Luongo: Energy Subsidies, Bitcoin, & The Socialist Takeover That Isn’t

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

“When you subsidize something, you get more of it.”

– RON PAUL

I have a friend who once described Bitcoin to me as an organism which feeds on electricity subsidies. Bitcoin searches out the lowest cost of electricity available and consumes as much of it as it can to produce profit for the miners, since electricity costs are their biggest costs.

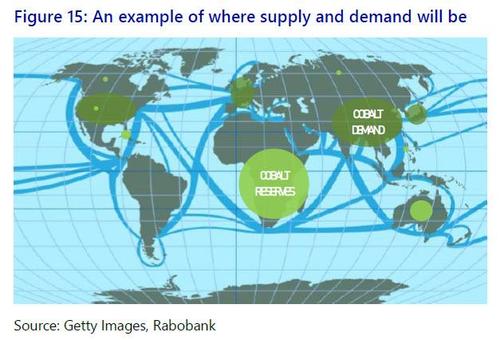

This is partly why China, for years, attracted the lion’s share of Bitcoin mining. Miners could co-locate next to hydroelectric power plants in China and suck up every extra available cheap and subsidized kilowatt-hour.

This is the essence of the free market. It finds inefficiencies and exploits them as capital flows to where it is treated best. It may be ‘predatory’ from the central planners’ point of view, but they opened themselves up to this effect the moment they intervened by subsidizing the market in the first place.

Bitcoin exposed a structural weakness in China’s electricity grid this summer which was under massive stress thanks to drought conditions there dimming the output of its hydroelectric generators. This is partly why Chairman Xi Jinping took the aggressive steps to kick the Bitcoin miners out of China this summer.

He could see the real costs of electricity rising as coal, oil and natural gas prices skyrocketed but, because of rate subsidies to end-users, revenue to power generating companies was flat. It served him in other strategic ways, like kicking out the flow of Bitcoin within the Chinese economy, cutting down would-be mining company financial oligarchs and ultimately lessening competition for the Digital Yuan.

The response from the Socialist is always the same, however. Today Russia is getting blamed for gas prices in Europe.

Price gouging in a crisis a moral failure, not the original wealth transfer (itself a theft) from one group of people to another, which is what an electrical subsidy is.

They see this as a market failure because to them the greater good is served by subsidizing certain aspects of the economy to achieve political and/or social goals. And, in some ways, they may be correct, but you’ll never know it because there can be no rational calculation of the costs versus the benefits, c.f. Mises’ critique of Socialism from 1921.

You see, the market is neutral. It doesn’t have a perspective other than expressing the very human response of seeing an arbitrage opportunity and exploiting it.

Rather than being a failure of the free market, Bitcoin miners seeking out and exposing the unsustainability of electricity subsidies is a massive success of market principles. It is firmly rooted in actual human behavior rather than some fantastical one created by a central committee and the force of the gun.

China kicking out the Bitcoin miners only forestalled the day of reckoning for its energy industry because their presence was a symptom of a deeper problem not the source of the problem itself. Today, four months later China is now rationing electricity to force demand down.

Rather than let market forces raise the prices, divert capital away from energy intensive (and possibly uneconomic) activity and give accurate signals to producers and consumers, China will do the authoritarian thing to blame the people and take away a basic function of a first world society.

This is a simple, yet dramatic, example of what’s fundamentally wrong with the world we live in today. China isn’t the only one guilty of this. Subsidies like these are everywhere and they do nothing except create pricing dislocations which attract massive amounts of capital creating economic bubbles in price.

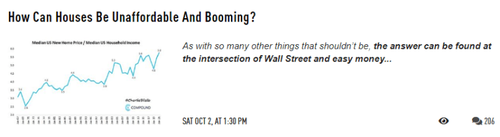

If you’re wondering where this headline could come from:

Zerohedge answers it with the pullquote.

In fact, it is the Austrian School critique of these subsidies which is its core competency; to explain in real terms why government intervention in a market ultimately subsidizes overinvestment in one activity at the expense of another.

Capital at any given moment is finite. That means there is competition for it ceteris paribus. That competition means that if better profits can be made mining Bitcoin in China rather than building a new road or gas pipeline, then that’s what will happen.

We can create more capital but that requires time, ingenuity and labor. Capital compounds at a pretty linear rate and all we do with things like deficit spending is pull forward capital from the future to subsidize production in the present.

