March Payrolls Preview: Can Wage Growth Slow Enough To Dent The Fed’s 50bps Rate Hike

With the Fed’s rates “lift off” already a done deal, traders will frame Friday’s March jobs data (which comes just hours after the month of March is in the actual history books) in the context of monetary policy, where money markets are assigning a 76% probability that the Federal Reserve will lift interest rates by a 50bps increment in May. Accordingly, as Newsquawk writes in its NFP preview, there will be much attention on the average hourly wages measures in the jobs report for signs about how the recent surge in inflation is affecting Americans’ real incomes, and for any evidence of the so-called second-round effects of inflation. The consensus looks for wages to rise in the month, lifting the annual measure, but some desks argue that the pressure is easing in the labor market, which should see wage growth ease in the months ahead. Meanwhile, proxies in the month continue to suggest a healthy labor market (initial jobless claims fell in the payrolls survey week, while business surveys suggest firms are ramping up hiring). While the data will likely cause the typical stock price volatility over the release, analysts have said that it would take a significant miss, accompanied by weakness in other economic data, for the Fed to waiver from its seeming intent to raise rates by 50bps in May.

Wall Street Expectations:

-

Consensus is for 490k nonfarm payrolls to be added to the US economy in March, with the rate of job creation easing to below recent trend rates (12-month average 556k, 6-month average 583k, 3-month average 582k).

-

Jobless rate is expected to fall by 0.1ppts to 3.7% (the Fed sees the jobless rate ending this year at 3.5%).

-

Wage metrics will attract a lot of attention amid the recent surge in inflation and inflation expectations; policymakers have been attentive to the possibility of both a wage-price spiral and second round effects; average earnings are expected to rise 0.4% M/M (vs unchanged in February), pushing the annual measure up to 5.5% Y/Y (from 5.2% in February).

POLICY DEBATE: Fed Chair Powell recently said that the central bank would move to a more restrictive policy if that was needed to restore price stability (translation: the Fed can and will create a recession to contain inflation, something markets refuse to believe) . UBS said that Powell was referring to a deliberate policy of pushing growth below trend; “it is important to note that this policy option was presented in a conditional way–if that is what is required– deliberately pushing policy to generate growth below trend would only be required if there were evidence of a wage-cost spiral developing, and there is not really evidence of that at the moment.” Other analysts point out that average hourly earnings have outperformed other indicators, and accordingly, some relative underperformance could be seen ahead. Either way, the consensus remains that the Fed will raise interest rates by a 50bps increment in May (money markets assign a probability of around 76% of that happening), and it would therefore take a dreadful labor market report combined with other weak data metrics for the Fed to back away from that course.

WAGES: Anecdotally, the compensation software provider Payscale, citing its data, said US firms were planning to give the highest pay increases in years, but these would still not match inflation. But Capital Economics says that the easing in job postings on Indeed.com suggests that there has been a softening in labor demand. While it notes that the relationship isn’t perfect, it would be consistent with employment growth easing too, and would match the slowdown in GDP. “The apparent drop-back in job openings also implies that there is now less excess demand for workers, consistent with broader evidence that labour shortages are starting to ease,” and it argues that the “unemployment rate, which is still above its pre-pandemic low, hasn’t proved a useful gauge of labour market slack over the past year”; while it expects this rate will fall in March other indicators suggest that conditions are no longer tightening. “After rising to their highest levels on record last year, the share of small firms struggling to fill job vacancies and the net share of consumers saying jobs are easy to find have both edged lower in recent months,” and “that suggests that the upward pressure on wages will also ease.” The consultancy sees the rate easing back to 5.0% Y/Y in the months ahead.

