“Catastrophic Risk To Stocks And Bonds”: Fed’s Balance Sheet Caused Inflation, Not Low Rates

By Vincent Cignarella, Bloomberg Markets Live commentator and reporter

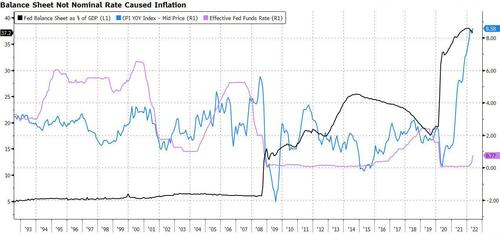

The Fed’s balance sheet as a percentage of GDP is what is driving today’s inflation — not the nominal Fed Funds rate. This will emerge as a major risk to stocks and bonds if not managed soon.

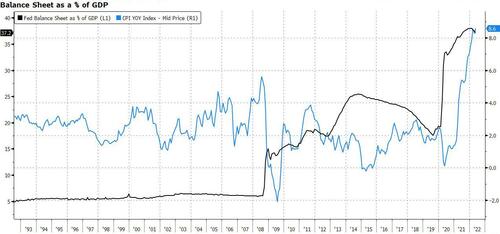

The chart below shows it was not the level of interest rates that contributed to higher inflation, but the Fed maintaining the size of the balance sheet at too-high levels for too long.

If economic growth slows as many expect, the influence the balance sheet has on GDP will be even greater and may pose potential catastrophic risk to stocks and bonds.

As growth slows, so must the balance sheet to maintain the equilibrium between supply and demand. The market will decide the level of rates; the Fed can just follow along.

Tyler Durden

Mon, 06/27/2022 – 21:55

via ZeroHedge News https://ift.tt/TEtajeB Tyler Durden