Lyft Jumps After Sales Beat, Reports Highest EBITDA In History

With dealer inventories of both new and used cars at all time lows, (thanks to the worst semiconductor supply chain SNAFU in modern history) and Americans unable to buy their preferred mode of transportation, they have no choice but to rely on the likes of Uber and Lyft, and as the latter showed moments ago, this is clearly benefiting the bottom line.

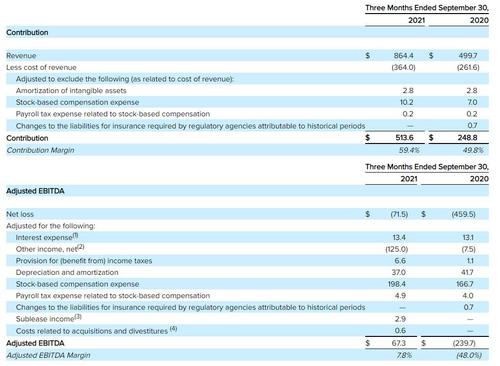

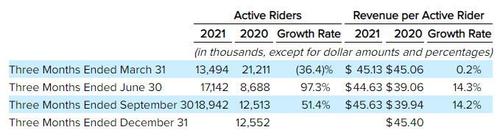

Lyft reported revenue for the third quarter that beat the average analyst estimate as the number of active riders rose 51% but slightly missed estimates even as revenue per rider rose to $45.63, above the consensus forecast; adjusted EBITDA printed in the green only for the second time in the company’s history:

- Revenue $864.4 million, up 73% y/y, and beating the estimate of $862.0 million

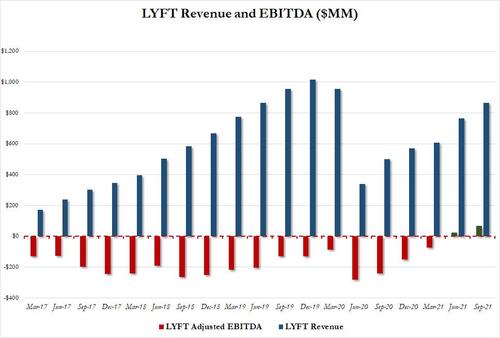

- Adjusted EBITDA $67.3 million vs. loss $239.7 million y/y, double the estimate of $33.0 million, and higher than the strongest forecast of $40.3 million

- Net loss narrowed to $71.5 million from a loss of $459.5 million, or $1.46 a share, a year earlier.

- Adjusted net $17.8 million vs. loss $280.4 million y/y, estimate loss $6.99 million

- Loss per share 21c vs. loss/share $1.460 y/y

- Revenue per active rider $45.63, estimate $44.43

- Lyft reported $2.4 billion of unrestricted cash, cash equivalents and short-term investments at the end of the third quarter of 2021.

- Cash and cash equivalents $728.4 million, estimate $624.4 million

- Active riders 18.9 million, +51% y/y, missing the estimate estimate 19.3 million

And visually:

Additionally, Lyft reports that it took a $119.3 million pretax gain in Q3 on Woven Planet transaction.

“Given our success onboarding new drivers and expected supply tailwinds, we anticipate our service levels will naturally improve in Q4 and lead to lower prices,” CFO Brian Roberts said.

Lyft co-founder and President John Zimmer said airport rides, which were up threefold compared to a year earlier, coupled with a rise in weekend and evening trips, was a positive sign that customers are reverting back to pre-pandemic habits. “We feel great about rider demand,” Zimmer told Bloomberg. “And since the release of booster shots, and children’s vaccinations becoming available, I feel good about the road ahead.”

Even as riders return, Lyft and Uber have struggled to find enough drivers. Lyft poured millions of dollars into incentives and bonuses to entice drivers who are hesitant to return, sometimes because they have unemployment benefits or health concerns. It’s finally working: driver supply increased 45% in the third quarter versus the same period last year. “We’ve seen [driver supply] levels improve materially and see a path for less dynamic pricing as we get the marketplace balance stabilized,” Zimmer said.

Lyft has worked to become profitable, slashing costs with a wave of layoffs and budget cuts at the height of the pandemic, and agreeing to offload its self-driving division to a subsidiary of Toyota Motor in April, cutting costly autonomous car research expenses.

In kneejerk response, Lyft shares jumped 3.6% in postmarket trading on Tuesday, after third-quarter revenue and adjusted Ebitda beat the average analyst estimate. Peer Uber’s shares also gained, up 1.6%.

Tyler Durden

Tue, 11/02/2021 – 16:38

via ZeroHedge News https://ift.tt/3GEurp7 Tyler Durden