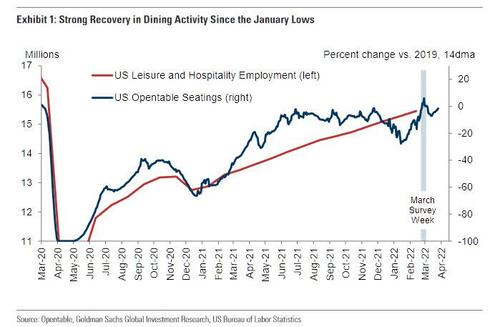

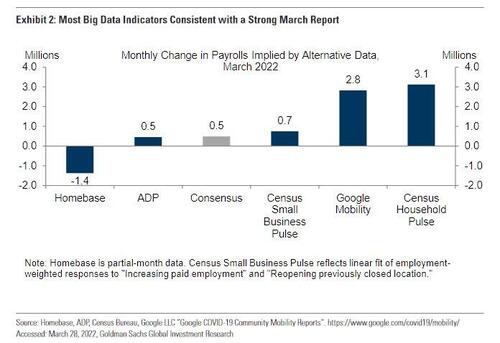

JOB ADDITIONS: Weekly initial jobless claims and continuing claims that coincide with the BLS’ employment report survey period both declined (initial claims eased to 215k from 249k into the February jobs report, while continuing claims eased to 1.35mln from 1.47mln). The ADP’s gauge of private payrolls was more-or-less in line with market expectations (455k vs expected 450k), while the February data was revised up a little (to 486k from 475k). The ISM business surveys have not been released ahead of the March jobs data– these usually offer us some insight about hiring activity. The comparable Markit PMI data, however, noted that companies were stepping up hiring, with the rate of overall jobs creation the highest since April 2021; “manufacturers and service providers alike recorded steeper upturns in employment,” the report said, “numerous firms noted that investment in recruitment campaigns was starting to show gains.” Goldman estimates that payrolls rose by an above-consensus 575k in March as “dining activity rebounded further in March, and most Big Data indicators are consistent with strong job gains.” Additionally, the bank believes that “fierce competition for workers incentivized firms to pull forward recruiting activities earlier in the spring hiring season.”

CONSUMER CONFIDENCE: Within the Conference Board’s gauge of consumer confidence, the number of consumers saying that jobs were “plentiful” rose to 57.2% from 53.5%, a new record high; the number of consumers who said jobs were “hard to get” fell to 9.8% from 12%, taking the differential to 47.4 from 41.5, boding well for those expecting the unemployment rate to decline. However, the survey also revealed that consumers were mixed in their views about the short-term outlook for the labour market, where the number expecting more jobs in the months ahead falling, even though those who anticipate fewer jobs also fell. Consumers were also mixed about their short-term financial prospects. “Confidence continues to be supported by strong employment growth and thus has been holding up remarkably well despite geopolitical uncertainties and expectations for inflation over the next 12 months reaching 7.9%—an all-time high,” the Conference Board said, adding that “these headwinds are expected to persist in the short term and may potentially dampen confidence as well as cool spending further in the months ahead.”

ARGUING FOR A STRONGER-THAN-EXPECTED REPORT:

- Public health. After reaching new highs in December and early January, covid infections fell sharply in February and March, returning to last summer’s relatively low levels. Dining activity also rebounded sharply over the last two months. Coupled with the rise in ADP’s estimate of leisure and hospitality jobs, Goldman expects a significant contribution from leisure-sector payrolls in tomorrow’s report (our estimates embed a rise of 150k, mom sa).

- Big Data. High-frequency data on the labor market also generally indicate strong growth in March employment. While Homebase is an outlier to the downside, that signal was overly pessimistic in five of the last six reports.

-

Seasonality. Some firms frontloaded spring hiring because of what Goldman believes was fierce competition for workers. In past tight labor markets, job growth tends to be stronger in the first quarter than in the second quarter. That being said, the March pace often slows relative to February’s.

-

Employer surveys. The employment components of business surveys generally increased in March. Goldman’s services survey employment tracker increased 1.8pt to 55.7 and our manufacturing survey employment tracker increased 0.5pt to 57.9. This resilience in domestic business surveys also argues against a meaningful employment drag from the Russia-Ukraine war.

-

Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—increased by 5.4pt to an all-time high of +47.4. JOLTS job openings edged down by 17k in February to 11.3mn but remained above the pre-pandemic peak. Jobless claims. Initial jobless claims decreased during the March payroll month, averaging 209k per week vs. 231k in February. Continuing claims in regular state programs decreased 132k from survey week to survey week.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT

-

Job cuts. Announced layoffs reported by Challenger, Gray & Christmas increased by 4% month-over-month in March, after decreasing by 8% in February (SA by GS).

NEUTRAL/MIXED FACTORS

-

ADP. Private sector employment in the ADP report increased by 455k in March, in line with expectations but somewhat below tomorrow’s consensus for private payrolls (+496k mom sa).

Tyler Durden

Thu, 03/31/2022 – 21:20

via ZeroHedge News https://ift.tt/BeyszI7 Tyler Durden