The Wheels Come Off: As Economic Growth Craters, NY Fed Suspends Its GDP Tracking Model

It’s official: while Q2 was the best quarter for the economy in decades, in Q3 it is now widely accepted that as we wrote a month ago, the wheels came off as a result of a “sudden negative change.”

One doesn’t have to look too hard to find out why: between today’s catastrophic jobs report, the near record plunge in consumer confidence, the troubling contraction in retail sales where reports have missed expectations for 3 months in a row, whether it is due to the end of stimmies or the recent restrictions from the Delta variant, one bank after another took a machete, or in the case of Morgan Stanley, a nuke to their GDP Q3 forecast, with Goldman now expecting GDP to grow just by 3.5% this quarter, its second downgrade in a month (it was 8.5% just one month ago) while Morgan Stanley yesterday cut its Q3 GDP to just 2.9% from 6.5% previously.

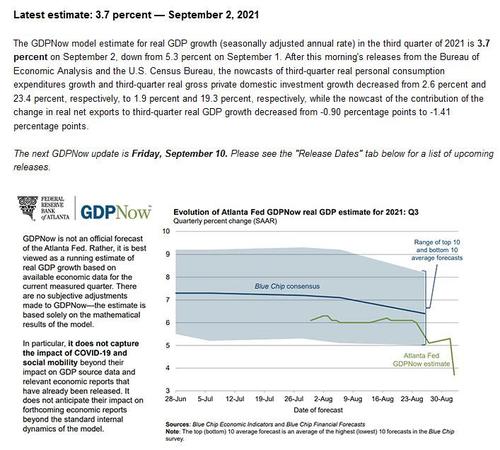

And while banks were as usual well behind the curve, only catching up to what our readers already knew one month ago, the regional Fed were dead last, with the Atlanta Fed’s GDPNow model yesterday cut to just 3.7% fron 5.3% on Sept.1

So what about that other Fed GDP model, the NY Fed GDP Nowcast? Well, a quickly look at the historical data shows that while the Atlanta Fed has a ridiculously high beta, and swings around like a drunken sailor, the NY Fed’s GDP tracker is much more credible and stable. Or rather way, because a quick look at the Ny Fed’s website where the Nowcasting Report is housed now shows this:

Suspension Notification

The uncertainty around the pandemic and the consequent volatility in the data have posed a number of challenges to the Nowcast model. Therefore, we have decided to suspend the publication of the Nowcast while we continue to work on methodological improvements to better address these challenges.

We find it odd how the NY Fed did not suspend its nowcast model on the way up in late 2020 when a similar level of pandemic confusion was present but when all the adjustments were the upward direction and nobody really cared if they are accurate or not.

There are two ways to interpret this sudden and unexpected development from some of the “smartest” economists in the room. Either i) nobody knows anything (which is true for most economists), or ii) the underlying economic data is now so ugly that instead of adjusting and goalseeking it to make it look attractive in its “tracker”, the NY Fed has simply decided to no longer even cover it.

Our money is in both i) and ii).

Up next: the BLS suspends its jobs report, ADP suspends its private payrolls update, the BEA suspends its GDP and PCE estimate, and the Dept of Labor suspends its CPI and PPI reports due to “uncertainty around the pandemic and the consequent volatility in the data.”

Tyler Durden

Fri, 09/03/2021 – 11:55

via ZeroHedge News https://ift.tt/3BTzSgP Tyler Durden