Rabobank: Milley’s Presence Is Massively Damaging Image-Wise For The US

By Michael Every of Rabobank

OER misses

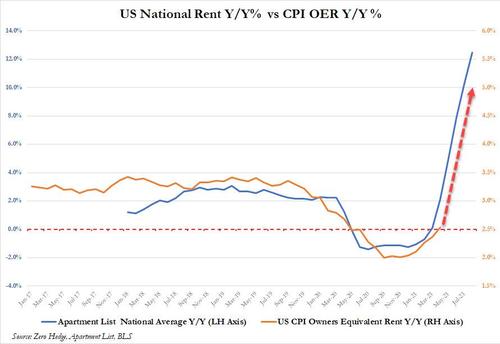

Today’s headline – “OER misses” – speaks to the key US CPI report yesterday, where the meme is suddenly that inflation pressures are past their peak because: 1) used car prices went down; 2) air travel prices went down; and 3) rent *officially* went up only a little as measured by the statistical construct that is Owners’ Equivalent Rent (OER) – which bears no relationship to actual rents being paid by people in the real economy. In short, a little statistical jazz-hands and we ‘transitory inflation!’,…despite the fact there are shortages wherever you look in US supply chains. You know where else used to have low reported inflation, but no goods on the shelves? It started with US and ended SR.

“OER misses” can also be read by middle-aged British readers as the risqué catchphrase “Ooh err, missus” of the late comedian Frankie Howerd. Besides Frankie overlapping with the USSR, and looking like Brezhnev as he aged, there is a need for that double-entendre today in terms of the broader context in which markets are operating.

Yesterday’s US Met Gala, which I would have loved to see Frankie comment on, was a po-faced-seriousness surreal dreamscape akin with costumes akin to ‘The Fifth Element’ –when do we get a celebrity called “Leeloo Multipass”?– without the comedic irony. Except in that the event was held during a pandemic, days after the 20th anniversary of 9/11, and the US defeat in Afghanistan, which is seeing intellectual angst about the decline or end of US global power –on which our global market architecture is built– in the US intellectual circles who don’t now cheer that end. (And as it now emerges Friday’s bilateral call saw Xi Jinping reject a proposed summit with President Biden.) The Gala’s unmasked, becostumed attendees, served by helpers wearing masks, displayed domestic and international political disconnect even larger than the inflation rents-OER gap. Deliberately political it was too, with AOC wearing a presumably-expensive “tax the rich” dress at a $50,000 a head soirée, just as Democrats consider rolling back the SALT tax provision “for two years” which caps federal tax deductions at $10,000 and sees mainly the rich in New York and California (i.e., Met Gala attendees) pay more tax. In short, the Met Gala was Davos channelled through fashion.

US media are also now abuzz with a new book from Bob Woodward –which everyone will tweet and nobody will actually read– claiming Joint Chiefs of Staff Chairman Milley held secret meetings and discussions with top military leaders and his Chinese counterpart to protect against a nuclear weapons launch from a “rogue” President Donald Trump. The sense of institutional decay in the global hegemon here is palpable.

Obviously Trump is now saying such action, if it happened, is treason, even if others now say unconstitutional checks and balances are needed when a president of a party they don’t like is in power. Moreover, the risks Milley, who remains in his position, raises in terms of the room for foreign policy misinterpretation and superpower policy missteps has serious analysts –not tweeters– losing sleep. It’s massively damaging image-wise for the US at a time of an ongoing collapse in the post-WW2 global security architecture, even if none of this is true. Neither Davos nor the Met crowd will much like a world without it once it is gone; but then the looming end of the world didn’t matter to plutocrat Gary Oldman or the vacuous fashionistas in ‘The Fifth Element’ much either.

As the US Internet was swooning over this decadence and heroics/treason, China was announcing a guideline on developing “a more civilized and well-regulated cyberspace environment,” with the stated aim being “to consolidate the guiding status of Marxism in the ideological cyberspace sphere, foster a common ideology among the whole Party and the Chinese people, and interiorize core socialist values.” This will include “higher ethical standards” and good online behavior: clicks and profits, not so much the priority. The same people in markets who didn’t read any Marx before the recent policy shift back towards Marxism in a Marxist political economy they had invested in, and who still refused to read any after that shift, will yet again have to try to explain why this is all still bullish “because markets”.

Yet China wasn’t finished there: they are also going to regulate casinos in Macau: so less gambling and more family entertainment – like risqué comedians? Markets seem to think so, with US casino stocks taking a hit. Evergrande continues to grab the headlines too: the Chinese government is hiring its own accounting experts to match those hired by the struggling property giant. “Ooh err, missus.” To match the current ideological outfit, how long until the markets takes the final hit and the firm is redirected to build social housing at low margins?

But back to the US, where one major change may well be closer to occurring. Back on 10 August the bipartisan “Ocean Shipping Reform Act of 2021” was introduced, which would mean a tsunami for global shipping if it passes. It includes provisions that: reciprocal trade must be established to promote US exports as part of the Federal Maritime Commission’s (FMC) mission; shifts the burden of proof regarding demurrage charges from invoiced parties to carriers or ports; and prohibits carriers from declining opportunities for US exports unreasonably. Naturally, shippers say this will spark a “protectionist race to the bottom,” and is doomed to fail. Well, besides US agricultural powerhouses, US retailers now also support the legislation. Watch this space, and the spaces on shelves, as you think about inflation, global maritime trade, and global security – because they are linked.

Lastly, a day after the RBA governor said he had given up forecasting the AUD, and had no idea why markets were forecasting that he was going to raise rates this year or next, the OECD is suggesting the first independent review of the Reserve Bank’s role and performance since 1981. Won’t that stir the pot, given it may call into question why the RBA keeps getting forecasts wrong, only just noticed high net immigration means lower wage growth, and is clearly focused on property? Can you imagine if they had to go the same route as the RBNZ and were forced to keep house prices stable? More seriously, how long can we all continue with our current nudge-nudge, wink-wink central bank policy globally? Surely at some point there is going to come a fork in the road where we either say they should go Austrian, and get out of the economy and markets completely; or we admit they are political, with political aims, but *unelected* – in which case let’s make them arms of government again, and let them reflect what the people want to see happen democratically. (Which will not be lowflation and asset price inflation.)

Whenever one tries to have an honest discussion about this at the highest levels, it is again all Frankie Howerd in response, who could talk for minutes while saying nothing: “Oooh err, missus! No! Nay, nay, and thrice nay! Look! Tsk! Ooooh! No! Never! Well, I….Stop that! Oooh!” You may think this is all irrelevant, and only that recent ‘weak’ US CPI print matters – but, really, titter ye not.

Tyler Durden

Wed, 09/15/2021 – 10:50

via ZeroHedge News https://ift.tt/3EnQHlI Tyler Durden