Jim Reid: “The End Of The Gold Standard Unleashed The Most Inflationary Period Ever”

On Monday, Deutsche Bank’s chief credit strategist Jim Reid released his annual Long-Term Asset Return Study, which marks the 50th anniversary of fiat money – on which it is focused – thanks to President Nixon ending the dollar’s link to gold in August 1971, arguably the most catalytic event that helped unleash the gargantuan wealth inequality we see today. Nixon broke down the Bretton Woods system that linked other currencies to gold, as well through a system of fixed exchange rates.

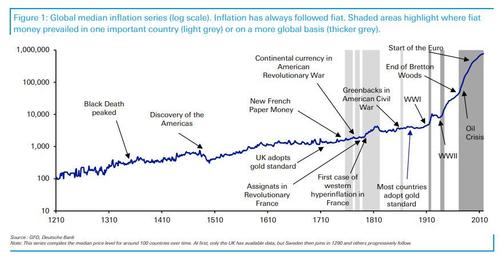

Excerpting from this lengthy piece, Reid dedicated his Chart of the Day to “Fiat, Fifty and Frail” in which he writes that “since the money we use today isn’t generally tied to anything, that gives policymakers a lot more scope to use inflationary policies, which is something they’ve definitely taken up the option on.”

Sure enough, with the link to gold broken, Reid then goes on to note that “over the last half century, we’ve seen the most inflationary period ever in the data series we have going back to the 13th century. So even though inflation has been tamer over the last decade, don’t be fooled that fiat money is anything other than inflationary through history.”

And in a remarkable twist, in which Reid basically sounds like a conspiracy theory blogger from ca. 2010 (it’s remarkable how so much “conspiracy talk” just a decade ago has been widely accepted by some of the most respected Wall Street strategists including Reid, Matt King, Michael Hartnett, Michael Every, and others), he refers to the chart below noting that “when fiat has arrived, inflation has followed. This is more graphically shown in the piece as we have the same graph for the US, UK, Germany, France, Italy and Japan through the centuries.” As Ried puts it “it collectively shows a stunning and even more extreme picture.”

Of course, it’s true that there have been a number of isolated hyperinflations in previous centuries, such as during the French Revolution, or in 1920s Germany. But, as the DB strategist points out, “the last 50 years is the first time we’ve seen such a broad upswing in the global price level across multiple countries.” Furthermore, since the chart uses a median series, that should also remove the impact of extreme values in some countries.

This brings up the next logical question: how long can this last for? As Reid writes, over the last half century, we’ve stress-tested our monetary system to extreme levels, with much higher levels of debt and unprecedented money printing from central banks. Fortunately, a number of exogenous factors have kept inflation lower than it might have been in recent years, like rising globalization and favorable demographics.

But can these always be relied upon (both are reversing) and will policymakers post-covid continue to flex fiat money even more aggressively, Reid asks? In response, his report highlights that monetary systems have changed a lot over prior centuries, and indeed for most of the twentieth century (and certainly before) most people couldn’t have imagined a world without money tied to gold.

So, he concludes “don’t take it for granted that our system of the last 50 years will survive your whole career.” Don’t worry, though, both bitcoin and gold fix this.

Tyler Durden

Tue, 09/14/2021 – 15:49

via ZeroHedge News https://ift.tt/2Xk2GjU Tyler Durden