Today we produce far more electricity than we use. It’s estimated that as much as 30% of global electricity goes to ground. Bitcoin uses up less than 0.5% of that wasted electricity. It’s actually performing a major market function to blow apart these layers of bureaucratic insanity by preying on a fraction of this over-production.

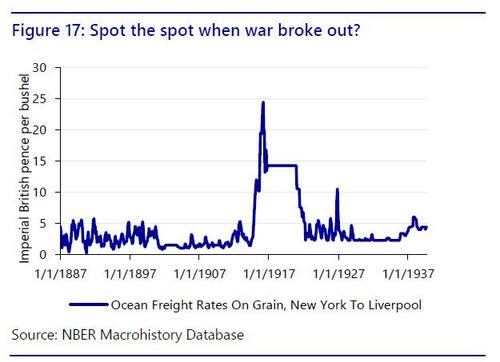

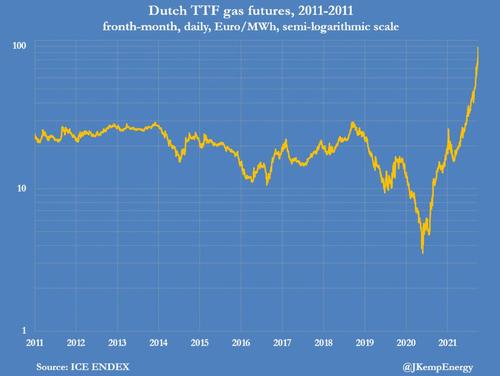

Since prices are set at the margin, small demand or supply shocks can create massive spikes or drops in price if the market is operating at peak capacity.

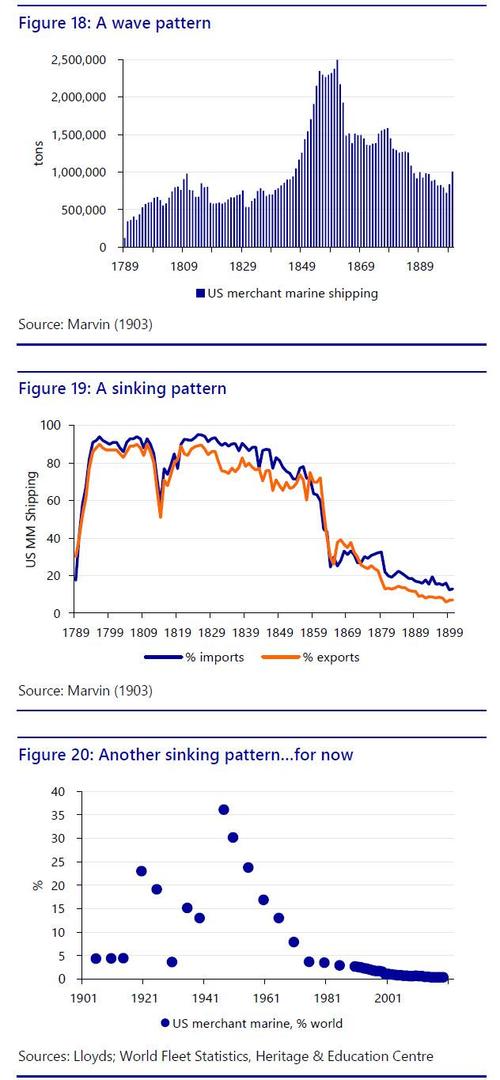

If you really stop to think about it, it’s quite astounding that the world’s economic system is this vulnerable to this basic application of free market principles. Today Bitcoin mining is co-locating next to the cheapest electricity produced on the planet, next to volcanos and nuclear power plants. It’s coming to America in a big, big way where it will further expose rural electrical subsidies here in the U.S. just like it did in China.

But, for now, this organism is healthy, strong and in no danger of dying from the heavy hand of inept socialists.

French Fried Grid Lines

What prompted this article was my reading with a certain perverse glee that France is dealing with the same problem China has but in a different way. They are now suspending a planned tax hike in electricity tariffs because prices to the French consumer are spiking thanks to rising gas, oil and coal prices that its nuclear power infrastructure can’t overcome.

Even if France fully passed on the input cost rises to the consumer, the tariffs the government charges for using electricity are another form of subsidy, not to the electricity generator, but to government itself. Why was France considering raising taxes on electricity during a global energy price spike?

