Cassandra in Greek mythology was the Trojan priestess who was cursed to utter true prophecies but never to be believed. Ideological environmentalism features a cohort of reverse Cassandras: They make false prophecies that are widely believed. Stanford biologist Paul Ehrlich in his 1968 classic, The Population Bomb, prophesied, “The battle to feed all of humanity is over. In the 1970s hundreds of millions of people will starve to death in spite of any crash programs embarked upon now.” Ehrlich continues to predict imminent overpopulation doom.

Another reverse Cassandra was Rachel Carson who warned in her 1962 Silent Spring of impending cancer epidemics sparked by humanity’s heedless use of synthetic pesticides. In fact, even as pesticide use has risen, rates of cancer incidence and mortality have been falling for 30 years.

On the occasion of the 53rd Earth Day, let’s take a look at the prophecies of another reverse Cassandra, the Club of Rome’s 1972 The Limits to Growth report by Donella Meadows, Dennis Meadows, Jorgen Randers, and William Behrens. The book and its dire forecasts were introduced to the world at a March 1972 conference at the Smithsonian Institution. Let’s focus primarily on the report’s nonrenewable resource depletion calculations. The 1973 oil crisis was widely taken as confirming the book’s dire scenarios projecting imminent nonrenewable resource depletion.

Back in 1989, I spent the day at the Massachusetts Institute of Technology (MIT) talking with some of the folks who had put together The Limits to Growth, especially with Jay Forrester, who had devised the World 2 systems dynamics computer model. The Limits to Growth team developed a modified version of Forrester’s model that they dubbed World 3 upon which the report chiefly relied for its findings. In the first chapter of the book, the researchers were particularly interested in and concerned about the nature of exponential growth. “Nearly all of mankind’s current activities,” they wrote, “can be represented by exponential growth.” Exponential growth occurs when something is increasing or growing rapidly as a result of a constant rate of growth applied to it. Compound interest is an example of exponential growth.

In the second chapter on the limits to exponential growth, the researchers asked, “What will be needed to sustain world economic and population growth until, and perhaps, even beyond, the year 2000?” The “physical necessities” included food, raw materials, and fossil and nuclear fuels. The researchers aimed to “assess the world’s stock of these physical resources, since they are the ultimate determinants of the limits to growth on this earth.”

