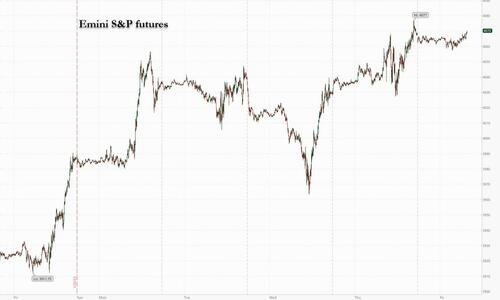

US futures dropped after yesterday’s meltup, led lower by semiconductor stocks and traded in a tight range on Friday after a catastrophic earnings report and guidance from (former?) chip giant Intel, while investors awaited key inflation figures for clues on what the Fed will do next week. Nasdaq 100 futs were down 0.3% by 7:30 a.m. ET while S&P 500 futures dropped 0.2%.

Europe’s Stoxx 600 index was 0.1% higher, building on its 0.4% gain from Thursday. The Bloomberg Dollar Spot index was modestly higher, while most Group-of-10 currencies remained under pressure amid muted trading. Treasuries were on the back foot, mirroring moves in German and UK bond markets. Oil and gold rose, while Bitcoin fell for a second-straight day. Focus today will be on the latest reading of the core personal consumption expenditures index, the Fed’s preferred inflation data.

Before the Intel report on Thursday, the S&P 500 index achieved its highest close in more than a month and the Nasdaq 100 rose 2% to a four-month high. Yesterday’s rally began with Tech earnings and then accelerated with macro data both a showing a resilient economy but one whose metrics are approaching Fed-preferred levels. Yesterday’s 7Y auction was strong, making 8 of 8 auctions this year where demand was strong enough to move yields lower.

Data on Thursday also showed US gross domestic product expanded at a faster-than-forecast pace into the end of 2022. That encouraged hopes the world’s biggest economy can achieve a soft landing, but could temper expectations of a Federal Reserve pivot towards rate cuts later this year. “Stronger data may negate the argument for recession, but then, it means the Fed has to be more hawkish,” Boardman-Weston said. “Markets are in a bit of a Catch-22.”

“You are seeing more and more companies turn cautious about the earnings outlook,” said Dan Boardman-Weston, chief investment officer at BRI Wealth Management. “If there is a recession, earnings will have to decline and price-to-earnings ratios have to come down.”

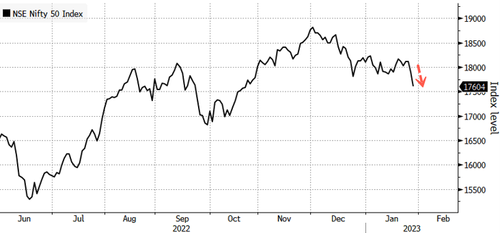

Another dampener was the continued rout in companies linked to Indian billionaire Gautam Adani. His corporate empire has shed some $50 billion of market value in less than two sessions following an explosive report from short seller Hindenburg. The losses dragged India’s Nifty 50 index to three-month lows.

In premarket trading, Intel shares plunged 11% after the chipmaker issued one of its weakest ever quarterly forecasts as a slump in personal-computer sales hits the business. Analysts say they were surprised by the magnitude of the weakness in the forecast. Visa shares rise as much as 1% in US premarket trading after the payments company’s earnings beat expectations, prompting analysts to raise their targets on the stock in the hope that the firm will be able to weather a weaker economic environment as travel rebounds and foreign exchange pressures ease. Bank stocks were lower in premarket trading, putting them on track to snap a two day winning streak. In corporate news, Wells Fargo kept Chief Executive Officer Charlie Scharf’s pay at $24.5 million for 2022. Meanwhile, South Korea’s financial regulator has fined US-based Citadel Securities almost $10 million over its use of high-frequency trades that allegedly disrupted the market. Here are some more notable premarket movers:

- Buzzfeed shares jump as much as 28% in US premarket trading, set to extend yesterday’s 120% rally on the digital-media firm’s plans to use OpenAI.

- Eastman Chemical’s results missed expectations and the chemicals group’s outlook implies an improvement across 2023 that may be viewed as ambitious, analysts say. Eastman shares fell 3% in extended trading after the update.

