“Markets Are Just Going To Break In Some Parts” – One Bank Sees Bond Market Turmoil Shifting To Stocks

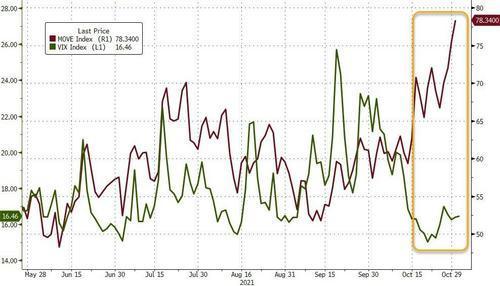

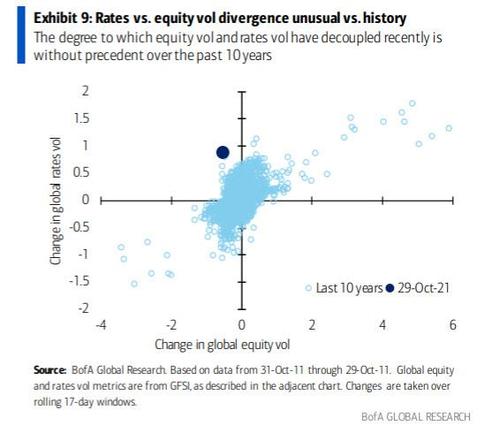

As we noted earlier today, a huge divergence has opened up between stock and bond market volatility, the former measured by the absurdly calm VIX index, the latter by the surging MOVE…

… whose spike pushed it to the highest levels since April 2020, suggesting bond traders are increasingly on edge over how the Fed’s taper announcement could impact bond prices even as equity markets continue to ignore any and all potential risks.

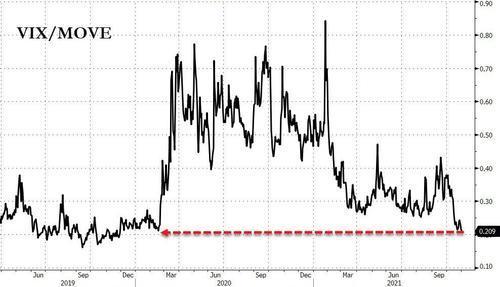

As the next chart shows, we haven’t seen a divergence this wide between the two since before the covid crisis:

We discussed some of the reasons behind the turmoil in bonds in “”10 To 20 Asset Managers Are Being Liquidated” – Rate Vol Exploding Just As Funds Pile Into Repo Trade That Blew Up Market” and earlier today we showed the ominous collapse in the 5s30s curve, one of the most credible early indicators that not all is well in the economy…

… a signal that was further reinforced by the first ever inversion in the 20s30s curve.

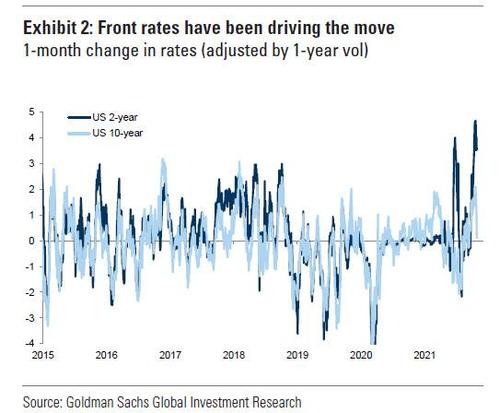

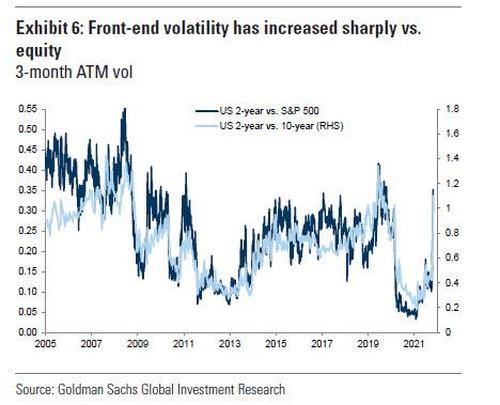

Commenting on the wild moves in the yield curve, Goldman’s Christian Mueller-Glissman writes that front-end rates have been the main driver of the move with 2-year rates recording a roughly 5 standard deviation move in October…

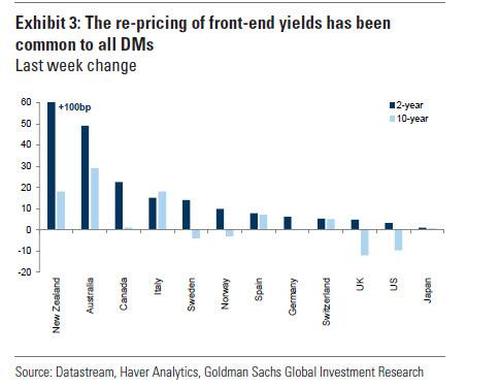

… as investors increasingly fear central banks will have to tighten policy faster due to inflationary pressures. At the same time, little confidence on the long-term growth outlook, excess savings and fears of slowdown risk due to excessive tightening has likely limited sell-offs further out in the curve although as DB’s George Saravelos notes, this flattening confirms the market’s view that the Fed is about to do a policy error by announcing a taper during tomorrow’s FOMC meeting. Meanwhile, outside the US, a mix of hawkish pivots and technical factors have triggered an even sharper front-end sell-off in Canada, Australia and New Zealand.

In Europe, sovereign spreads have been widening post-ECB last week, in part as the market might have been pricing a too bullish QE outlook.