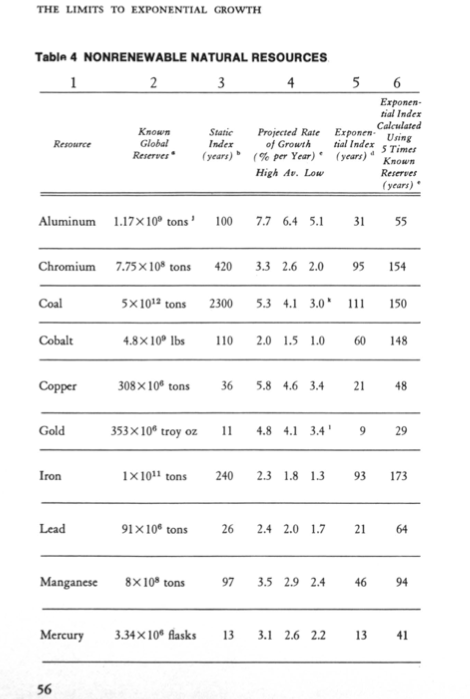

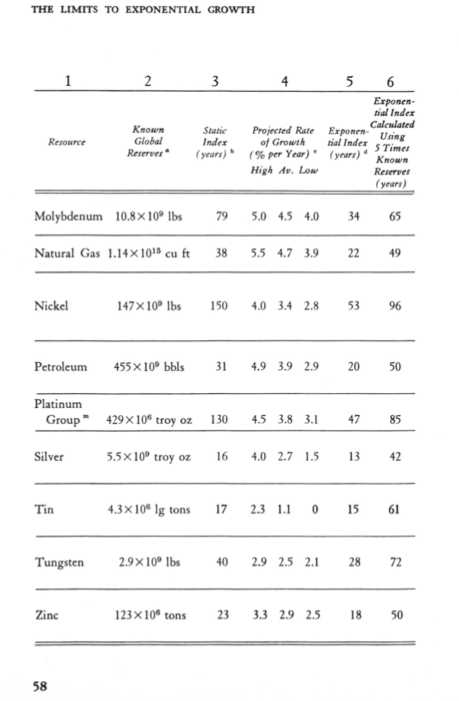

On October 16, 1989, Forbes published my article “Dr. Doom.” Using data from the report’s Table 4 on global 1972 nonrenewable resource reserves and expected future rates of consumption, I calculated how much longer the global reserves estimated by the MIT team would last. “Limits to Growth predicted that at 1972 rates of growth the world would run out of gold by 1981, mercury by 1985, tin by 1987, zinc by 1990, petroleum by 1992, copper, lead and natural gas by 1993,” I wrote.

The depletion dates I cited simply came from reading those data right off of their exponential index years listed in column 5 in Table 4. As they explained in a footnote to Table 4, their column 5 calculations represent “the number of years known global reserves will last with consumption growing exponentially at the average annual rate of growth.” As an example, the authors calculated that at the current rate of consumption global supplies of copper would last 36 years but applying the annual average rate of growth in copper consumption of 4.6 percent yielded the result that known global copper reserves would be used up in only 21 years.

So at the exponentially increasing rates of consumption that the researchers fully expected to ensue, known reserves in 1972 of gold would be depleted in nine years; mercury in 13 years; tin in 15 years; zinc in 18 years; petroleum in 20 years; and copper, lead, and natural gas in 22 years.

As I reported in my Forbes article when I asked Forrester about these figures, he told me, “I think in retrospect that Limits to Growth overemphasized the material resources side.” Well, yes.

However, The Limits to Growth, remains something of a sacred text to certain 21st-century prophets of impending resource doom. For example, the “peak oil” panic at the beginning of this century later morphed into a “peak everything” frenzy. One especially avid defender of The Limits to Growth faith is University of Florence physical chemist Ugo Bardi. Bardi was an early and enthusiastic proponent of peak oil, publishing his book, The End of Oil, in 2003 and moving on to peak everything in 2007. Bardi was particularly anxious to defend The Limits to Growth.

On March 8, 2008, at the now defunct peak oil website The Oil Drum, Bardi published a long essay, “Cassandra’s Curse: how ‘The Limits to Growth’ was demonized.” Bardi wrote, “Just as Cassandra was not believed, so it was for the “Limits to Growth” which, today, is still widely seen as a thoroughly flawed study, wrong all along. This opinion is based only on lies and distortions but, apparently, Cassandra’s curse is still alive and well in our times.” According to Bardi, the chief liar and distorter was me.

“We can locate a specific date and an author for the actual turning point, the switch that changed LTG from a respectable, if debatable, study to everybody’s laughing stock. It happened in 1989 when Ronald Bailey, science editor of the Forbes magazine, published a sneering attack (Bailey 1989) against Jay Forrester, the father of system dynamics. The attack was also directed against the LTG book which Bailey said was, ‘as wrong-headed as it is possible to be’.

To prove his point Bailey revived an observation that had already been made in 1972 by a group of economists on the “New York Times” (Passel 1972). Bailey said that:

‘Limits to Growth” predicted that at 1972 rates of growth the world would run out of gold by 1981, mercury by 1985, tin by 1987, zinc by 1990, petroleum by 1992, copper, lead and natural gas by 1993.'”

Yes, I did. And so did the book’s own authors. Just take another look at the data they published in their Table 4.

I was actually unaware of Passel’s New York Times April 2, 1972 book review, but now that I’ve read it, it really stands the test of time. In any case, with respect to Limits‘ analysis of resource depletion Passel notes in his criticism that according to Limits: “World reserves of vital materials (silver, tungsten, mercury, etc.) are exhausted within 40 years.” As it happens, the calculations in Column 6 of Table 4 which assumes five-times known reserves actually did project the depletion of those minerals in next four decades or so. Now, 50 years later, Passel has been prescient.

In any case, Bardi continues to damn me for poor reporting. Bardi asserts that Table 4 “was there only to illustrate the effect of a hypothetical continued exponential growth on the exploitation of mineral resources. Even without bothering to read the whole book, the text of chapter 2 clearly stated that continued exponential growth was not to be expected.” In fact, I did read the whole book, and I still have my highlighted and underlined copy beside me even as I type this essay.

