Stocks & Bonds Slammed As Market Reprices Rate-Hike Trajectory Ahead Of J-Hole

Anxiety over what J-Pow will say at J-Hole on Friday is manifesting in multiple markets…

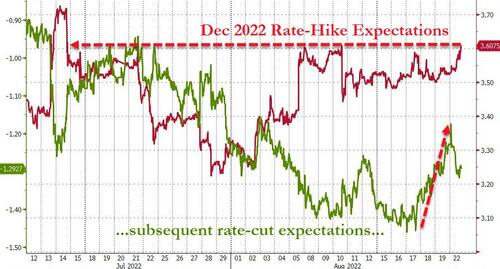

Rate-hike expectations are back at their highest since the ECB chaos in July (and rate-cut expectations have tightened too)…

Source: Bloomberg

US equities extended their recent weakness today with Nasdaq the ugliest horse in the glue factory (futs were sold at the Asia open, EU open, and US open)…

Nasdaq is now down 6% from its rebound highs…

And the S&P is down over 200 points since we advised investors of BofA’s Michael Hartnett’s call to “start shorting now”…

And all the majors continue to push back down towards their 100DMAs (blue line) after rejecting their 200DMAs (green line)…

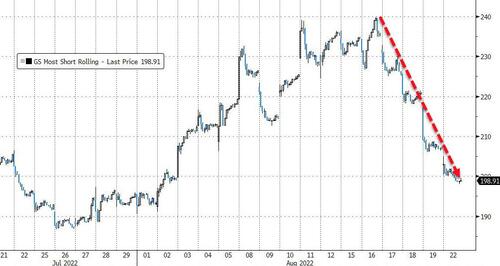

Hedge funds continued to press shorts today with Goldman’s “Most Shorted” basket now down a stunning 18% from last Tuesday’s highs…

Source: Bloomberg

VIX spiked back above 24 today…

Treasury yields were all higher on the day with the long-end outperforming (and the curve flattening/inverting further)…

Source: Bloomberg

10Y Yields topped 3.00% again today, for the first time since July 21st…

Source: Bloomberg

Real rates have been a one-way street higher since touching 0.0% on Aug 2nd…

Source: Bloomberg

Time for stock multiples to re-compress again…

Source: Bloomberg

Euro crashed to its weakest against the dollar since 2002 (dropping below July’s lows)…

Source: Bloomberg

Sending the DXY (dollar index) to its highest close since June 2002…

Source: Bloomberg

Cryptos traded sideways to down today with Bitcoin finding support at $21,000…

Source: Bloomberg

Gold extended its losses below $1800 today as the dollar soared…

Oil prices dumped (on Iran Deal hope) and pumped (on OPEC+ production cut hints) to end higher on the day…

US NatGas front-month neared $10 today, hitting its highest since 2002…

For context, European NatGas is trading at $500 per barrel…

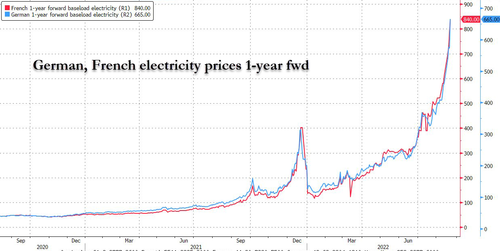

And before we leave commodity land, here’s a look at European 1-year-ahead electricity prices…

Source: Bloomberg

Hyperinflation much?

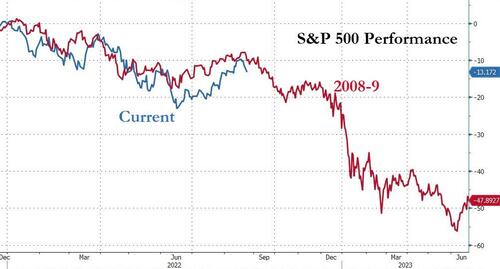

Finally, we note that the 2008 analog continues to play out…

Source: Bloomberg

Is a reality check in order?

Source: Bloomberg

It’s different this time…

Tyler Durden

Mon, 08/22/2022 – 16:00

via ZeroHedge News https://ift.tt/qKOZGAt Tyler Durden