A Record $2 Trillion Options Just Traded; What It Means For Friday’s Massive Quad Witch OpEx

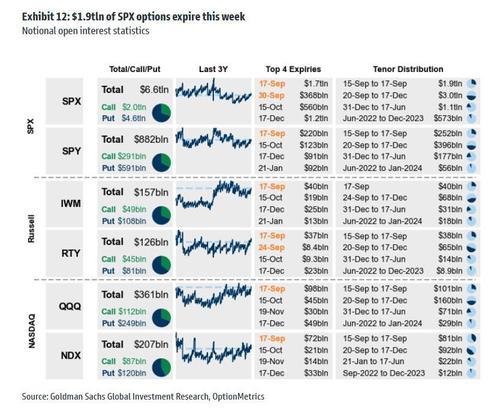

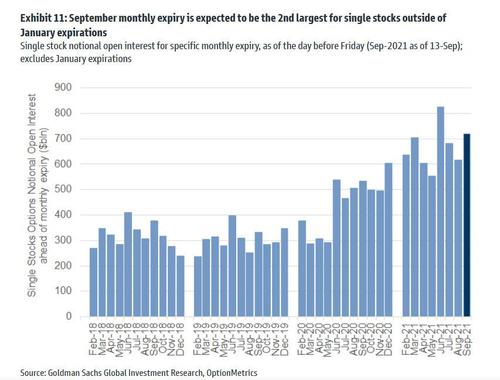

Now that stocks have emerged from their 5-day losing streak, narrowly averting 6 consecutive days of declines which would have been the longest such streak since the February 2020 depths of the covid crisis, attention shifts to the market’s technicals and especially Friday’s upcoming quad-witch which sees some $1.5 trillion in SPX option expirations, as well as $1.4tln in options across underlyings expiring on Friday afternoon, including the 2nd largest expiration for single stocks outside of a January.

Courtesy of Goldman, here Four observations on option positioning ahead of Friday’s quarterly maturity:

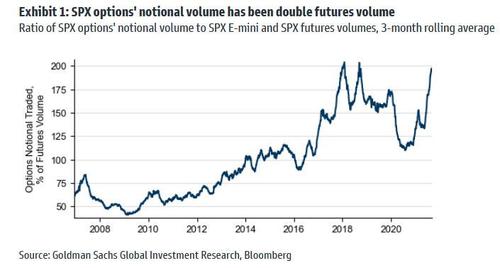

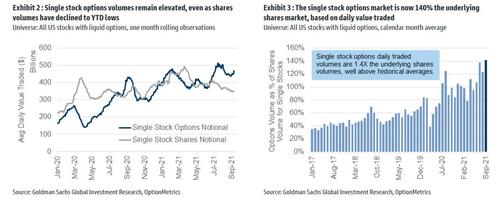

1. Option volumes have been continuing to grow relative to delta-one volumes. Both index and single stock option markets have shown volume growth in Q3, while delta-one volumes (futures and shares) have fallen. Having traditionally traded well below 100%, SPX options notional volumes are now double the volume of futures traded.

Single stock options have traded $500bln/day notional in September to date, 140% of the underlying shares volumes.

Hardly a secret to those following the tidal wave of retail trading, option markets are an increasingly important source of trading liquidity.

* * *

2. This past Friday (Sept 10) represented the US listed option market’s first $2tln notional volume day. By the metric of comparing notional to the size of the equity market cap, Friday was also one of the larger days on record.

The $2tln of trading volume included $975bln of SPX index options, of which $330bln expired the same day, and $120bln expired the next trading day (Mon, Sept 13). Goldman notes that these large, put-heavy, totals on the SPX’s 5th consecutive down-day reflected investors’ preference for adding to hedges once a sell-off has begun instead of pre-emptively and continually hedging.

* * *

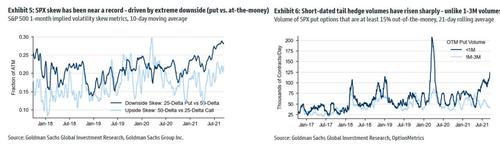

2. Hedges galore: downside skew is extremely high amidst high short-dated tail hedge volumes. While skew has been high across underlyings and vol surfaces, SPX downside has been especially strong according to Goldman. Short-dated tail hedge volumes have risen: while 1-3 month SPX deep-out-of-the-money put option volumes are at the bottom of their range, over the past two weeks 15%+ out-of-the-money put option volumes with less than 1 month to maturity have hit their highest point since the height of the coronavirus crisis in 2020.

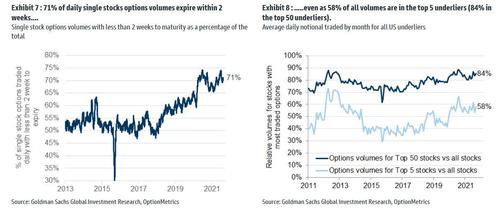

Single stock options have similarly shifted toward short-dated activity: 71% of total volumes have been in short-dated maturities, expiring within 2 weeks. The volume is concentrated in fewer underlyings- 58% of all activity is in 5 underlyings, while 84% is in the top 50 stocks. Average S&P 500 constituent 1M skew has increased significantly in Q3, and is now in its 97th percentile vs. the last year.

* * *

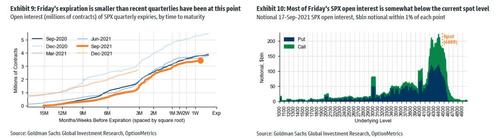

4. Friday’s expiration is large (including $1.5tln SPX notional expiring Friday morning), but smaller than recent quarterlies. Long “street” gamma positioning likely contributed to low recent SPX realized volatility (10-day realized vol: 5.7%), though high downside skew implies that investors may expect gamma to reverse in a further sell-off.

As Goldman has observed previously, the lower-than-usual open interest level of September’s quarterly itself (10% fewer contracts than Sept 2020 had at this point) reflects continued rotation away from the traditional 3rd Friday expirations (driven by systematic, longer-term investors) toward the full schedule of daily/weekly expirations. Inclusive of all underlyings, Goldman estimates that roughly $3.4tln of listed US equity options expire this Friday: $1.5tln of SPX quarterly, $310bln of options on E-mini futures, $220bln of SPY options, $610bln of other index/ETF options…

… and $720bln of single stock options.

Tyler Durden

Tue, 09/14/2021 – 11:21

via ZeroHedge News https://ift.tt/398yVVw Tyler Durden