Let’s see what the text in chapter 2 actually says:

“But column 4 in table 4 shows that the world usage rate of every natural resource is growing exponentially. For many resources the usage rate is growing even faster than the population, indicating both that more people are consuming resources each year and also that the average consumption per person is increasing each year. In other words, the exponential growth curve of resource consumption is driven by both the positive feedback loops of population growth and of capital growth.”

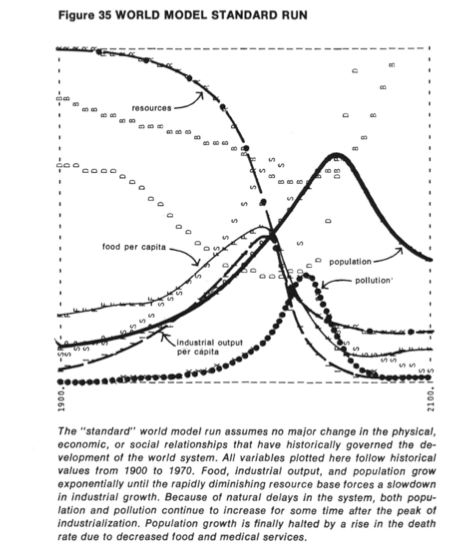

So Bardi is clearly wrong. The Limits‘ researchers did fully expect the exponential consumption of nonrenewable resources to continue. Bardi goes on to observe that “the rest of the book, then, showed various scenarios of economic collapse that in no case took place before the first decades of 21st century.” In large part, the projected collapse of civilization doesn’t occur until after the year 2000 because the Limits researchers’ standard computer model run “assumed that in 1970 there was a 250-year supply of all resources, at 1970 usage rates.” They tellingly add, “The static reserve index column of the resource table in chapter II will verify that this assumption is indeed optimistic.”

So, 50 years on, how has the standard run fared with respect to the imminent depletion of non-renewable natural resources? Not so well. In her 2021 update to Limits of Growth, Gaya Herrington, the vice president of ESG [environmental, social, and governance] Research at the KPMG consultancy, attempts to rescue the forecasts made in the 1972 study. Her new dire study of imminent resource depletion garnered headlines such as “Yep, it’s bleak,” “2030 to Mark the Decline of Civilization,” and “Society is right on track for a global collapse.”

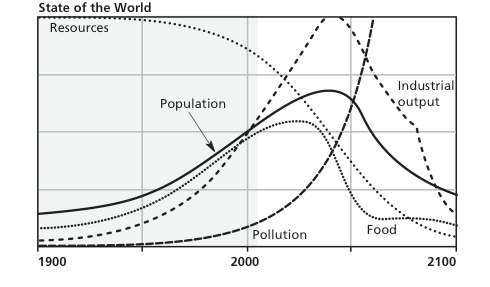

Herrington focuses on four scenarios from an earlier 2004 modeling update published by the original team of researchers. Comparing the 2004 model run with the 1972 model run is interesting.

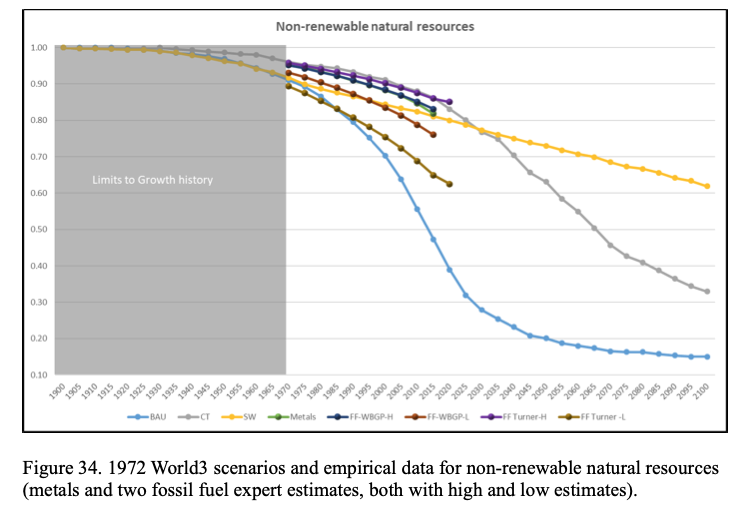

Tracking the projections in the 1972 model run projected that more than three-quarters of the world’s nonrenewable resources existing in 1900 would have been used up by now. The track in the revised 2004 version lowers that projection to only about one-third of the world’s resources by now. In Herrington’s 2020 Harvard sustainability thesis that preceded her published 2021 update, the blue track traces what she calls the “business-as-usual” (BAU) nonrenewable resource depletion projected in the 1972 The Limits to Growth standard run.

