Doug Casey Reveals 3 Ways You Can Opt-Out Of The Rising Insanity

Authored by Doug Casey via InternationalMan.com,

International Man: Ever since the outbreak of the Covid hysteria, government control over everyday life has reached unprecedented levels. Petty bureaucrats now exercise control over who can open their businesses, whether you can go to a restaurant, and even whether children can go to school.

Where is this all going?

Doug Casey: There are basically two types of people in the world—people that like to manipulate the physical universe and create things and people who like to manipulate other people and control them. The people who go into government, whether they’re Democrats or Republicans, are the latter. They’re dangerous.

The problem is that the average citizen in every country around the world has come to think that the government is the most important entity in society. It’s not; it’s a coercive fiction, a parasite that produces nothing. The wrong kinds of people are being given even more control.

Once people with a certain psychological mindset—that second type of person I just mentioned—take control, things inevitably get worse.

In Washington, DC, as well as in many state and local governments, we now have genuine Bolsheviks and Jacobins in control. That’s not to say that they’re necessarily believers in those philosophies, but they’re exactly the same psychological types. In other words, they’re exactly the kind of people who once destroyed France and Russia, reincarnated in today’s America.

Once these types get control of the machinery of the State, they won’t give it up. Power—the ability to coerce and control others—is central to their very beings. They’ll try to cement themselves in place now that they feel they can get away with it.

They’ll use their power aggressively, installing counterproductive and destructive policies. The worse things get, the more the public will look to the government to save them. It’s a self-reinforcing feedback loop.

The chances of getting a genuine lunatic as the president are very high. I’m very pessimistic because trends in motion tend to stay in motion—and this trend is accelerating rapidly.

International Man: As a result of this trend, more parents than ever have opted for homeschooling.

What’s your take on this?

Doug Casey: It’s cause for optimism.

First of all, education is something that you provide for yourself. It’s not something that somebody—certainly not the State—gives you.

The value—and the original purpose—of public schooling was basically to teach the three Rs: reading, writing, and arithmetic. With those essentials and the ability to use a library or the Internet, which places all of the world’s knowledge at your fingertips—you don’t need anything else beyond that.

The basics can be picked up in the first six or seven years of grade school—for anybody, even slow learners. Beyond that, school just bores most kids and is actually counterproductive. It not only wastes their time and money but actually makes them dislike learning. Homeschooling allows them to make the world their oyster while teaching individual responsibility.

Secondly, most schooling today—certainly once you get into high school and absolutely once you get into college—is little more than indoctrination. Schools are places where your kids pick up bad ideas from the educators and bad habits from other young yahoos they’re surrounded by.

Schools do not teach critical thinking—if indeed they ever did—at least since Plato’s Academy and Aristotle’s Lyceum. Critical thinking is the habit of questioning all assertions and examining everything that we think we know in the light of knowledge, logic, the scientific method, and your own research. That doesn’t exist anymore in schools. In fact, the government and the establishment don’t want schools to turn out critical thinkers and free thinkers. To the contrary, they want obedient, indoctrinated serfs who will do as they’re told and act as cogs in the wheel.

I think it’s irresponsible on the part of parents not to properly educate their kids. And that doesn’t mean just sending them off eight hours a day where they sit behind a desk and listen to government employees lecture them.

It costs an average of about $12,000 per pupil per year—we’re talking a nine-month year with long vacations—to babysit and corrupt kids. That’s an outrageous amount. College, often over $50,000, can only be described as a scam.

Nobody has more of an interest in making education available to kids than their parents do; certainly not members of the teachers union. If the public schools vanished, it would be a good thing. That $12,000 per pupil could stay in society so that people that wanted to educate their kids properly wouldn’t have to pay the toll twice.

A couple families could easily get together and hire full-time, first-rate tutors to teach their kids one-on-one, as opposed to sending them off to a government factory to be indoctrinated.

The school system has become very corrupt from what it once was. Schools and universities are grossly overweight with grossly overpaid administrators. Ninety percent of these phony “educators” should be fired. Furthermore, most teachers now are overtly Marxist, and the rest are dim, but sympathetic to Marxist ideas. Schoolhouses at all levels should be intellectually cleaned, then fumigated, if they can’t be abolished.

I’m glad many people are dissatisfied with schools and some are doing something about it. It’s one of the few good things to come out of the Covid hysteria.

International Man: What other ways can people opt out and regain more control over their lives?

Doug Casey: The ideal solution is to become a PT—a permanent traveler or prior taxpayer—but that’s not easy for most people. As I mentioned last week, even if you don’t want to internationalize, the next best thing is to quit your job and become self-employed.

But beyond that, in order to have control of your life, you need capital, which gives you flexibility and room to run.

So how do you get that capital?

If you’re not in a position to quit your job and become self-employed, then take a second job— part-time. The advantage of that is your income will go up and your expenses, in the way of consuming, will go down. Put that money aside.

The key is to cut your spending to the bone and save. That means don’t buy that new car or trade up to a larger house. Don’t go out and get a new wardrobe.

Build capital while the economy and the currency are still held together. Capital will allow you to take advantage of opportunities in the future, as opposed to getting deeper in debt like a serf.

