictions to curb the spread of the delta variant.

In other overnight news, the BoJ Deputy Governor Masazumi Wakatabe indicated in a speech that the central bank may revise down its economic assessment at this month’s policy meeting as the spread of the delta variant has caused the expansion and extension of the state of emergency.

With September having arrived, we’re now finally in the month of the German election, for which yet more polls yesterday showed the centre-left SPD in the lead. The first from Ipsos had them at 25%, ahead of the CDU/CSU on 21% and the Greens at 19%. And then another from Forsa had a slightly tighter race at the top, with the SPD on 23%, the CDU/CSU on 21%, and the Greens on 18%. The SPD’s candidate for chancellor, German finance minister and Vice-Chancellor Olaf Scholz, has sought to project himself as the heir to Chancellor Merkel, with whom he’s currently serving in the grand coalition with. But yesterday Chancellor Merkel herself took aim at this portrayal, saying that a major difference between the two is that she would never go into coalition with Die Linke, whereas she said it “remains an open question” whether Scholz was of this view.

Turning to the pandemic, there was some positive news as European Commission President von der Leyen confirmed that 70% of adults in the EU were now fully vaccinated. Meanwhile vaccine “passports” are becoming more widespread with Italy requiring travellers on planes, ferries and long-haul trains show proof of vaccinations or a negative Covid-19 test.

Looking at yesterday’s other data, inflation in France came in at a stronger-than-expected +2.4% (vs. +2.1% expected) in August, using the EU harmonised measure, whilst the Italian reading also surprised to the upside at +2.6% (vs. +2.1% expected). Over in the US, the MNI Chicago PMI for August fell to 66.8 (vs. 68.0 expected), though the S&P CoreLogic Case-Shiller national home price index was up +18.6% year-on-year in June, which is the fastest since that series begins in 1988.

To the day ahead now, and the main data highlight will be the release of the global manufacturing PMIs and the ISM manufacturing reading from the US, but there’s also the Euro Area unemployment rate for July, along with the ADP’s report of private payrolls from the US for August. Otherwise, central bank speakers include the ECB’s Weidmann and the Fed’s Bostic.

Tyler Durden

Wed, 09/01/2021 – 07:58

via ZeroHedge News https://ift.tt/3Dxngxv Tyler Durden