“Small Caps Are Already Pricing In A Recession”: Marko Kolanovic Is Out With His Latest “Buy The Dip” Reco

It’s that time of the week (i.e., Monday) when JPMorgan’s head stock permabull, markets cheerleader and chief equity strategist, Marko Kolanovic, publishes his weekly JPMorgan View note and we doubt that it will come as a surprise to anyone that Marko’s market assessment – as last week, and the week before, and the week before that – is to buy the dip.

Echoing what JPMorgan’s trading desk said earlier, when as we reported the bank’s trader Andrew Tyler said that in the “near-term, we go higher” (even though “over the longer-term”, the the JPM trader thinks “investors will need to see Liftoff, at a minimum, before feeling comfort in being maximally deployed”), Kolanovic dispenses with the hedging and writes that “the equity market sell-off is overdone in our view, and we reiterate our call to buy the dip, particularly in cyclicals and small caps.”

According to Kolanovic, “stocks are in bear market territory and erased their post-pandemic re-rating, small cap valuations are at 20Y lows, and investor sentiment is bearish. Many market metrics such as recent performance of high vs. low beta stocks and valuations of small caps are already fully pricing in a recession – something we do not see materializing.”

In addition to those, the JPM strategist also sees very attractive risk-reward in China and EM equities, and notes that “while jitters around a Fed hiking cycle are understandable, this has been magnified by technical factors that can change quickly–i.e., we could see a reversal of systematic outflows, pickup in buyback activity as we exit blackout windows, and magnification of flows by weak liquidity and short-gamma hedgers”, echoing what Goldman’s flow trading desk said over the weekend.

Medium-term, the Croat says that JPMorgan “favors China, EM, Eurozone and UK equities vs. the US given growth convergence, interest rate sensitivity, attractive valuations, and favorable positioning.”

And while he agrees that Powell’s tone “which was more hawkish than the Fed statement, prompted a sell-off in bonds, stocks and other risk assets” spooked investors, and with reason since even JPM’s economists now forecast five hikes in 2022, he thinks that “the risk is that inflation-related data improve and fewer hikes are ultimately delivered.”

Drilling down on the bank’s rates expectations, Kolanovic writes that “last week’s FOMC meeting delivered another step in a hawkish direction via Powell’s remarks in the post-meeting press conference. He strongly hinted at a March lift-off, which in of itself was not surprising, but rather in emphasizing differences between the current conjuncture and the 2015 start to the hiking cycle in terms of the strength of labor markets and growth, in a response to whether the Fed would hike every meeting.”

Following Powell’s hints towards a faster pace of hikes, JPM now looks for five rate hikes this year, which is roughly in line with current market pricing.

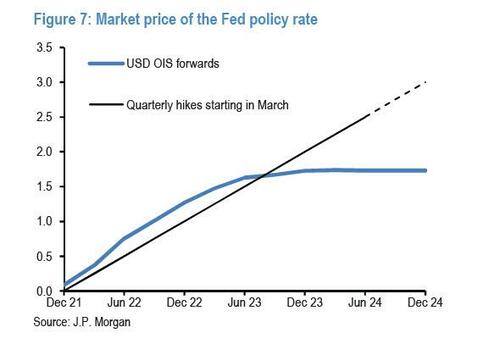

Indeed, after the meeting, market pricing shifted to price in some probability of a 50bp hike in March and the Fed funds futures for Jan23 (the first full month after the Dec22 meeting) shifted from pricing four of hikes the day before the FOMC meeting to pricing in nearly five hikes currently. In turn, Kolanovic notes that “this implies that the hurdle for additional hawkish surprises this year has increased.” That said, as per JPM’s revised rate forecast, while markets price in a faster pace for 2022, pricing flattens out markedly in 2023 with only just over 50bp of hikes priced in and less than 10bp priced in for 2024.

