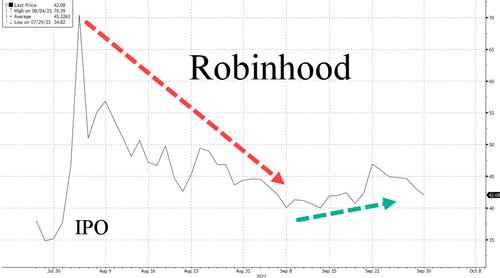

Robinhood Popularity Plunges, JPMorgan Warns Shares Could Drop 20% By Year End

Robinhood founder and CEO Vlad Tenev certainly timed his company’s (much-hyped) direct listing almost perfectly.

As Robinhood shares languish below their post-IPO high of around $56, JPMorgan is out with a new report claiming the company’s shares, which debuted via direct listing back in July, could shed as much as 20% of their value by the end of the year. It’s also the only broker on Wall Street with a “sell” rating on Robinhood’s shares.

Hopefully JPM’s traders cleared the bank’s entire position (or indeed, went short), because the report had its desired effect, leaving shares of HOOD down more than 2% on the last trading day of the month and quarter.

Looking more closely at the report, JPM’s “investment thesis” relies on a series of indicators suggesting revenue growth is about to suffer from a an abrupt double-whammy: a startling drop in trading revenue, combined with a sharp slowdown in customer acquisition. And then there’s always the regulatory wrath HOOD has provoked by making PFOF an industry standard practice.

Indeed, new allegations that Citadel lied about having foreknowledge of Robinhood’s decision to shut off trading in a handful of increasingly popular meme stocks back in January (and that a high-ranking $HOOD executive placed some questionable trades in AMC and other meme stocks ahead of the company’s decision to halt trading), new pressure has emerged against Robinhood. Still, to put it bluntly, it would be a surprise to see Jim Swartwout, President and COO of Robinhood, ever investigated or held accountable for any potential conflicts which he is being accused of online (and against which his firm has chosen to aggressively defend).

At this point, it would almost be a surprise to see the story linger on the fringes of the news cycle for another day or week before the ember dies out completely.

But we digress…

The first part of JPM’s thesis is the risk of a flood of supply given the dilution that looms as more shares are unlocked for sale, leaving the price vulnerable.

Robinhood’s float started out small at ~59.3MM shares at the IPO, including the greenshoe (some of which was used up to support the share price during the IPO). Keep in mind, Robinhood reserved like 20% of the shares offered in the IPO for its own users.

-

JPM expects the unlocking of 48.9MM shares associated with Tranche Ia of convertible notes and the unlocking of another 48.9MM shares of Tranche Ib once the registration is effective.

-

It also expects a substantial 567.9MM shares will be unlocked as of Dec. 1, when the majority of the selling restrictions expire.

-

These unlocked shares compare to the fully diluted share count of ~924mn including the greenshoe at the IPO price of $38

That’s a pretty big jump in just a few months, and with the increasingly dim outlook on the market, expect another wave of insider selling.

Moving on to JPM’s second issue, the significant slowdown in user growth and trading. These are important metrics because HOOD’s business is “much more transaction based” than that of its rivals (put another way: ‘Robinhood makes money by enticing people to trade as much as possible and, now that its users aren’t minting money every week, they’re starting to catch on to the scam’).

-

According to data from Apptopia cited by JPM in its research, the number of new Robinhood app downloads (a proxy for account openings) is down -78% from 2Q21 and daily active users (a proxy for activity levels) have declined -40% from 2Q21, both substantially weaker than peers.

-

We rate Robinhood Underweight with a 12/2022 price target of $35

JPM said “while the founders have leveraged innovation, guts and ideal market conditions to build a leading US retail broker, we do not see growth as sustainable and we question the ability of the company to generate competitive margins over time given the focus on such small accounts that have limited room to be profitable.”

There’s also the inevitability of the Fed’s great QE unwind, which could unleash long-suppressed animal spirits that may ultimately turn on stocks once investors accept the fact that the era of “free money” is coming to an end.

As lawmakers crack down on Robinhood for “game-ifying” the act of trading, it seems many of its more successful clients have moved on to one of Robinhood’s competitors. Indeed, JPM believes “its position [is] inferior to larger existing participants that have been able to leverage peer-to-peer and payments technology to build and leverage a compelling network.”

The analysts continued: “While Robinhood founders have built a company that brings investing to those that have been underserved, we don’t see a technological competitive advantage, and we see a brand and product offering that risks investors graduating to other more comprehensive financial institutions over time.”

Before we go, we’d like to remark upon the fact that, since Robinhood decided to go public via direct listing, it cut investment banks like JP Morgan out of the juicy fees that the investment banks see as their just reward for granting access to the markets.

We’re not saying that JPM being sore about losing the deal inspired the report – just that we doubt we would see such scathing analysis about, say, Didi (where JPM served as one of the lead underwriters).

But will JPM’s rivals once again follow it to the kill?

Tyler Durden

Thu, 09/30/2021 – 20:00

via ZeroHedge News https://ift.tt/3mcXRBa Tyler Durden