Because its government spends too much money, doing what…?

…regulating its economy, which it has done an objectively miserable job of.

So, to subsidize its bloated and now openly tyrannical government France wanted to squeeze its citizens for more money to keep that arrangement in place: to fund The Davos Crowd’s mandates about COVID-9/11 vaccines, restrictions on travel, blasting protestors with water cannons… you know, protecting and serving the public.

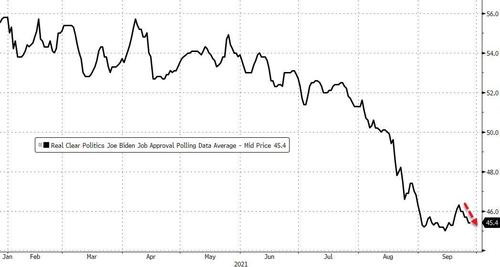

But with massive protests around the country and the people’s falling confidence and patience with its government, France had to back off lest this latest tax hike enflame passions there even more six months out from a Presidential election.

In typical central planner Newspeak they called the simple act of not raising taxes, the ultimate form of government aggression, ‘price protection.’ It’s patently absurd for them to frame it this way when the last thing the French government actually does is protect its people, except those that work for it, from, well, anything.

He {French Prime Minister Jean Castex} said any new natgas tariffs following Friday’s scheduled 12.6% hike would be postponed until prices decrease in late March/April, adding that it will shield 5 million households who are on floating-rate contracts.

Castex said the French government would lower taxes on power prices, capping the scheduled increase in residential electricity tariffs at 4% in February.

In the midst of an energy price crisis the French government, in a blatant pander to voters for the 2022 election, not only scrapped raising taxes but also further subsidized lower income households, encouraging them to use even more electricity and worsening the government’s fiscal position.

Someone has to pay to move those electrons around just not those that might vote to re-elect Emmanuel Macron.

These are decisions not made with any long-term economic benefits in mind, but rather the most crass short-term political consequences trying to put a band-aid on a government-inflicted wound on the people themselves.

“The government is good at one thing. It knows how to break your legs, and then hand you a crutch and say, ‘See if it weren’t for the government, you wouldn’t be able to walk.”

– HARRY BROWNE

Capital Gone Walkabout

Meanwhile, Germany is now running out of coal, as a major coal power plant there had to shut down because it ran out.

German utility Steag halted its coal-fired power plant Bergkamen-A after it ran out of hard coal supplies amid an energy crunch globally and logistics challenges domestically, the company told Bloomberg on Friday.

“We are short of hard coal,” Steag spokesman Daniel Muhlenfeld told Bloomberg via email.

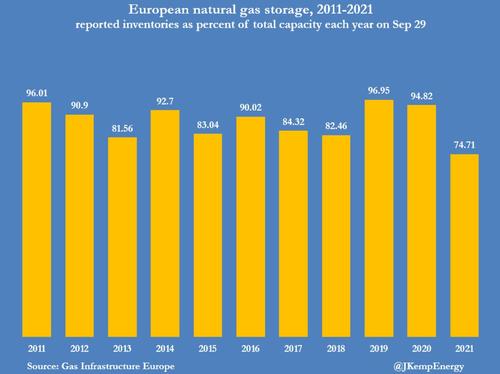

Germany has been the poster child for Europe’s Quixotic quest for carbon-neutrality. What it’s wound up with is windmills not spinning (and the birds chirped in excitement), solar panels covered in snow when the cloud cover clears and gas prices never before seen in history, at over $1200 per thousand cubic meters.

Oil prices keep trying to fall and new conflicts and controls keep trying to push the price higher, be it from OPEC+ members trying to subsidize their national governments, or the U.S. actively pushing supply off the market to subsidize its LNG exports. But, none of the price rise is because we’re running out but because supply is being artificially restricted by central planners wanting to create a false reality.

How does anyone expect the mighty German industrial economy to absorb these costs without some kind of output slowdown? The answer is no one. In fact, if you think through the situation, it’s clear Davos is happy about this because this puts downward pressure on growth, starving out Germany’s powerful industrial and middle class, who stand confused as to the cause, if the results of the election there are any indication.

Because those people produce wealth. Growing wealth to those of limited understanding is problematic. If the world is finite, they argue, growth must be finite. That’s only true, however, at any single point on the timeline of our understanding of the universe.