- Hasbro shares sink as much as 5.3% in US premarket trading after the toy and game maker reported weaker 4Q sales that fell short of analyst estimates. Jefferies says the quarter is just a “painful period” in the firm’s transformation, which will see it cut 1,000 jobs and reshuffle management. Truist Securities says the results raise concerns around the firm’s ability to grow in 2023.

- L3Harris outpaced estimates in its 4Q results and its outlook is good enough to match low expectations, analysts say. Shares in the aerospace and defense group rose 3% in after- hours trading.

- KLA Corp shares declined 5.5% in extended trading on Thursday after the semiconductor capital equipment company gave a third-quarter revenue forecast that was below expectations at the midpoint.

Despite Friday’s weakness, US stocks remain on track for their best month since July, while the Nasdaq 100 is on course for its fourth straight week of gains – its longest such streak since mid-August – as investors bet signs of easing inflation will prompt the Fed to ease the pace of rate hikes. While the Fed is set to hike interest rates by 25 basis points next week — shifting away from last year’s bigger moves — hopes for end-2023 rate cuts are “a step too far” and may end up being frustrated, according to Erick Muller, head of product and investment strategy at Muzinich & Co. Ltd.

“We will probably see the Fed say ‘we are entering the final phase but listen carefully guys: we will continue to raise rates,” Muller said. “A lot of volatility in rates will depend on the path of inflation from here.”

Victoria Scholar, head of investment at Interactive Investor, said Friday’s declines also suggested some profit taking after the strong run of gains. “On top of that, there’s growing caution ahead of the PCE price index, which could provide some clues into the US inflation outlook at the Fed’s next move,” she said. Meanwhile, a note from Bank of America showed investors continued to prefer non-US equities in the week through Jan. 25. European stock funds had $3.4 billion of inflows, the note said citing EPFR Global data, while US funds saw just $300 million.

And speaking of Europe, the continent’s equity indexes were slightly higher on the day and on course for a weekly gain as earning season continues in earnest. The Stoxx 600 is up 0.1%, led by outperformance in the energy, construction and consumer product sectors. Travel and retail fall. The Stoxx index has gained almost 7% so far, but caution has seeped in as company earnings trickle out. Here are some of the biggest European movers on Friday:

- LVMH rose to a fresh record high, up 0.8% in early trading as the market focused on the prospects of the Chinese market reopening for the luxury behemoth rather than its weak 2H operating profit margins

- SSAB gains as much as 11% as the Swedish steelmaker’s higher-than-forecast dividend and plans for a buyback offset its 4Q earnings miss, according to analysts

- Husqvarna rises as much as 16% after Germany’s Bosch said it would acquire shares in the Swedish lawn-care and outdoor equipment firm, increasing its stake to about 12%

- Sainsbury climbs as much as 6.5%, the most intraday since November, after convenience-store operator Bestway Group said it has acquired or agreed to acquire a 3.45% stake in the grocer

- JCDecaux gains as much as 6.6% after reporting better- than-expected 4Q revenue, even though the outdoor advertising firm’s China business was hit by a drop in mobility

- Adidas rises as much as 2.5% after the sportswear brand was upgraded to buy at Warburg, which said the company’s low starting point will ensure earnings will improve

- Hennes & Mauritz drops as much as 7.9%, the most since May, after the clothing retailer reported fourth-quarter gross margin that missed analyst estimates

- Remy Cointreau falls as much as 3.2% after the premium spirits maker’s US inventories overshadowed 3Q organic revenue that beat the average estimate

- Scor drops as much as 8.2%, the most intraday since July, after Chief Executive Officer Laurent Rousseau resigned less than two years into the role

- Vestas pares declines of as much as 5.6% as analysts said external challenges continue to weigh on the firm, but that there are signs of improvements

Earlier in the session, Asian stocks advanced for a sixth straight day, supported by mild risk-on sentiment ahead of US consumer spending data that would offer further clues on the Federal Reserve’s policy path. The MSCI Asia Pacific Index climbed as much as 0.6%, headed for its highest close since April. India’s benchmarks fell the most in the region, dragged by Adani Group shares. Hong Kong’s Hang Seng Index climbed despite increasing restrictions against China’s semiconductor industry. The gains in broader Asia track overnight moves in US markets, where stocks jumped as data showed that America’s economic growth is cooling somewhat and as tech shares rallied. Investors are awaiting data on US personal income and consumption as well as home sales later in the day, among the final set of data the Fed will analyze before setting rates next week.

