Laid-Off Silicon Valley Workers Panic Sell Start-Up Shares As Valuations Crash

Silicon Valley tech companies have benefited from over a decade of low-interest rates and easy money. But since the Federal Reserve turned off the liquidity taps to combat inflation — at least for now — tech firms have been forced into aggressive cost-cutting measures, such as reducing headcount.

This brings us to the workers who were fired this year. Financial Times reported, “employees of embattled tech groups are flooding secondary markets — where stakeholders in a private company sell shares to third parties.” And as they unload shares on the private market, the valuations of these startups are collapsing.

The latest data from Crunchbase shows more than 91,000 workers in the U.S. tech sector have been laid off this year.

“We are seeing an inflow of people being laid off trying to sell their shares,” Greg Martin, managing director of Rainmaker Securities, which facilitates private stock transactions. “These companies have built their headcounts up so much, so there are a lot of people highly motivated to get a sale done,” he said.

Martin added while there’s an increasing number of laid-off workers trying to cash out, many of these sales are happening during valuation declines of “30-80% from a year ago.”

A valuation reset for startups has led venture capitalists to sit on the sidelines and wait for the smoke to clear. The selling of private stock has also pushed down startup valuations.

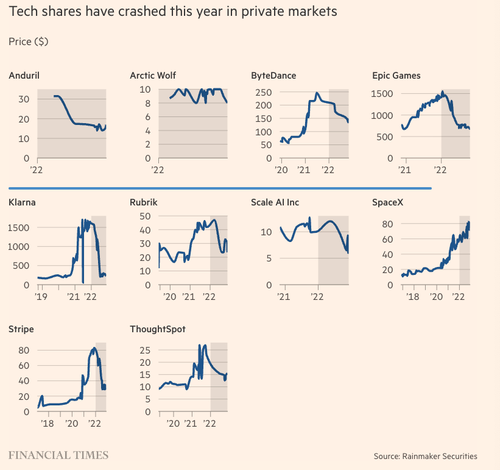

FT published market valuations of private companies that show a rollercoaster ride in the last year.

The highly illiquid market for private secondary markets, such as those operated by Rainmaker, further complicates assessing valuations in times of market turmoil.

Data from Rainmaker showed that shares in Anduril, a defense artificial intelligence company backed by Peter Thiel’s Founders Fund and Andreessen Horowitz valued at $8.5bn, traded at $16.95 per share in November, down from $31.50 in March. Brokers such as Rainmaker trade Anduril shares indirectly through special purpose vehicles, as Anduril prohibits direct trading of its shares on secondary markets.

Shares in SoftBank-backed Chime Bank, which was valued at $25bn when it last raised external capital in August 2021, have lost a quarter of their value since then on secondary markets, trading at $60 per share, according to the most recent data. –FT

Rainmaker’s Martin warned there’s a wave of laid-off employees who are dumping private stock into illiquid markets. The collapse in fundraising for the IPO market has complicated things for private companies, who are now scrambling to find lending lifelines.

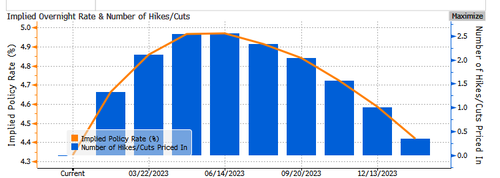

On public markets, unprofitable tech companies have underperformed this year and are likely to continue doing so until the Fed pivots. Interest rate swaps suggest the Fed could begin cutting by late 2023.

The basket of money-losing tech companies compiled by Morgan Stanley has plunged 54% — an epic roundtrip back to pre-Covid days.

Profitability has become necessary for investors in these challenging times. There may come a time when unprofitable companies outperform again, but that widely depends on Fed policy.

Tyler Durden

Sat, 12/31/2022 – 19:15

via ZeroHedge News https://ift.tt/C8Rl796 Tyler Durden