Yesterday’s Remarkable Market Reversal Explained

Stocks are solidly in the green today after another early morning dump, with Powell’s testimony easing fears of an ultra-hawkish Fed, just as we predicted would happen first thing this morning…

Powell aggressively talked back the Dec Fed meeting’s initial hawkish market take. He will do the same today in the Senate after last week’s minutes

— zerohedge (@zerohedge) January 11, 2022

… but the framework for today’s continuation was set during yesterday’s session, which saw the S&P experience a 2%, and the nasdaq a 3%, intraday reversal.

What was behind the move? Well, according to JPMorgan’s trading desk, the move was triggered by dealer gamma positions and aided by retail investor buying, especially (and ironically) after JPMorgan’s Marko Kolanovic published his latest reco to BTFD just around noon when the reversal kicked in.

So here is a more detailed explanation of what happened, first from JPM’s Michael Gormley who notes that gamma hedging drove the index lower at the start of the session. SPX dealer positioning has been near max short to the tune of ~$40bn, and with a 1.6% decline from SPX open, the pressure rose to around ~$60bn of theoretical gamma pressure, though it is likely less than that. Then, as the index rose, it became a feedback loop, and at least half of that had to be bought back, which became a positive driver through the session.

As SpotGamma further notes, yesterdays ~70 handle drop and subsequent ~100 handle rally led to a lot of options volume and an implied volatility crush. SG’s intraday metrics showed that options were likely a huge driver of yesterdays price action, particularly in the QQQ. What is also interesting, is that despite huge volumes, open interest levels in both the S&P and QQQ were little changed.

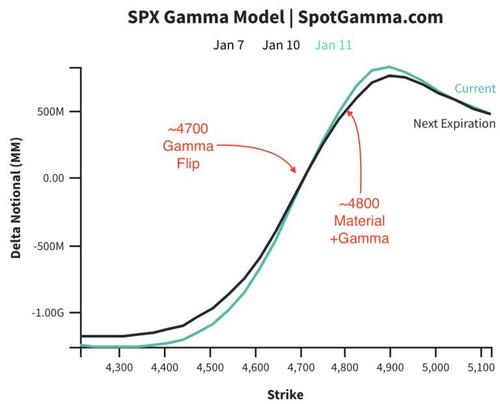

As a result yesterday move off the lows can be characterized as a “short cover rally” fueled by delta (puts closed/rolled) and vanna (implied volatility crush). That said, and looking ahead, prices will likely remain unstable, with SpotGamma’s models continuing to expect high volatility until the 4700 strike is recovered – and it is not until 4800 that we would see significant dealer based support.

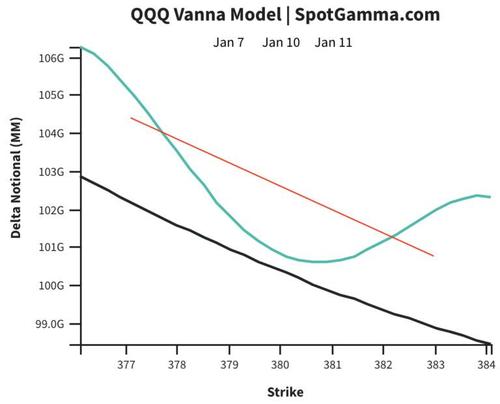

SpotGamma also calculates that we would need another 1% rally for the bulk of QQQ negative gamma to fade as vanna models show a very sharp skew in positioning, which suggests dealers still have material hedges to buy (to cover) as QQQ rallies, and plenty to sell as QQQ declines.

And then, there is retail buying and this interesting stat from JPM QDS Strategist Peng Cheng: retail bought $1.07 Billion, the third consecutive day of greater than $1 billion buying; with Tuesday the 93rd percentile. Putting this in context, Black Friday net buying was $1.6bn, which was the highest on record.

Tyler Durden

Tue, 01/11/2022 – 14:13

via ZeroHedge News https://ift.tt/3Gl5X3F Tyler Durden