How To Trade The Post-Jackson Hole Market: Thoughts From The JPMorgan Trading Desk

Some observations from JPMorgan trader Andrew Tyler on the post J-Hole reality.

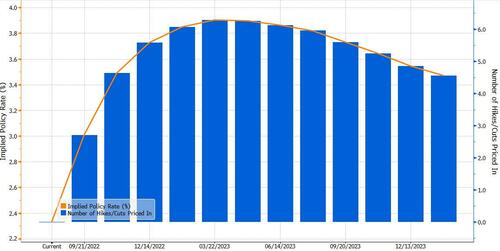

The Fed is seemingly more hawkish but bond market is pricing in roughly the same probability of 75bps as pre-JH. The terminal rate is looking to be about 3.75% in this tightening cycle. Implying about another 125bps or 150bps of tightening. JPM view is another 125bps of tightening (75bps in Sept, 25bps in Nov, and 25bps in Dec; as a reference Goldman is 50/25/25).

What changed with bonds? 2023 rate cut expectations have shifted from Sept to Nov for the first cut. Jay Barry had flagged that yields had moved a touch too far and we are seeing buyers overnight. Keep an eye on the USD as any move lower could attract buyers of treasuries.

To me, the biggest change from the Fed was them telling the market that they are more concerned about inflation than economic growth. They still maintain a data dependent approach. Recall that Volker halted his tightening cycle when CPI hit 4%. Earlier this month, bond market had been pricing in CPI falling below 3% by summer 2023.

What does this mean for stocks? This century, Sept has been the seasonally weakest month of the year and Q4 the strongest quarter. This could repeat itself as

- (i) increases in rates vol have been negative for Eqys,

- (ii) rates vol has spiked into Fed events and CPI prints,

- (iii) we could see rates vol collapse after the Sep 21 Fed,

- (iv) earnings season could be similar to Q2 and if so that is net positive for stocks but need to see how co’s continue to deal with inflation and FX risk.

What are the risks from here?

- (i) a move higher in oil; oil over a $100 seems to be a psychological bear level for stocks;

- (ii) EPS risk is key as many investors thought Q2 would be the beginning of an earnings recession;

- (iii) macro data worsening which could look like growth metrics falling while the labor mkt tightens

What’s the trade?

- I think Tech leads on the move higher especially if the 10Y fails to make new highs (3.47%).

- Tactically, Energy seems to be a tradeable trend with WTI oscillating in the $90 – $100 range; longer-term Energy remains a buy.

- Financials could be a tactical long as they have tended to trade higher into EPS; also we have seen clients look to do a Financials L/S index via JPM Delta-One as NIM continues to expand there are idiosyncratic winners/losers.

- China is an interesting tactical trade as the $29bn bailout fund seemingly removes a Lehman-like event and stimulus removes some of the Tech-sector regulatory overhang.

- We have seen clients replace US Tech exposure with FXI and KWEB exposure as recently as last week. I like hedging with IG Credit.

More in the full note available to pro subs.

Tyler Durden

Wed, 08/31/2022 – 15:47

via ZeroHedge News https://ift.tt/lswoJk6 Tyler Durden