J.D. Power Says Auto Prices To Hold Firm In 2022, Despite Lower Sales Volume

It looks as though those sky-high auto prices aren’t going to be coming down anytime soon.

In addition to numerous automotive CEOs – the latest of which was Elon Musk on yesterday’s Tesla conference call – blaming continued supply chain and semiconductor issues for their lack of inventory, a new report from J.D. Power released this week shows that prices will likely remain high despite sales declining from January 2021.

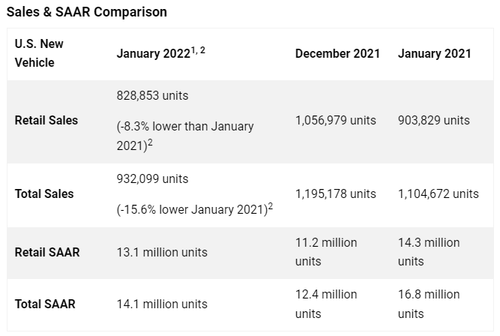

J.D. Power’s most recent estimates including that “new-vehicle sales for January 2022, including retail and non-retail transactions, are projected to reach 932,100 units, a 15.6% decrease from January 2021”.

The consumer intelligence company also predicted that the “seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 14.1 million units, down 2.6 million units from 2021”.

“Despite optimism towards the end of 2021 that diminishing supply chain disruption would result in more vehicles being delivered to dealerships, the new-vehicle supply situation has shown no meaningful improvement. January month-end retail inventory is expected to be below one million units for the eighth consecutive month. The volume of new vehicles being delivered to dealerships in January has been insufficient to meet strong consumer demand, resulting in a significantly diminished sales pace,” said Thomas King, president of the data and analytics division at J.D. Power.

Consumers are projected to spend more, despite the lower volumes, the report notes: “Despite lower volumes, higher prices mean that consumers are on track to spend a healthy $37.2 billion on new vehicles this month, the highest on record for the month of January and 10% above January 2020.”

King continued: “Dealers also are continuing to benefit from high transaction prices with total retailer profit per unit—inclusive of grosses and finance & insurance income—being on pace to reach a $5,138, an increase of $2,969 from a year ago and the fourth consecutive month above $5,000. The gains in per-unit profit are offsetting the drop in sales volume as the total aggregate retailer profit from new-vehicle sales is projected to be up 117% from January 2021, reaching $4.3 billion.”

“Record new-vehicle prices are being supported by exceptionally strong used-vehicle prices, as new-vehicle buyers benefit from more equity on their trade-in vehicles,” the report continues. “The average trade-in equity for January is trending towards $9,852, an 88% increase of $4,611 from a year ago. Also, interest rates are favorable when compared with a year ago. The average interest rate for loans in January is expected to decrease 14 basis points to 4.14%. Even with lower interest rates and increased trade-in values, the average monthly finance payment is on pace to hit a record high for the month of January of $669, up $73 from January 2021.

Despite the lack of supply, Power’s King says that the underlying metrics of the auto industry “have never been stronger”:

“Although the start of 2022 is disappointing from a sales standpoint, the underlying health metrics of the industry have never been stronger. Looking forward to February, the overall industry sales pace will continue to be constrained by procurement, production and distribution and all indications are that deliveries will not rise substantially for the industry in aggregate. This means February will likely be another month of suppressed sales volume offset by near record level pricing and profitability.”

The release also broke down key details for the auto sales market in the U.S.:

- The average new-vehicle retail transaction price in January is expected to reach $44,905. The previous high for any month, $45,283, was set in December 2021.

- Average incentive spending per unit in January is expected to reach $1,319, down from $3,482 in January 2021. Spending as a percentage of the average MSRP is expected to fall to 2.9%, down 5.2 percentage points from January 2021.

- Average incentive spending per unit on trucks/SUVs in January is expected to be $1,310, down $2,202 from a year ago, while the average spending on cars is expected to be $1,353, down $2,019 from a year ago.

- Buyers are on pace to spend $38.2 billion on new vehicles, up $4.4 billion from January 2021.

- Truck/SUVs are on pace to account for a record 80.1% of new-vehicle retail sales in January.

- Fleet sales are expected to total 103,200 units in January, down 48.6% from January 2021 on a selling day adjusted basis. Fleet volume is expected to account for 11% of total light-vehicle sales, down from 18% a year ago.

Tyler Durden

Fri, 01/28/2022 – 05:45

via ZeroHedge News https://ift.tt/34bMfJo Tyler Durden