Tomorrow we’ll figure out some new thing, some new efficiency, material or overcome some obstacle we didn’t have time for yesterday. We’ll take our surplus time we earned as profit today and deploy it to fix some other problem tomorrow, opening up new pathways for growth.

But this type of growth, where it isn’t directed by oligarchs and governments who stand in front of them, is somehow evil or unsustainable.

Yeah, for them.

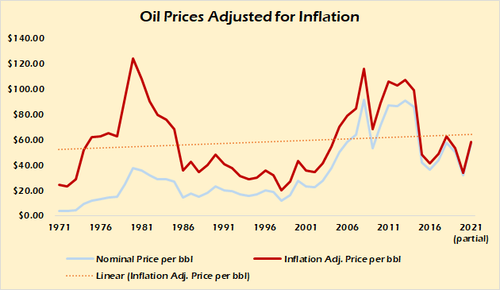

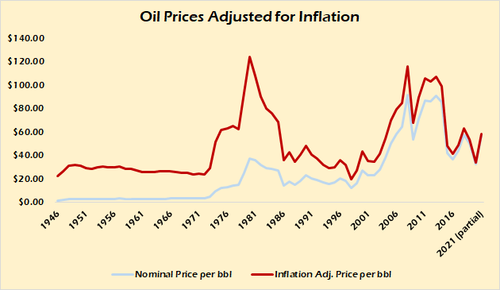

For the past fifty years they’ve been telling us peak oil would end modern civilization and yet, absent their manipulations of energy markets through lockdowns, wars, currency manipulation and regulation, the real price of oil has risen just 12% over the past fifty years, when indexed for inflation, which they manipulate to the downside to sustain their power.

One could easily argue that today’s price shocks aren’t any more sustainable than any other commodity whose supply and demand fundamentals are driven by politics more than they are the markets themselves. Remove those obstacles and I bet we’ll see oil production subsidies driven out of the market the same way that bitcoin drove China and France to ‘protect consumers’ from electricity subsidies.

We had to invent a new word to describe the fight over energy, geopolitics, because of our adherence to the socialists’ maleducation on basic human behavior. We also had to invent a new definition of inflation in the age of money unmoored from the stored energy of gold and other hard assets, based on prices not the supply of money.

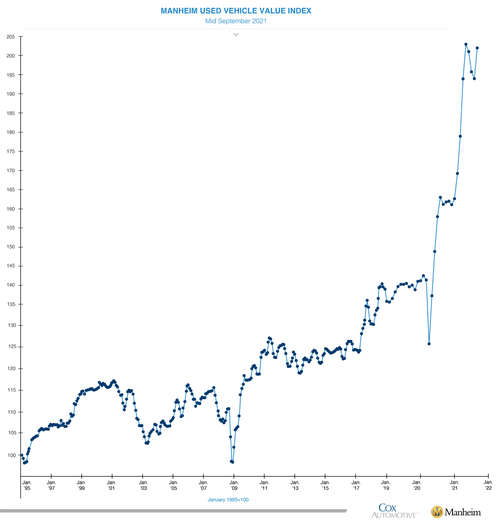

Instead of basing our money on our past work, tokenized by gold, they gave us a money based on what we will produce for them, debt. What I didn’t show in the above graph is the stability of oil in real terms before we entered this era.

All Malthusian arguments about the end of cheap energy are themselves indefensible and unsustainable and yet that is all we are ever told is coming. They deny the Marginal Revolution (1871-74) in economics, which negated all of Marx’s complaints about capitalism before his death (1883), and yet his idiotic ideas fuel the unquenchable thirst for power of midwit oligarchs and the envy of their socialist useful idiots.

When someone is lying to you, you really owe it to yourself to ask why.

Davos has broken the world supply chain for energy for the sole purpose of proving a point that history itself has already debunked, Facebook be damned.

They do this, nominally, in the name of sustainability, arguing the wastefulness of capitalism is the end state of it.

But, as I’ve already shown with bitcoin and electricity, oil and money printing, it is the over-production of something through subsidization that creates unsustainable waste and malinvestment which eventually has to be liquidated in a rational system.

But instead of bowing to the rational, ending that system of privilege for them, they make the monetary system ever more irrational to the point of absurdity.