Her chart also tracks the projections of two other computer modeled scenarios— comprehensive technology (CT-gray) and stabilized world (SW-yellow)—of nonrenewable resource use over the rest of this century. To devise her estimates of nonrenewable resources, Herrington relied chiefly upon the earlier studies from other researchers who are also infatuated with The Limits to Growth computer modeling. With respect to remaining fossil fuel reserves, she cites the high (purple) and low (green-gold) global estimates from Australian physicist Graham Turner. Making the heroic assumption that the sources upon which Herrington relies for her estimates of nonrenewable resource reserves, her chart shows that humanity has so far exploited only about 20 percent of those resources instead of depleting them by 80 percent as projected in 1972.

Herrington derives another global fossil fuels along with metals reserve projections (green) from the 2014 study, Natural Resources in a Planetary Perspective, by University of Iceland chemical engineer Harald Sverdrup and sustainability scientist Kristin Vala Ragnarsdottir. Interestingly, Sverdrup and Ragnarsdottir begin their study by citing the Cassandra myth. They then assert that a fatally optimistic humanity has failed to heed the prophecies of impending collapse made modern environmentalist Cassandra’s including Thomas Robert Malthus (overpopulation), Marion King Hubbert (peak oil), Paul Ehrlich (overpopulation), and, of course, The Limits to Growth.

Let’s delve a bit into the global nonrenewable resource reserves used in Herrington’s Limits update as calculated by Sverdrup and Ragnarsdottir. “It is now well documented that fossil fuels are experiencing peak production now,” they assert. In fact, they calculate that global oil production peaked in 2008. Is that so? The world was producing 83 million barrels per day in 2008, and post-pandemic production is slated to be over 100 million barrels per day this year. (Although Russia’s invasion of Ukraine is now roiling global markets.)

With respect to metals and minerals, the Icelandic researchers in 2014 calculated that the remaining recoverable reserves of copper, zinc, and lead stood at 560 million tons, 1.1 billion tons, and 700 million tons, respectively. In contrast, the U.S. Geological Survey’s Mineral Commodity Summaries 2022 report estimates a remaining resource base for copper, lead, and zinc at 2.1 billion tons, 1.9 billion tons, and 2 billion tons, respectively.

In 1972, Limits estimated that world’s remaining reserves of copper amounted to 308 million tons, gold at 11,000 tons, tin at 4.37 million tons, zinc at 123 million tons, and lead at 91 million tons. Crude oil reserves stood at 455 billion barrels and natural gas reserves amounted to 1.14 quadrillion cubic feet. At 1972 rates of consumption, all of those reserves would have been entirely depleted before the year 2000.

The USGS reports that 50 years later current proved reserves of copper stand at 880 million tons, gold at 54,000 tons, tin at 4.9 million tons, zinc at 250 million tons, and lead at 90 million tons. Global reserves of petroleum is estimated at 1.7 trillion barrels and natural gas 7.3 quadrillion cubic feet. In other words, the proven reserves of nonrenewable resources have not been depleted over the past 50 years, they have instead increased substantially.