“The disinflation impulse is likely to stretch further, as has been evident from CPI releases lately, likely continuing to build a case for a 25bps rate hike by the Fed next week,” Saxo Capital Markets strategists wrote in a note. With Friday’s gains, the MSCI Asia gauge is set to cap its fifth weekly advance. Shares in South Korea were among the top gainers in the region while Vietnam’s stock measure jumped in a catch-up rally as traders returned from the Lunar New Year holidays. Mainland markets reopen Monday. Next week is set to be one of the busiest this earnings season in Asia with over 200 companies reporting, according to Bloomberg-compiled data. Traders will assess the impact of higher interest rates and slowing demand on corporate profits in the region, with China’s reopening expected to provide some reprieve

Japanese equities posted modest gains after a tech rally drove peers higher in New York, with investors assessing the implications of the latest economic data including a slowdown in US economic growth. The Topix Index rose 0.2% to close at 1,982.66 in Tokyo, while the Nikkei advanced 0.1% to 27,382.56. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index gain, increasing 2.7%. “US GDP data showed that interest rate hike is slowly taking effect, and concerns about further hikes have receded,”said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management.

Indian stocks declined for a straight second session on Friday as a selloff in Adani Group shares deepened after a damaging report from a short-seller. The S&P BSE Sensex shed 1.5% in Mumbai as traders returned from a one-day holiday, while the NSE Nifty 50 Index extended its drop to 1.6%. Friday’s drop was biggest single-day plunge since Dec. 23 for both gauges while their two-day slide was most since Sept. 26. For the week the indexes slipped more than 2% each and are more than 6% away from their all-time high level seen early December. The India VIX Index, a measure of volatility expectations, rose 18%, the most since Feb. 24, tracking plunge in the benchmark. S&P BSE AllCap Index, India’s broadest gauge by number of companies, saw 1006 companies declining while 158 advanced. Adani Green Energy, Adani Transmission and Adani Total Gas all slumped 20% in the second trading session after US investment firm Hindenburg Research released a report alleging financial malpractice. The fresh bout of selling happened as market participants evaluated the impact of US short-seller Hindenburg Research’s report on Adani Group, Nishit Master, a portfolio manager with Axis Securities said in note. Markets will likely stabilize over the next few days as investors opt for bargain buying as good stocks with history of free cash flow generation are available at reasonable valuations, he added. Foreign investors have been sellers of Indian shares this month, taking out $1.6 billion through Jan. 24, after net selling $167 million in December.

The Dollar Index is flat ahead of US PCE data later today, trading mixed against its Group-of-10 peers, though currencies largely consolidated recent moves. The yen led gains and the pound and the Swedish krona were the worst performers and the pound underperformed its G10 rivals.

- The euro traded in a narrow 1.0866-1.0900 range. Volumes were 60% above recent averages Thursday as traders position for next week’s meetings by the Fed and the ECB. European bonds slipped, led by the belly, and 10-year German yields headed for their biggest weekly increase so far in 2023

- The pound and gilts slipped, with the UK currency heading for its first week of losses against the dollar since the start of the year. BOE also meets next week

- The yen strengthened after Tokyo inflation data beat estimates, adding to expectations that the Bank of Japan may tweak its ultra-loose monetary policy. Tokyo consumer prices excluding fresh food rose 4.3% y/y in January, fastest pace since 1981; estimate 4.2% gain

- New Zealand dollar was steady after paring an earlier advance. Business confidence index rose to -52 in January from -70.2 in December, according to ANZ Bank New Zealand

In rates, treasuries were pressured lower, following losses across core European rates with Italian bonds notably underperforming over the London session. US yields were cheaper by up to 6.5bp across 10-year sector which leads losses on the day, cheapening 5s10s30s fly by 2.6bp and steepening 2s10s by 3bp; in 10-year sector bunds lag by additional 1.5bp on the day while Italian bonds trade 5bp cheaper. US session focus switches to data with US personal spending and PCE deflator expected.

In commodities, oil prices extended gains, benefiting signs of a resilient US economy and China’s continued recovery; WTI added 1.2% to trade near $82.00. Analysts at Goldman Sachs predicted crude prices to head to $100 a barrel later this year from current levels just above $80. Spot gold is little changed at $1,928/oz. Gas markets were pressured as Freeport’s Texas LGN plant has received approval to restart alongside forecasts for elevated European temperatures next week. EU proposed a price cap on Russian premium oil products of USD 100/bbl and USD 45/bbl on discounted oil products, while EU governments are to discuss the proposals today before entry into force on February 5th.