Last year, Paul Krugman was calling the $1 trillion coin “an accounting gimmick” that “wouldn’t even fool anyone”, now he’s all in on the illegal power grab with a New York Times column headlined, “Biden Should Ignore the Debt Limit and Mint a $1 Trillion Coin”.

That only took a little over a year.

The End of Socialism

This brings me to the final point of this essay. They are losing. They are losing not because they aren’t powerful or aren’t making our lives miserable but because their system of subsidy, which produces unearned wealth (or rent) for them is failing rapidly.

They embarked on this Great Reset solely for the purpose of defaulting on their socialist promises made by buying off present generations with the labor of future generations. We call this in modern parlance debt.

Now that the debt is unpayable and the future liabilities of their governments overwhelming everything they have unleashed a torrent of policies around the world to starve, freeze and kill off entire generations of taxpayers who they can’t afford to bribe anymore.

COVID-9/11, no matter how you look at it, as a political operation has shortened lifespans in the U.S. by 18 months in 2020, according to the CDC. What will those numbers look like in 2021? This is a radical contraction which lifted trillions of unfunded liabilities in Social Security and Medicare payments from future U.S. governments.

And they call libertarians heartless?

Draw your own conclusions from this but I think you know what it means.

Davos is purposefully shrinking the division of labor in order to prove the Marxist critique of capitalism correct when it has done nothing but lift billions out of poverty which the Malthusian central planners told us a century ago then was unsustainable.

Central planners aren’t rational. They are simply tyrants who prey on the fear and weakness of people grown soft through abundance. Because in their mind sustainability is only measured by the continuity of their power over society not the actual economics of that society. The instability, chaos and conflict come from their inability to accept that someone else may have a better solution to society’s problems than they do.

And what truly keeps them up at night is the gnawing feeling that the best system is the one where no one person or group of people could ever manage a system as complex and dynamic as seven-plus billion people acting in their own self-interest creating a spontaneous and self-correcting order which doesn’t need their help.

When I look out today and see bills in the U.S. Congress to deny unvaccinated people from flying or children from getting an education all I see is a failing system of energy distribution and subsidy trying to protect itself from the ravages of its own stupidity.

I’ve said it before and I’ll say it again here, power doesn’t prove you’re smart, it simply makes you stupid.

Bitcoin, among other technologies, is slowly eating away at these unsustainable markets while the socialists in China, France and yes, Washington D.C. scramble to keep the central planners’ dream alive of a world where they control access to everything you need to live your most productive life.

They are scared to death of a private banking system that doesn’t need them or a division of labor that coordinates production where their toll booths can’t collect. To them we are just livestock to be farmed, batteries to be discharged and liabilities on their balance sheets to be written down.

Energy isn’t scarce, it is abundant. Human energy, that is. Oil is finite. So is gas. So is coal. But until we properly price its costs, we’ll never figure out what’s the best replacement for them and at what point in time that change should occur.

Between now and then it will be a long, cold winter.

“I know you’re out there. I can feel you now. I know that you’re afraid. You’re afraid of us. You’re afraid of change. I don’t know the future. I didn’t come here to tell you how this is going to end. I came here to tell you how it’s going to begin. I’m going to hang up this phone, and then I’m going to show these people what you don’t want them to see. I’m going to show them a world without you, a world without rules and controls, without borders or boundaries, a world where anything is possible. Where we go from there, is a choice I leave to you.”.

– NEO, THE MATRIX

* * *

Join my Patreon if you want to subsidize the truth

BTC: 3GSkAe8PhENyMWQb7orjtnJK9VX8mMf7Zf

BCH: qq9pvwq26d8fjfk0f6k5mmnn09vzkmeh3sffxd6ryt

DCR: DsV2x4kJ4gWCPSpHmS4czbLz2fJNqms78oE

LTC: MWWdCHbMmn1yuyMSZX55ENJnQo8DXCFg5k

DASH: XjWQKXJuxYzaNV6WMC4zhuQ43uBw8mN4Va

WAVES: 3PF58yzAghxPJad5rM44ZpH5fUZJug4kBSa

ETH: 0x1dd2e6cddb02e3839700b33e9dd45859344c9edc

DGB: SXygreEdaAWESbgW6mG15dgfH6qVUE5FSE

Tyler Durden

Sun, 10/03/2021 – 13:32

via ZeroHedge News https://ift.tt/3a3pEys Tyler Durden