Credit Suisse Stock Ends Record Losing Streak As Chairman Promises ‘Bank Run’ Is Over

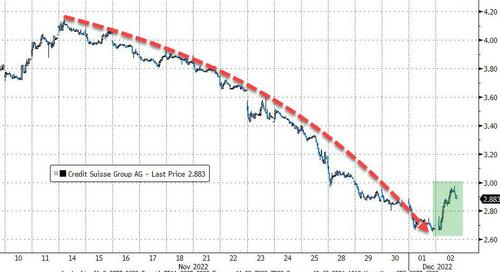

Yesterday we highlighted the fact that Credit Suisse stock was suffering its longest losing streak in history falling to just a few percent above the price of 2.52 francs for the 4 billion Swiss Franc subscription rights that the bank offered existing investors.

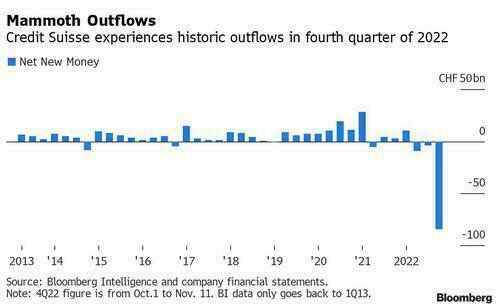

The big Swiss bank also announced further layoffs which follows years of scandals, mismanagement, mammoth asset outflows, and the current dilution from a vital capital raise that is under way.

BUT today that record 13-day losing streak is over…

And here’s why…

Chairman Axel Lehmann told Bloomberg TV that the bank’s liquidity was improving and the huge outflows of client assets that had spooked markets were coming to an end.

Withdrawals at the Swiss lender, which surged to about 84 billion francs ($90 billion) earlier this quarter after rumors about the bank’s stability, have “basically stopped.”

As a reminder, in October, outflows of assets and the subsequent use of liquidity buffers had caused the bank to fall below certain regulatory levels at some of its entities.

“When I speak to clients, I already know that there are going to be inflows,” Lehmann said.

“We already see it partially happening. So we have plans to continue to reach out to clients. It might take a bit of time but it will come back and we will go back to normal.”

Bloomberg reports that investors also took comfort from comments by Lehmann that the main indicators of the bank’s financial stability were strong and that its level of liquidity was improving after declines in recent weeks.

“I think core shareholders believe us and they will exercise their rights,” Lehmann said, adding he’s in regular discussions with investors.

“Of course, when you’re an investor in Credit Suisse for 20 years and you see where the share price is, these are challenging discussions.”

In other words, BTFD because “trust me”…

Tyler Durden

Fri, 12/02/2022 – 11:25

via ZeroHedge News https://ift.tt/Ou2VQ3J Tyler Durden