Bostic Walks Back 50bps Rate Hike, Says Fed Won’t Start Recession But Yield Curve Says it’s Too Late

As we reported on Sunday (in “Atlanta Fed President Pours Gasoline On Fire With 50Bps Hike Comment, But There Are Reasons To Fade It“), Atlanta Fed president Rafael Bostic (2024 voter, hawk) sparked a fresh round of Fed fears (and catalyzed much of the overnight weakness in US futures) when in an interview with the FT, he suggested that a more aggressive approach is possible if the data warranted it which would mean rate hikes at every remaining policy meeting this year, adding that a 50bp hike is possible if inflation remains stubbornly high. Although, as we explained, not only is that not his base case – he maintains his call for three 25bps hikes in 2022 – but there were various mitigating factors suggesting that investors should not equate his comment with a Fed trial balloon that a 50bps rate hike is coming in March.

Sure enough, fast forward to this afternoon, when perhaps seeking to ease market nerves, Bostic was interviewed by Apollo’s Yahoo Finance, and said clarified that “a 50bps hike is not his preferred policy action for March“, adding that the “Fed is not fixed on a set policy progression” and that we “should get a few rate moves in hand then reduce size of the balance sheet.”

“I would adjust my policy to maybe not be as aggressive in terms of raising interest rates” if inflation decelerates more than expected

The walkback was enough to reverse the spike in rate hike expectations earlier on Monday, prompted by his weekend statements.

Bostic also reiterated that his personal preference is for three hikes in 2022, but caveated that there is lots of data ahead. Echoing what he told the NYT, he again said that he is laser focused on the next meeting and how data on inflation and jobs is evolving.

Noting that it is hard to anticipate too much what the “long arc” of policy will be at this point, the Atlanta Fed president said that he is not set on any particular trajectory. In terms of what he does expect, he said that he sees 3% inflation for FY22, and expects labor and supply disruptions will ease.

He then used the usual hedges, saying that if inflation responds quickly, he Fed could go slower but that is not his base case since businesses appear to have built in price increases already.

Looking ahead, Bostic said that this Friday’s jobs report will likely be a little lower than recent months (translation: brace for a negative print) showing the influence of Omicron, although he remains hopeful job growth will rebound in February and March.

Shifting away from rates, the Fed president said he wants to get the balance sheet unwind underway as soon as possible, can be more robust.

“Let’s get interest-rate moves in order,” and after moving away from zero it will be time to start reducing size of balance sheet

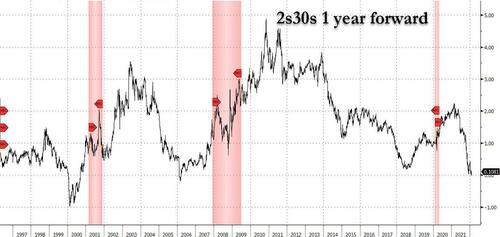

Last, but certainly not least, Bostic claims that the Fed should manage to avoid undue flattening of the yield curve, adding that the risk the Fed’s policies will cause a recession is “relatively far off.” Well, unfortunately for Bostic and the Fed, it’s not “far off” at all, and instead has arrived, because as the 2s30s forward chart shows, the curve is now on the verge of inversion, which means the countdown to the next recession has essentially begun.

Tyler Durden

Mon, 01/31/2022 – 15:40

via ZeroHedge News https://ift.tt/otjaOxKL3 Tyler Durden