Bears Are Taking Over The Options Market

The bears are taking over the equity options market.

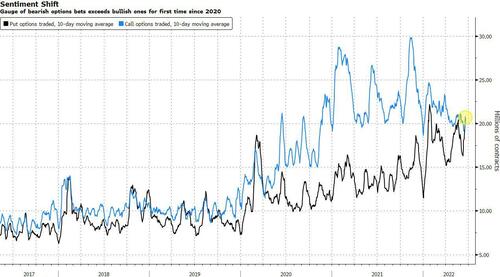

As Bloomberg markets live reporter and commentator, Cormac Mullen, details, the 10-day moving average of put options traded in the US stock market – a gauge of speculative downside protection bets – has pushed above the equivalent for bullish calls for the first time since 2020, according to data compiled by Bloomberg.

The latter was a good measure of speculative individual investor demand for US equities, peaking with the meme-stock waves that bookended last year. That suggests retail traders are shifting to betting against the market, albeit at an intensity well below the peak of meme madness.

Interest in put options is higher than the worst of the coronavirus market fears in 2020, and has been a number of times already this year, the gauges show.

Of course, the jump in bearish retail sentiment can also be a contrarian signal for market direction. As Sundial Capital Research founder Jason Goepfert put it Tuesday — “it’s rare for the smallest traders to bet against the stock market, and when they do, stocks have never failed to fail them.”

Tyler Durden

Thu, 06/23/2022 – 07:20

via ZeroHedge News https://ift.tt/EjmCeVB Tyler Durden