International Man: All the governments around the world are inflating away their currencies and taxing their citizens at ever-increasing levels.

How can the average person opt out or at least limit the government’s theft of their savings?

Doug Casey: You want to save, but saving in fiat puts you on a treadmill.

If you leave your money in US dollars or other currencies, you’re going to lose everything or almost everything. You really have to learn to invest and speculate.

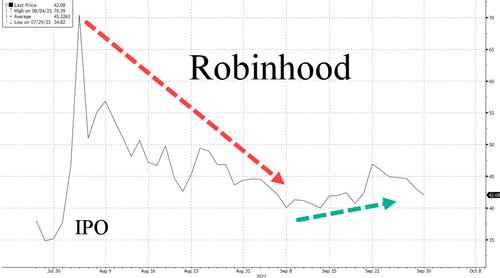

Unfortunately, investing in the kind of chaotic, government-controlled economy we’re moving into is hard and becoming harder. On the bright side, the distortions the government is creating offer lots of avenues for speculation. I’ve discussed the differences between saving, investing, speculating, and gambling in the past. But unless you study economics and the markets, if you try to speculate, you’ll probably wind up gambling—which is very different.

The key is to educate yourself on the ins and outs of the markets—including crypto, currency, and commodity markets, not just the stock, bond, and real estate markets.

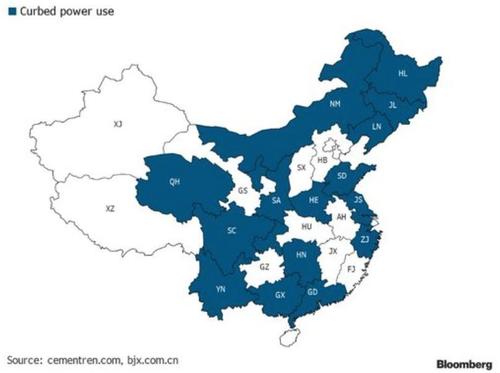

Right now, commodity markets are particularly interesting. For example, I’m of the opinion that natural gas, which is traded on the futures market, is currently around $5.00 per Mcf. I believe it could go much higher.

I’ve personally sold naked puts to capture the premiums, and I’ve bought long-term bull call spreads. If you’re not familiar with these things, then don’t take my advice. But try to become familiar with these things.

One of the reasons I’m bullish on commodities is that with the Bolsheviks in office in Washington, DC, and actual communists in control of a lot of countries around the world, commodity production of all kinds is being made harder. At the same time, all the money they’re printing is creating artificial demand, and all the regulations they’re passing are artificially restricting supply.

Commodities are about the only cheap things left; their prices are going a lot higher. You can capitalize on this as a speculator if you know what you’re doing. But be careful because you can easily wipe yourself out.

Any savings that you have should be in small gold and silver coins, not in fiat currencies. I don’t see gold as a good speculation at $1800. It is, however, ideal for saving. In addition to providing long-term upside, gold and silver coins are far more private than keeping US dollars in a bank account, which the government can monitor.

Lastly, if you’re going to keep your house and stay in the same place, you might want to save by buying things like cigarettes, whiskey, instant coffee, ammunition, and the like. If times get tough, all of those things are going to be hard to come by. They’ll be in high demand—and they’re an alternative to fiat.

International Man: Today, what we buy, who we interact with, and what we say are more easily tracked.

Everyone’s private information is under assault by a private-public partnership of governments and big corporations.

Where is this all going, and what do you suggest people do about it?

Doug Casey: As much as possible, keep a low electronic profile.

Get off Facebook and other social media platforms. I have a Facebook account, but I never use it or access it in any way for anything personal. It’s strictly a business tool—the same for LinkedIn and the rest of them.

Everybody should realize that social media is the primary way that they track you, learn what you think, and discover who you are. It’s just not good for that information to be in the hands of the bad guys.

Of course, everybody has a cell phone today; they’re tracking devices. Entirely apart from that, the things are a nuisance, and most people are addicted to them. I have one, but I never use it except when I’m traveling or at a conference.

I understand the value of apps for navigating and such. It might be good, however, to have two cell phones. The one you use for talking should be a flip phone. The other can be used selectively for whatever apps you need.

On a personal level, speak up about these things whenever possible. Even though it’s pretty hard to turn back the tidal wave of statism and collectivism that’s washing over society, everyone should do what they can. You might want to start by going to LiveandLetLive.org, run by my friend Marc Victor, for practical thoughts on what you can do. We just taped a videocast that’s pretty good, in my opinion. It will be released shortly.

I’m afraid the US and most advanced countries in the world are well on their way to combining the worst traits of George Orwell’s 1984 with those of Aldous Huxley’s Brave New World.

* * *

The months and years ahead will be politically, economically, and socially volatile. What you do to prepare could mean the difference between suffering crippling losses and coming out ahead. That’s precisely why, legendary investor and NY Times best-selling author Doug Casey just released this urgent report on how to survive and thrive. Click here to download the PDF now.

Tyler Durden

Thu, 09/30/2021 – 21:00

via ZeroHedge News https://ift.tt/3D0DvBT Tyler Durden