Soaring Inflation And Crashing Rates Are Sparking Trucking’s “Great Purge”

By Craig Fuller, CEO at FreightWaves

The last trucking market crash was in 2019. The current market could end up worse for small truckload fleets.

The freight market crash in 2019 was caused by two factors – a freight slowdown due to tariffs on Chinese imports and a surge of new fleets flooding the market, even as rates continued to fall.

Until 2019, we had never seen that many new fleets enter the market, especially during a market downturn. During 2019 an average of 7,200 fleets entered the market per month compared to an average of 5,200 fleets per month during 2008-18.

The 2019 drop in freight volumes wasn’t significant. At their deepest trough, tender volumes registered a 4.6% drop in year-over-year load requests, and that lasted for just a few short months (May-July).

Trucking is a commodity and anyone that has been around commodity markets understands that it doesn’t necessarily take a dramatic move on one side of the market to change the balance of supply/demand and cause significant price swings.

In 2019, the trucking market already had too much capacity relative to demand. The year-over-year decline was only in the mid-single digits. But, it was enough to push rates below carriers’ operating costs.

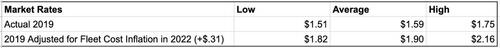

Removing the cost of diesel from the spot rate, here is what the market looked like in 2019 (van per mile):

-

Low: $1.51

-

Average: $1.59

-

High $1.75

We are nearing 2019’s rock-bottom, inflation-adjusted spot rates

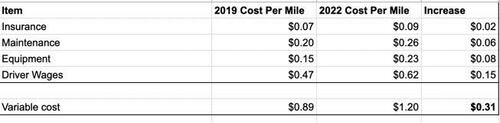

Trucking companies have much higher operating costs now than they did in 2019, even when removing fuel from the number. Every fleet’s operating cost will be different, but using data from TCA, ACT, and FreightWaves’ own analysis, we can draw some conclusions about the cost increases that a fleet would experience in 2022 compared to 2019.

Assuming a fleet averages 6,500 miles per truck per month and purchased a four-year-old used truck in 2019 at $50,000, plus sales tax, financed for five years at 5% interest, the monthly payment would cost around $0.15/mile. With used truck prices surging during the pandemic, a four-year-old used truck last fall would run $77,000. If the vehicle was financed with similar terms, the per mile cost would be around $0.23/mile.

A driver employee with experience working for a top-paying fleet can expect to make around $0.62/mile. In 2019, the same driver would have made around $0.47/mile.

Higher variable operating costs include insurance (+$.02/mile), maintenance (+$.06/mile), equipment (+$.08/mile) and driver wages (+$.15/mile).

All in, variable costs have increased at least $0.31/mile more for fleet operators in 2022 compared to 2019. These numbers are likely understated, as they don’t include increases related to back-office operations and support staff, which can vary widely among fleets.

Adjusting the 2019 numbers, the rates per mile total:

-

$1.82 (low)

-

$1.90 (average)

-

$2.16 (high)

The current spot rate (net fuel) is $1.95/mile. On a variable cost-adjusted basis, the trucking spot rates have matched 2019 since May 2022 – $2.16/mile, dropping $0.21/mile. It’s likely to get worse. The month of May typically has among the highest rates we’ll see all year, with July and August being some of the weakest months.

It is conceivable that spot rates will drop below the inflation-adjusted 2019 low of $1.82 per mile in July, since there doesn’t seem to be any near-term market catalysts to drive additional demand.

U.S.- bound container volumes, which have been driving a substantial amount of the freight surge in the U.S. trucking market since 2020, are seeing a significant drop, as reported by Henry Byers, FreightWaves’ senior global trade analyst.

There are also the economic challenges that are apparent in the economy, including record-low consumer confidence, declining construction and industrial activity, surging inflation, and a Federal Reserve that is determined to slow the economy down to tame inflation, even if it means putting the economy into a recession.

All of this means that the freight market will likely encounter additional headwinds and there are more reasons to believe that trucking spot rates have further to fall.

Capacity matters

Of course, trucking is a two-sided market. Demand is only one part of the equation; capacity also matters.

Capacity is really just a function of how much dispatchable capacity is in the market. Like 2019, the trucking industry has seen a record number of new entrants enter the trucking market to take advantage of what were strong market conditions and record high spot rates created because of government stimulus over the past two years. The number of new entrants into the trucking industry nearly doubled the 2019 monthly record average. Since 2020, the monthly average of new fleets entering trucking has increased to 13,370 per month, up from 7,200. In April, the number hit 23,479.

This large number of new entrants means that the trucking industry has many companies that are brand new, have higher cost structures (because they joined when the freight market was peaking) and that have never experienced a downturn.

This massive surge of dispatchable capacity was built for a market that had much more freight activity. If the economy contracts further, it could spell disaster for many of the most vulnerable operators.

The summer doldrums

Even if the economy doesn’t contract, July and August are always slower than June. It is the time of the year when supply chains take a break and get ready for the retail surges that typically begin after Labor Day.

The retail surge is a really important part of the freight calendar and often offers some of the highest spot rate opportunities. In the first half of the year construction, auto, beverages, and fresh produce drive the surges in trucking.

In the second half of the year, surges are caused by retailers scrambling to get inventories placed for the holiday shopping season. That may not happen this year, with many retailers’ inventories overstocked. Since their warehouses and distribution centers are full, they are reluctant to add additional inventory to their supply chain and will focus their efforts on liquidating what they currently have in stock.

Trucking spot rates will not increase significantly until the Great Purge is over

As long as the market has excess capacity, freight rates will remain depressed. It will take a substantial purge of capacity before spot market carriers can expect relief.

FreightWaves editorial director Rachel Premack covered this topic last week in her article titled “the Great Purge.”

The unfortunate reality of trucking is that the market is often “feast or famine” and with so many new mouths to feed, the famine this year could be much worse than was experienced in 2019.

Tyler Durden

Tue, 06/28/2022 – 10:20

via ZeroHedge News https://ift.tt/Ig8BpSw Tyler Durden