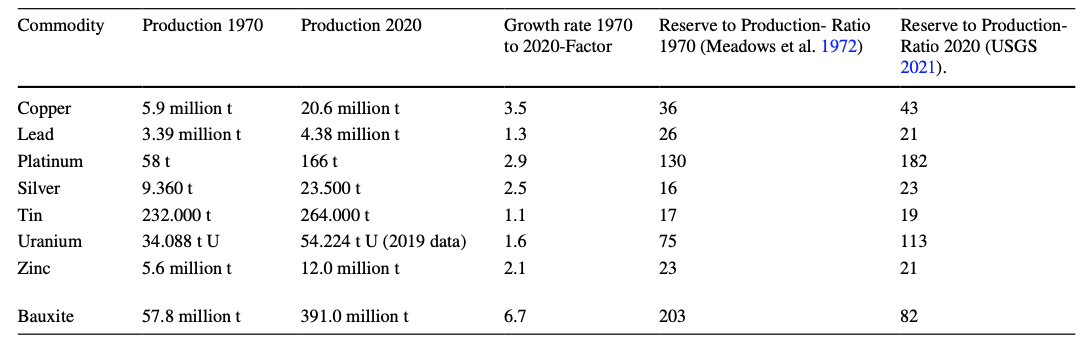

In his insightful 2021 article in Mineral Economics, German geologist Friedrich-Wilhelm Wellmer explains that when markets signal that a mineral or metal is in short supply, companies develop new more efficient ways to exploit current reserves and seek to find new resources. Consequently, the supply horizon for most metals, minerals, and fuels remains always about 20 years out. In addition, efficiency innovations mean that most products and services use less and less of any specific resource over time. Wellmer offers a handy table comparing Limits‘ 1972 production data with 2020 data. Even as humanity produced more and more of those resources, the time horizon for the eventual depletion at current rates of consumption increased rather than shortened.

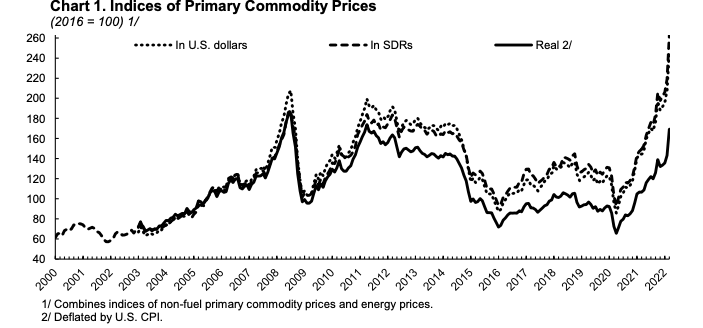

Of course, there have been steep recent increases in the prices of lots of nonrenewable resources lately. Is this a signal that the world is finally close to running out of resources? The International Monetary Fund’s commodity index in real terms has more than doubled recently as the world’s economies rebound from the pandemic’s economic slowdown. The earlier increase was the result of the huge demand for resources as China’s economy massively expanded at beginning of this century.

Wellmer does worry that commodity prices may stay at a permanently higher level for two reasons: The future raw materials demand associated with the accelerating green energy transition and ever higher costs stemming from the restraining requirements of the social license to operate.

It takes a lot of material to build solar panels, wind turbines, and batteries. Even so, Wellmer argues that these technologies will become increasingly sparing of materials as they evolve. As evidence, he points out that on a kilogram per megawatt (MW) basis that a 3.45 MW wind turbine today contains less than 15 percent less concrete, 50 percent less fiber glass, 50 percent less copper and 60 percent less aluminum than an earlier 2 MW turbine did. Material usage for constructing solar cells has dropped by 75 percent over the past 13 years.

In addition, meeting extensive environmental and regulatory requirements as well responding to the demands of community stakeholders are raising the costs of mineral, metal, and fuel production. These costs will be reflected in the prices of these commodities.

Despite these new pressures, Wellmer sanguinely concludes: “Supply shortages have been forecast frequently in the past. They never actually happened. The self-regulating feedback control cycle of mineral supply safeguards adequate supply over time. There is no reason to assume that this system of self-correcting forecasts will not work in the future.”

For her part, Herrington, unfazed by the past failures of the Limits model’s projections, contrarily concludes that the two of her updated Limits scenarios that align most closely with the data she cites “indicate a halt in welfare, food, and industrial production over the next decade or so, which puts into question the suitability of continuous economic growth as humanity’s goal in the twenty-first century.”

If anyone is an unheeded Cassandra with respect to resource depletion prophecies, I am. Given its manifold predictive failures, I confidently expect to report back on the 60th anniversary of The Limits to Growth that it is still “as wrong-headed as it is possible to be.” Happy Earth Day everyone!

The post After 53 Earth Days, Society Still Hasn't Collapsed. appeared first on Reason.com.

from Latest https://ift.tt/Jk8flg7

via IFTTT