Latest PMI Data Confirms China “Entering Period Of Stagflation”

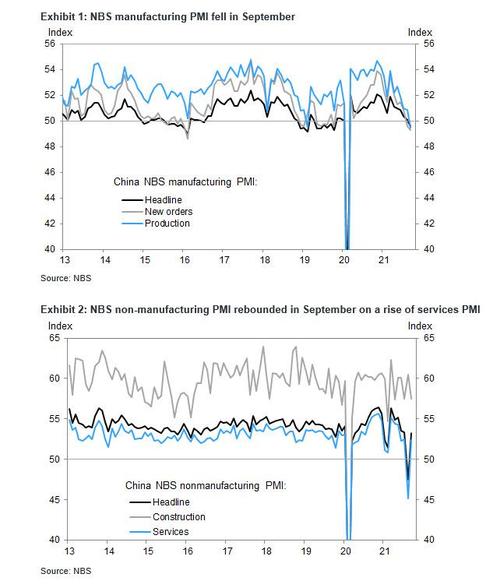

Just days after Goldman slashed its Q3 GDP estimate for China to 0%, predicting no growth in the world’s second largest economy, overnight Beijing confirmed that the Chinese economy has indeed stalled, with the September Mfg PMI contracting in September for the first time since the COVID-19 outbreak, even as the non-Mfg PMI rebounded after the end of the recent Delta outbreak.

Commenting on the contraction in mfg PMI, Goldman attributed it to the production cuts caused by energy constraints with both the output sub-index and the new orders sub-index in the NBS manufacturing PMI survey decreasing in September. However, Goldman warned that the numbers may not capture full impact of energy restrictions as the NBS survey was taken around 22nd-25th of the month.

Key highlights:

- Mfg PMI contracted in September for the first time since the COVID-19 outbreak on the back of weaker production. The headline reading declined by -0.5pp from August to 49.6, overriding the seasonality, weaker than market expectations of 50. PMI dropped by -1.5pp to 49.7 for medium sized firms and by -0.7pp to 47.5 for small ones but edged up 0.1pp to 50.4 for large enterprises. NBS indicated the industry divergence remained significant in September – the production and new order indexes of high energy intensity industries fell below 45.0, likely due to the production cuts caused by energy constraints, while the production and new order indexes of high-tech manufacturing were above 54.0, suggesting continued expansion.

- Production declined by a significant -1.4pp to 49.5. The abrupt power cuts and the “dual energy control” already started to show the impact.

- New orders lost -0.3pp to 49.3, with new export orders down by -0.5pp to the 15-month low at 46.2. Imports pulled back by a larger -1.5pp to 46.8. Both domestic and external demand seemed to have weakened further.

- Purchasing price and producer price indices rose by 2.2pp to 63.5 and by 3pp to 56.4, respectively. The energy outages and supply disruptions kept up industrial prices.

- Finished goods inventory slid -0.5pp to 47.2 as production waned, while raw materials inventory climbed 0.5pp to 48.2.

- Mfg employment dropped by -0.6pp to 49, showing a deterioration of the labor market condition.

- The new export order sub-index fell to 46.2 in September vs. 46.7 in August, and the import sub-index fell to 46.8 in September (vs. 48.3 in August).

- Non-Mfg PMI rebounded after the end of the earlier Delta outbreak. Following a -7.3pp slump in August, it recovered 5.7pp to 53.2, way above market consensus at 49.8. All sub-indices improved, with new business up 6.8pp to 49 and employment up 0.8pp to 47.8. Sector-wise, PMI almost returned to the pre-Delta level, up 7.2pp to 52.4, for services. In contrast, PMI printed -3ppt lower at 57.5 for construction, likely due to the property slowdown.

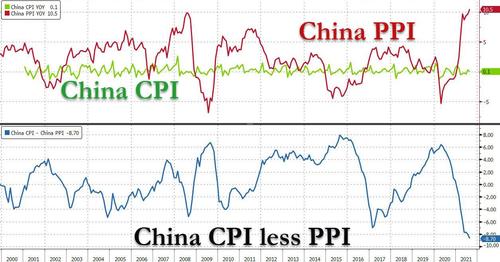

Yet as the manufacturing economy contracted, price indicators in the NBS manufacturing survey suggest inflationary pressures escalated somewhat with the input cost sub-index rising to 63.5 (vs. 61.3 in August), and the output prices sub-index also jumped to 56.4 (vs. 53.4 in August). NBS mentioned the input cost sub-indexes of petroleum, coal and other fuels, chemical materials and products, and smelting and pressing of ferrous metal were above 69.0 in September, suggesting a sharp rise of input costs. The output prices sub-index of smelting and pressing of ferrous metal was above 70.0 in September. By enterprise size, PMI of large enterprises edged up to 50.4 (vs. 50.3 in August), while PMI of medium and small enterprise fell to 49.7 and 47.5, respectively, (vs. 51.2 and 48.2 in August).

It’s also notable that the construction PMI fell in September to 57.5 (vs. 60.5 in August). NBS mentioned the employment and business expectation sub-indexes of construction rose to 52.6 and 60.1 in September (vs. 50.6 and 58.4 in August), suggesting improved labor market conditions and confidence in the construction sector. Expect much more weakness as the fallout from the Evergrande saga affects a bigger share of the property market.

Looking at the latest data, Citi’s China economists conclude that “China seems to be entering into at least a short period of “stagflation” adding that when the “supply constraints are largely binding, it is not appealing to forcefully boost (investment) demand via broad-based stimulus for now. Instead, we see more targeted policy efforts in the near term.”

Some more details from Citi:

- We recently trimmed our growth forecasts to 4.9% for 21Q3 and 4.5% for 21Q4 and downgraded the full-year projection to 4.9% for 2022 on the Evergrande spillover. Rising production cuts for the power outages and/or the “dual control” post a downside risk ~0.5ppt to our Q4 projection.

- While relief measures are possible, we see no quick fix to the power shortages throughout the winter. The need to ensure blue skies for Beijing’s Winter Olympics would constitute an extra reason for the government to limit the production of raw materials in northern China.

- In the meantime, the supply disruptions in the peak season should outweigh the demand weakness induced by the property down-cycle, backing energy and industrial prices. We expect PPI inflation to stay >9% toward the year-end.

- With CPI muted on the sluggish consumption catch-up, the deep PPI-CPI divergence would squeeze the profit margin of mid/downstream sectors, especially SMEs. When the supply constraints are largely binding, it is simply not appealing to forcefully boost (investment) demand via broad-based stimulus.

Looking ahead, Citi – like Morgan Stanley recently – sees more targeted support in the near term, and the anticipated 50bp RRR cut may be advanced to October. The PBoC’s new credit facilities to support decarbonization will likely start to operate soon. Regulators can also bring forward a part of the 2022 mortgage quota to Q4 to support non-speculative housing demand. The back-loaded local bond issuance and fiscal resource deployment will facilitate the climb, if not rebound, of infra investment.

Finally, when supply constraints ease after the winter, Citi expects much more aggressive policy actions to arrest the property-led slowdown.

Tyler Durden

Thu, 09/30/2021 – 11:08

via ZeroHedge News https://ift.tt/3ilyRGC Tyler Durden