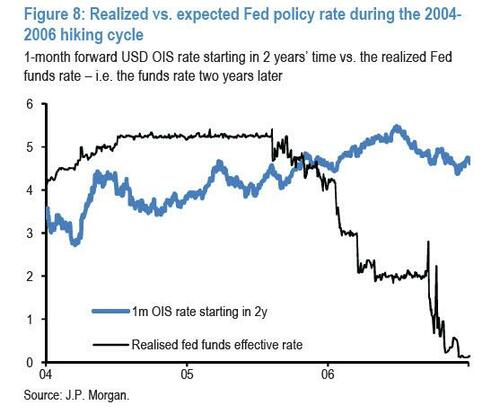

For interest rate markets to price in less hikes than the Fed eventually delivers is not unusual. Indeed, this is precisely what happened during the 2004-2006 hiking cycle. Figure 8 shows the 1-month forward USD OIS rate starting in 2 years’ time vs. the realized fed funds rate – i.e. the funds rate two years later – during that hiking cycle. It shows that throughout 2004 and most of 2005 the market priced in a lower Fed funds rate than the Fed eventually delivered, though note that from late 2005 onward the realized Fed funds rate shown in Figure 8 covers the financial crisis.

Kolanovic then rhetorically asks how did the equity market perform during the 2004-2006 tightening cycle, and answers:

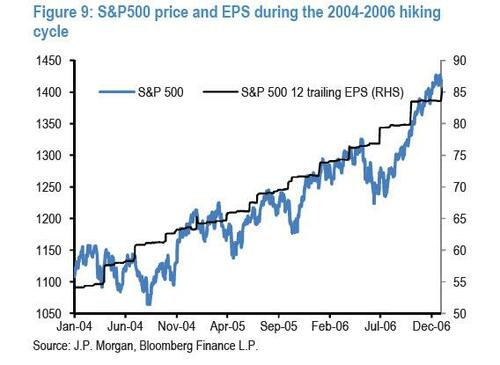

From the start of 2004 to the end of 2006, the S&P 500 index delivered annualized total returns of around 10% supported by annualized 12-month trailing EPS growth of around 15%, and this allowed P/E multiples to gradually de-rate through the expansion without hurting the equity market.

Clearly no two cycles are identical, and the starting point for equities is somewhat different with a current P/E multiple above that seen in the run-up to the first hike in 2004. But, given the approaching Fed tightening is set to occur against a backdrop of well-above trend growth and tight labor markets, we believe 2004-2006 is the closest comparison to the current backdrop. And similar to 2004-2006, above-trend EPS growth should allow the equity market to easily outperform cash and fixed income over the coming years, even if one assumes some gradual derating.

It is this longer-term picture that keeps Kolanovic overweight equities in his model portfolio and he believes “it would be a mistake to over-interpret short-term equity market gyrations, especially given the recent deterioration in market liquidity.” As we highlighted every day last week…

Liquidity level: catastrophic. Moderate-sized order moves ES 10 ticks pic.twitter.com/U2TP8ZIgKS

— zerohedge (@zerohedge) January 28, 2022

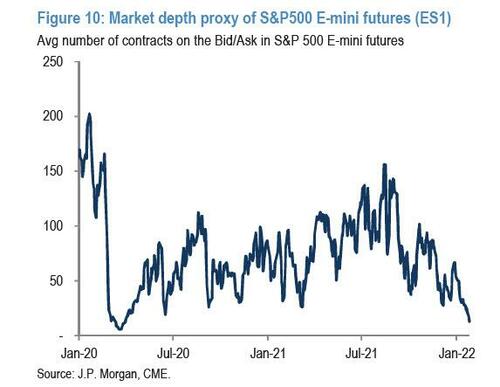

… and as also JPM discussed in the latest issue of its Flows & Liquidity publication, proxies for market depth, market breadth and the share of ETFs in equity trading are all pointing to severe deterioration in liquidity conditions this year to levels last seen in March 2020. In particular, the market depth metric for the S&P500 e-mini futures contract based on the average number of contracts at the tightest bid/ask – our preferred market liquidity indicator – has been deteriorating steadily since last September and currently stands at its lowest level since March 2020 at the peak of the pandemic correction…

Liquidity is as bad as when the Fed had to inject $5 trillion to kickstart the market. https://t.co/IH5kv02m7j

— zerohedge (@zerohedge) January 26, 2022

… something which Kolanovic also pointed out in his note today .

This poor liquidity picture raises the probability of large equity market moves either way, and we thus advise clients to not get carried away by short-term fluctuations in equity markets and to instead focus on the longer-term picture.

