Authored by Nouriel Roubini and Brunello Rosa via Project Syndicate,

Like the COVID-19 pandemic, Russia’s war in Ukraine has contributed to the stagflationary pressures in the United States and other advanced economies. While fiscal and monetary authorities currently have the situation under control, they are likely to run up against the limits of their policy options as conditions change.

The global economy has suffered two large negative supply-side shocks, first from the COVID-19 pandemic and now from Russian President Vladimir Putin’s invasion of Ukraine. The war has further disrupted economic activity and resulted in higher inflation, because its short-term effects on supply and commodity prices have combined with the consequences of excessive monetary and fiscal stimulus across advanced economies, especially the United States but also in other advanced economies.

Putting aside the war’s profound long-term geopolitical ramifications, the immediate economic impact has come in the form of higher energy, food, and industrial metal prices. This, together with additional disruptions to global supply chains, has exacerbated the stagflationary conditions that emerged during the pandemic.

A stagflationary negative supply shock poses a dilemma for central bankers. Because they care about anchoring inflation expectations, they need to normalize monetary policy quickly, even though that will lead to a further slowdown and possibly a recession. But because they also care about growth, they need to proceed slowly with policy normalization, even though that risks de-anchoring inflation expectations and triggering a wage-price spiral.

Fiscal policymakers also face a difficult choice. In the presence of a persistent negative supply shock, increasing transfers or reducing taxes is not optimal, because it prevents private demand from falling in response to the reduction in supply.

Fortunately, the European governments that are now pursuing higher spending on defense and decarbonization can count these forms of stimulus as investments – rather than as current spending – that would reduce supply bottlenecks over time. Still, any additional spending will increase debt and come on top of the excessive response to the pandemic, which accompanied a massive fiscal expansion with monetary accommodation and de facto monetization of the debts incurred.

To be sure, as the pandemic has receded (at least in advanced economies), governments have embarked on a very gradual fiscal consolidation, and central banks have begun policy-normalization programs to rein in price inflation and prevent a de-anchoring of inflation expectations. But the war in Ukraine has introduced a new complication as stagflationary pressures are now higher.

Fiscal-monetary coordination was the hallmark of the pandemic response. But now, whereas central banks have stuck with their newly hawkish stance, fiscal authorities have enacted easing policies (such as tax credits and reduction in fuel taxes) to soften the blow from surging energy prices. Thus, coordination seems to have given way to a division of labor, with central banks addressing inflation and legislatures tackling growth and supply issues.

In principle, most governments have three economic objectives:

-

supporting economic activity,

-

ensuring price stability, and

-

keeping long-term interest rates or sovereign spreads in check through persistent monetization of public debt.

An additional goal is geopolitical:

- Putin’s invasion must be met with a response that both punishes Russia and deters others from considering similar acts of aggression.

The instruments for pursuing these objectives are monetary policy, fiscal policy, and regulatory frameworks.

Each is being used, respectively, to address inflation, support economic activity, and enforce sanctions.

Moreover, until recently, re-investment policies and flight-to-safety capital flows had kept long-term interest rates low by maintaining downward pressure on ten-year Treasury and German bond yields.

Owing to this confluence of factors, the system has reached a temporary equilibrium, with each of the three objectives being partly addressed. But recent market signals – the significant rise in long-term rates and intra-euro spreads – suggest that this policy mix will become inadequate, producing new disequilibria.

Additional fiscal stimulus and sanctions on Russia may feed inflation, thus partly defeating monetary policymakers’ efforts. Moreover, central banks’ drive to tame inflation via higher policy rates will become inconsistent with accommodative balance-sheet policies, and this could result in higher longer-term interest rates and sovereign spreads, which are already drifting sharply upwards.

Central banks will have to continue juggling the incompatible objectives of taming inflation while also keeping long-term rates (or intra-eurozone spreads) low through balance-sheet maintenance policies. And all the while, governments will continue to fuel inflationary pressures with fiscal stimulus and persistent sanctions.

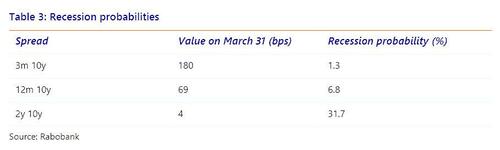

Over time, tighter monetary policies may cause a growth slowdown or outright recession. But another risk is that monetary policy will be constrained by the threat of a debt trap. With private and public debt levels at historic highs as a share of GDP, central bankers can take policy normalization only so far before risking a financial crash in debt and equity markets.

At that point, governments, under pressure from disgruntled citizens, may be tempted to come to the rescue with price and wage caps and administrative controls to tame inflation. These measures have proved unsuccessful in the past (causing, for example, rationing) – not least in the stagflationary 1970s – and there is no reason to think that this time would be different. If anything, some governments would make matters even worse by, say, re-introducing automatic indexation mechanisms for salaries and pensions.

In such a scenario, all policymakers would realize the limitations of their own tools. Central banks would see that their ability to control inflation is circumscribed by the need to continue monetizing public and private debts. And governments would see that their ability to maintain sanctions on Russia is constrained by the negative impacts on their own economies (in terms of both overall activity and inflation).

There are two possible endgames.

-

Policymakers may abandon one of their objectives, leading to higher inflation, lower growth, higher long-term interest rates, or softer sanctions – accompanied perhaps by lower equity indices.

-

Alternatively, policymakers may settle for only partly achieving each goal, leading to a suboptimal macro outcome of higher inflation, lower growth, higher long-term rates, and softer sanctions – with lower equity indices and debased fiat currencies then emerging.

Either way, households and consumers will feel the pinch, which will have political implications down the road.