US Layoffs Far Higher Than Suggested By Initial Jobless Claims, JOLTS

When it comes to labor market data (or rather “data”), Biden’s labor department is a study in contrasts (and pats on shoulders). One day we get a contraction in PMI employment (both manufacturing and services), the other we get a major beat in employment. Then, one day the Household survey shows a plunge in employment (in fact, there has almost been no employment gain in the past 9 months) and a record in multiple jobholders and part-time workers, and the same day the Establishment Survey signals a spike in payrolls (mostly among waiters and bartenders). Or the day the JOLTS report shows an unexpected jump in job openings even as actual hiring slides to a two year low. Or the straw the breaks the latest trend in the labor market’s back, is when the jobs report finally cracks and shows the fewest jobs added in over a year, and yet initial jobless claims tumble and reverse all recent increases despite daily news of mass layoffs across all tech companies, as the relentless barrage of conflicting data out of the BLS just won’t stop, almost as if to make a very political point.

But while one can certainly appreciate Biden’s desire to paint the glass of US jobs as always half full, reality is starting to make a mockery of the president’s gaslighting ambitions, as one by one core pillars of the administration’s “strong jobs” fabulation collapse. First it was the Philadelphia Fed shockingly stating that contrary to the BLS “goalseeking” of 1.1 million jobs in Q2 2022, the US actually only added a paltry 10,000 jobs (just as the Fed unleashed an unprecedented spree of 75bps rate hikes).

And now, it is Goldman’s turn to make a mockery of the “curiously” low initial jobless claims, by comparing them to directly reported WARN notices which no low-level bureaucrat and Biden lackey can “seasonally adjust” because there they are: cold, hard, fact, immutable and truly representative of the underlying economic truth. So what is said truth?

Before we answer that, a quick background into what a WARN notice is.

As Goldman’s Manuel Abecasis writes in “Introducing a Timely Measure of Economywide Layoffs Based on WARN Notices” (available to pro subs), while job openings have declined substantially without any increase in the unemployment rate so far, “a key question is whether this pattern is now changing. Press reports indicate that layoffs are rising, but they tend to overemphasize the technology sector. The official JOLTS data indicate that the economy-wide layoff rate remains low, but they are released with a lag.”

So, to track layoffs in a way that is both representative and timely (and not skewed by political favoritism and arbitrary and false seasonal adjustments), Goldman has collected data from advance layoff notices filed under the Worker Adjustment and Retraining Notification (WARN) Act. The WARN Act requires companies to notify state governments and affected individuals of plans to lay off 500 or more employees (and 50 or more employees when an employment site is shut down or when the number of layoffs make up at least one-third of the company’s workforce) at least 60 days in advance. If companies fail to comply with the WARN Act, they are required to pay wages and benefits to the affected workers for the duration of the violation. Companies are exempted from the WARN notification requirement only when layoffs are the result of natural disasters or unforeseeable business circumstances, or when issuing a WARN notice would prevent a company from obtaining capital or business that would allow it to postpone or avoid a shutdown.

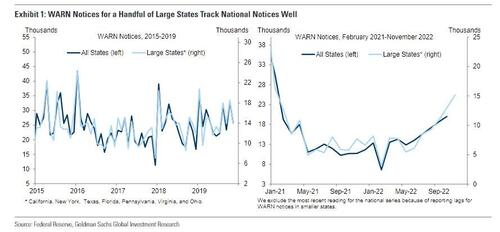

And since many state governments upload these notices to their websites right after they are received, this allows analysts to use the data for a few large states to construct a timely measure of planned layoffs. In Exhibit 1, we use data from researchers at the Cleveland Fed to show that WARN notices for the states we cover account for most of the variation in national WARN notices.

So turning to the actual data, what does it reveal.

Well, as shown in the chart below, that’s Goldman’s recently constructed timely WARN notices measure. To account for reporting delays, the bank’s economists adjusted their measure for the average number of days between when notices are dated and when they are posted on state government websites. The analysis suggests that WARN notices were well below their pre-pandemic levels between April and August of 2022 but have risen relative to the pre-pandemic seasonal norm in the last few months. The notices we have observed so far this month are consistent with a roughly 21k monthly rate for January, somewhat higher than the 19k average in 2017-2019.

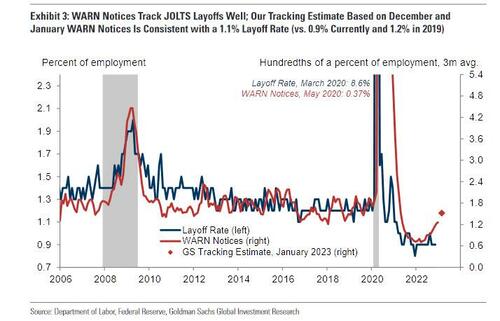

The next and final chart shows that WARN notices also track the JOLTS layoff rate: WARN notice counts remained elevated in late 2020 even as the layoff rate declined, but this likely reflects unusual reporting delays during the pandemic and the exclusion of layoffs at closing establishments in the JOLTS survey, which WARN notices capture provided firms remain in business. Not surprisingly, Goldman’s tracking estimate based on December and January WARN notices for the large states covered not only shows that the recent drop in initial claims is unlikely, but that it is also consistent with a layoff rate of around 1.1%, higher than the 0.9% in the November JOLTS report.

And while the WARN data clearly indicate that both claims and JOLTS data is misrepresenting the underlying economic reality in an overly cheerful manner, the silver lining is that the bank’s findings are consistent with recent survey results from the Conference Board, which have signaled that company executives would be more reluctant to lay off workers than in typical downturns. Of course, that is all contingent on the coming recession being shallow, a concept which as we discussed before, is at best idiotic.

More in the full report available to pro subs.

Tyler Durden

Tue, 01/17/2023 – 12:08

via ZeroHedge News https://ift.tt/ZDtPUAx Tyler Durden