And here the $64 trillion question emerges: why despite the recurring, P&L-crushing VaR shocks in bond land, has the equity market ignored the turmoil below the surface?

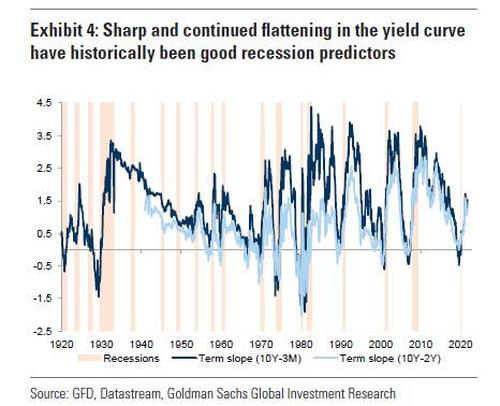

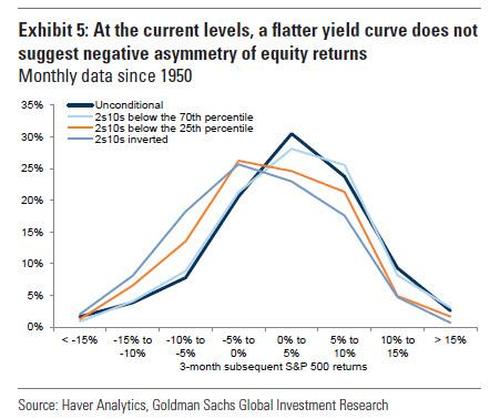

One theory comes from Goldman which notes that stocks have “digested the global rates re-pricing surprisingly well” and the bank speculates that this is “likely on the back of another good earnings season and longer-dated real yields continuing to be anchored at very low levels, which continued to support the current high valuation regime.” Yet even Goldman admits that historically, continued flattening of the yield curve can point to rising recession risk and equity International market peaks…

…but absolute levels of the 2s10s also matter. In fact, according to Goldman only levels below the 25th percentile (i.e., closer to an inversion in the yield curve) suggest more negative asymmetry in equity returns.

Instead, Goldman notes that from levels around the 70th percentile as we are seeing now, equities have delivered positive returns on average, especially in front-end led flattening episodes (bear flattenings). Additionally, one key feature of the current recovery is that the curve steepened much less than usual, which can distort the yield curve signals.

There is another, far simpler reason why stocks are ignoring the bond market turmoil: Goldman believes that continued low rates ensure a regime of TINA and as long as the shorter-dated rates volatility does not spill over to the back end…

… and the macro backdrop remains supportive, “equities might remain relatively insulated and equity vol might stay anchored.”

Others, however, disagree, and according to Bank of America strategists, the “end of an era” of abundant liquidity means that stock markets trading at record highs won’t be able to stay immune for much longer to the multiple-sigma moves in bonds.

Showing just how unusual the latest divergence between equity and bond vol is in a historical context…

… Asis writes that “this divergence is unlikely to sustain and the risk is equities are forced to price in the increasingly unfavorable policy environment.”

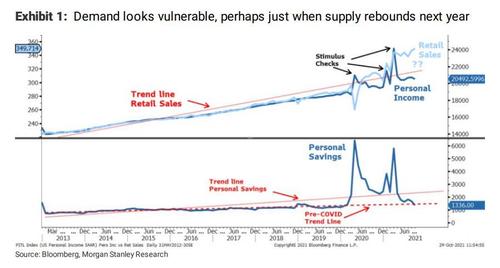

Wall Street’s biggest bear, Michael Wilson agrees, and as he wrote over the weekend, “the fundamental picture for stocks is deteriorating as the Fed starts to tighten monetary policy and earnings growth slows further into next year, turning outright negative for some companies.” His argument is one based on fundamentals: the strategist warns that the earnings growth slowdown will be worse and last longer than expected as the payback in consumer demand arrives early next year with a sharp year-over-year decline in personal disposable income. As he writes, “while many have argued that the large increase in personal savings will keep consumption well above trend, it looks to us as if personal savings have already been depleted to pre-COVID-19 levels.”

Alas, none of that matters to a generation of traders who have been trained like obedient Pavlovian dogs to buy each and every dip. According to Wilson, stocks are “continuing to rise as retail investors keep plowing excess cash into these same investments. Meanwhile, with strong seasonal trends and pressure to perform high at this time of year, many institutional investors we speak with are staying fully invested for these technical reasons. If our analysis is correct, we think that this bullish trend can continue into Thanksgiving, but not much longer.”

So who will be right: Goldman, which expects the recent fireworks to be contained to bonds, or Morgan Stanley, which sees the bond turmoil spilling over into stocks by the end of November. We may get the answer as soon as tomorrow when Powell announces the start of tapering.

Then again, with a market as cynical as this one, we may well end up with an outcome where a collapse in bonds leads to an accelerated meltup in stocks simply because even a hypothetical market crash would merely lead to even more intervention by the Fed which will have no choice but to undo its upcoming tightening (and with apologies to all the macrotourists out there, but tapering is tightening, as Michael Wilson explained one month ago). And yes, this is a paradox, because investors will have to sell to trigger panic at the Fed… and yet after the bazooka example of March 2020 where we saw to what lengths the Powell Fed will go to stabilize equities, absolutely no one wants to be the first to dump stocks in a world where equity downside is all but outlawed.

Tyler Durden

Tue, 11/02/2021 – 14:07

via ZeroHedge News https://ift.tt/2ZVq3Bn Tyler Durden