August Hawk-nado Hammers Stocks, Bonds, Commodities, & Crypto

Worryingly high EU inflation data started the day off and that was followed by worryingly low ADP jobs data as the $100 trillion question remains unanswered: whether “bad (data) is bad (for markets)” because the Fed and ECB have their hands still tied – e.g. this morning’s ADP miss as a ‘tell’ into NFP – or alternatively, whether “good (data) is bad (for markets)” – e.g. yesterday’s JOLTS and US Consumer Confidence, along with this morning’s ‘hot’ Euro Area inflation beat.

Financial Conditions ‘eased’ dramatically from the start of July to mid-August but have ‘tightened’ since…

Source: Bloomberg

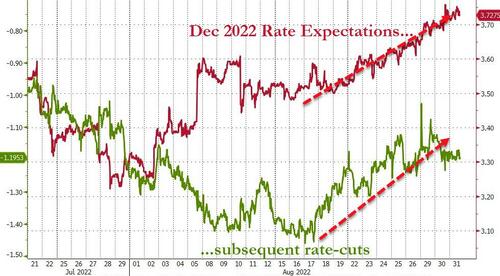

But, if any chart highlights the background for asset-performance in August, it is the drastically hawkish shift in market expectations of both rate-hikes this year (and rate-cuts next year)…

Source: Bloomberg

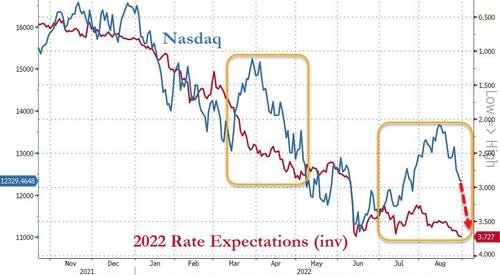

As FedSpeak stomped on the throat of the stock market’s dovish “Fed Pivot” narrative…

Source: Bloomberg

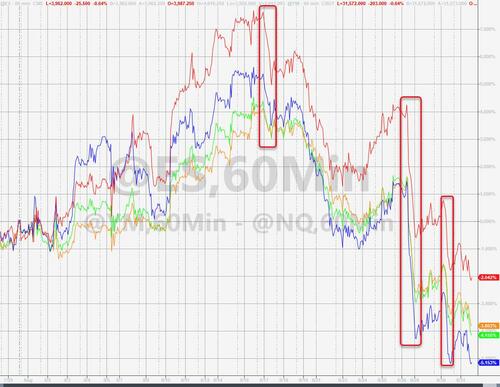

Bonds and Stocks were dumped into the month-end close.

Nasdaq was the worst performing US Major this month, now down 4 of the last 5 months. The Dow & S&P 500 were also down around 4% on the month (after being up over 4% mid-month)…

As Goldman’s Chris Hussey notes, S&P 500 performance for August can be summarized as a tale of 2 halves – investors developed an appetite for risk assets in the first half of the month on expectations of a potential peak in inflation and an eventual Fed pivot, followed by a steep reversal (and then some) as markets digested Fed Chair Powell’s speech which reiterated the FOMC’s commitment to bring down inflation and outlined that the FOMC will likely need to maintain ‘a restrictive policy stance for some time’. The round-trip suggests that the market might have gotten a bit too far ahead in pricing a Fed pivot, particularly given inflation remains well above its 2% target.

After trading up to their 200-DMAs mid-month, all the US majors are now back below the 50-DMAs…

Only Energy and Utes sectors ended the month green while tech was the ugliest horse in the glue factory…

Source: Bloomberg

Credit and equity risk ended notably worse on the month, despite the first half of August seeing an easing of tensions…

Source: Bloomberg

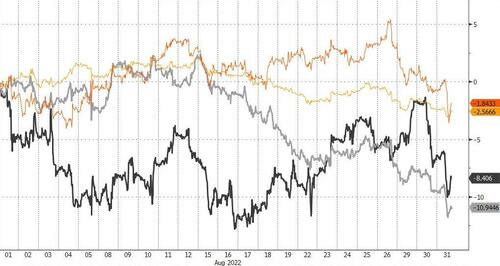

Bond bulls suffered a one-way street of pain this month with the shorter-end of the curve underperforming as yields soared. The last week saw a decoupling with the long-end as recession fears resume…

Source: Bloomberg

The 5Y yield saw its 2nd biggest monthly spike since Nov 2009, closing the month at its highest since May 2008…

Source: Bloomberg

The yield curve did nothing but flatten all month with 5s30s puking almost 40bps back into inversion…

Source: Bloomberg

The dollar rallied for the 3rd straight month in August (5th of last 6)…

Source: Bloomberg

Cryptos had another ugly month in August with Bitcoin underperforming Ethereum (-16% vs -9% respectively)…

Source: Bloomberg

The broad commodity space ended the month unchanged…

Source: Bloomberg

But that hid a lot of pain under the hood with silver slammed hard and oil tumbling…

Source: Bloomberg

August was WTI’s worst month of the year (and 3rd straight month lower)…

Gold has seen a massive roundtrip after bouncing off $1700 in mid-June and stalling above $1800 around mid-August, plunging back lower since…

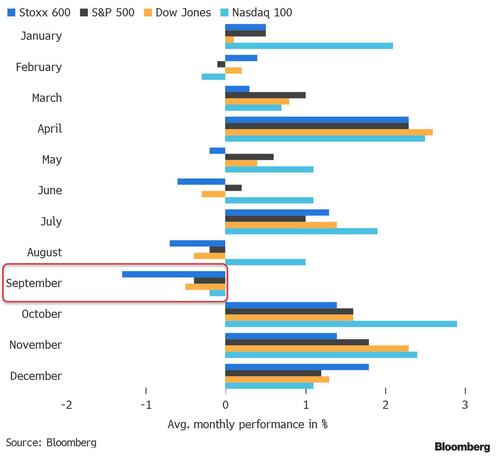

Finally, bear in mind that US and European stocks are entering the seasonally weakest time of the year, with major benchmarks posting negative average performance in September over the past 30 years.

Source: Bloomberg

September is set to present a flurry of catalysts, with Powell’s Sept. 8 speech and US inflation data paving the way for the crucial Fed meeting.

Tyler Durden

Wed, 08/31/2022 – 16:01

via ZeroHedge News https://ift.tt/qtem4Ad Tyler Durden