Looking ahead, and for the next few months, Kolanovic again agrees with his trading desk, writing that the March FOMC meeting is the next obvious risk event as the FOMC dots could be raised by more than the market expects for 2023 and 2024: “This is especially true if the next two payroll reports show further tightening in US labor markets. Until then, i.e. until the March FOMC meeting, we believe the balance of risks for equity markets is skewed more to the upside due to potential re-emergence of buybacks following the January blackout period as well as quarter-end rebalancing flows by pension funds into March.”

But even if the Fed surprises to the hawkish side, Kolanovic already hints at what his take will be: why Buy the Dip of course:

If the March FOMC meeting proves hawkish and causes another correction in equity markets, that should be seen as another temporary dip/consolidation within a bull market.

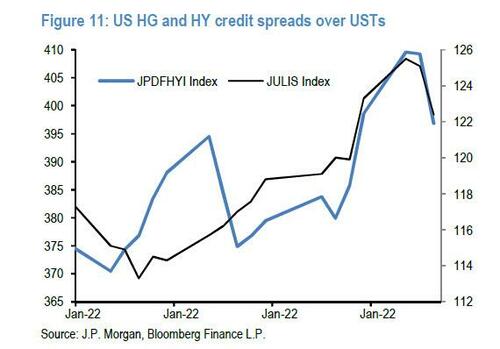

One other reason cited for his endless supply of permacheer and market optimism, is that “credit markets have shown remarkable resilience to this month’s equity market correction. Credit spreads are up by only 7bp in US HG and by 30bp in US HY.”

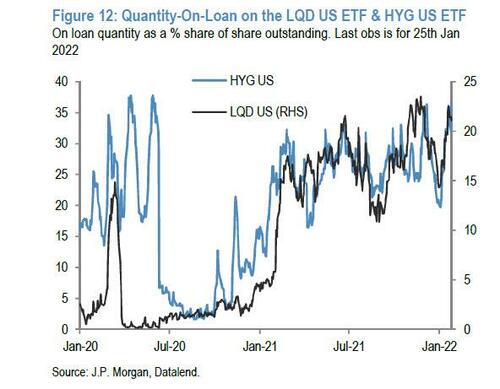

Here Kolanovic admits that this resilience reflects in large part “more bearish investor positioning in credit vs. equity markets. Indeed the short interest on the two biggest credit ETFs, HYG and LQD, has been elevated since last March.”

One interesting point made by the Croat strategist is that the lower participation of retail investors in credit vs. equity markets, “might have cushioned credit markets from retail investor positioning unwinding, which hit hard both equity and crypto markets YTD.” Beyond these position and retail flow differences, Marko believes that credit markets are sending an overall positive message that the Fed tightening would not derail the credit or economic cycle “and that fears of Fed policy mistake or of an early end to the current cycle are overdone in a backdrop of above average nominal income growth.”

So putting it all togetger, Kolanovic – unlike both BofA’s Michael Hartnett, Morgan Stanley’s Michael Wilson and – of course – SocGen’s Albert Edwards – disagrees with fears of a Fed policy mistake or an early end to the current cycle, and instead believes “that similar to 2004-2006 Fed tightening cycle the current cycle is taking place in a backdrop of above average nominal GDP and EPS growth, which should allow the equity market to easily outperform cash and fixed income over the coming years even if one assumes some gradual de-rating.”

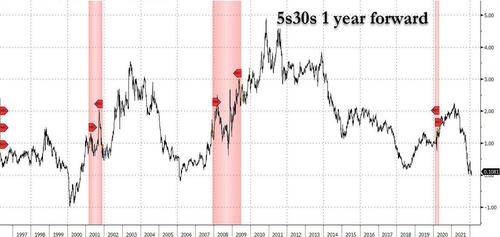

We disagree… and so does the market, because one look at the 1 year forward 2s30s shows that we already have an inversion.

And once the curve has pancaked, the countdown to a recession has begun; the only question is when?

Tyler Durden

Mon, 01/31/2022 – 14:42

via ZeroHedge News https://ift.tt/Q5OHTh4cR Tyler Durden