Bitcoin is little changed and holding around the USD 23k mark, with fresh catalysts limited and focus on upcoming key US data.

Looking at the day ahead, data releases from the US include personal income, personal spending and the Fed’s preferrered inflation indicator, the core PCE, as well as December’s pending home sales and the University of Michigan’s final consumer sentiment index for January. Over in Europe, there’s also French consumer confidence for January, the Euro Area money supply for December. Lastly, earnings releases include American Express, Charter Communications and Chevron.

Market Snapshot

- S&P 500 futures down 0.3% to 4,061.25

- MXAP up 0.4% to 170.70

- MXAPJ up 0.2% to 560.17

- Nikkei little changed at 27,382.56

- Topix up 0.2% to 1,982.66

- Hang Seng Index up 0.5% to 22,688.90

- Shanghai Composite up 0.8% to 3,264.81

- Sensex down 1.5% to 59,300.13

- Australia S&P/ASX 200 up 0.3% to 7,493.83

- Kospi up 0.6% to 2,484.02

- STOXX Europe 600 up 0.1% to 454.54

- German 10Y yield little changed at 2.25%

- Euro little changed at $1.0884

- Brent Futures up 1.4% to $88.67/bbl

- Gold spot down 0.1% to $1,927.47

- U.S. Dollar Index little changed at 101.84

Top Overnight News from Bloomberg

- Back-to-back interest-rate increases of 50 basis points are approaching from the European Central Bank, whose battle with persistent inflation will see it hike borrowing costs until May, according to a Bloomberg survey of economists

- The IMF said Sweden might have to require banks to hold more capital and increase funding for the financial regulator, as risks rise in the country’s property sector

- Japan and the Netherlands are poised to join the US in limiting China’s access to advanced semiconductor machinery, forging a powerful alliance that will undercut Beijing’s ambitions to build its own domestic chip capabilities, according to people familiar with the negotiations

- Nearly a year into an invasion that was supposed to take weeks, Vladimir Putin is preparing a new offensive in Ukraine, at the same time steeling his country for a conflict with the US and its allies that he expects to last for years

- Putin demanded his government to come up with a plan for re-jigging Russia’s oil levies in a move to offset the effects from western energy sanctions on the nation’s budget revenues

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a positive bias after the mostly strong US data releases, albeit with advances capped as participants also digested earnings including disappointing results from Intel, and firm Tokyo CPI data. ASX 200 was marginally higher on return from holiday with the index propped up by tech and financials. Nikkei 225 lacked decisiveness following firm Tokyo CPI data in which core inflation rose at its fastest pace since 1981 and further added to the pressure for the BoJ to rethink its ultra-easy policy. Hang Seng was choppy and struggled to sustain early gains after data showed a wider contraction in Hong Kong’s exports and with Japan and the Netherlands set to join the US’s chip curbs on China.

Top Asian News

- Japan and the Netherlands agreed to join the US on China chip curbs with US, Dutch and Japanese officials set to conclude talks as early as today, while the Netherlands is to expand restrictions on ASML (ASML NA) and Japan will set similar limits on Nikon (7731 JT), according to Bloomberg and Reuters.

- Hong Kong Dollar Bears Stage a Comeback as Funding Costs Slide

- India Regulator to Study Hindenburg Report on Adani Group: Rtrs

- Apple’s iPhone Dominated China Last Quarter Despite Disruptions

European bourses are near unchanged levels, Euro Stoxx 50 +0.3%, though a very mild positive skew is seen in quiet post-earnings newsflow. LVMH slips with attention on lower margins, Intel (-9.5% pre-market) lags after a miss on the headline metrics and a weak market outlook. US futures are lower across the board with the NQ -0.5% lagging post-INTC; focus for the session ahead is firmly on US PCE before next week’s hefty Central Bank docket.

Top European News

- UK Chancellor Hunt says the best cut in tax right now would be a cut in inflation, today’s announcement is more of a general plan/guide, will need to wait for budgetary events for further details. Should aim for the most competitive tax regime of any major nation but sound money needs to come first. Need restraint in public spending. Unlikely that we will have the headroom to cut business taxes in March.

- 7 EU nations Finance Ministers have sent a letter to Trade Commissioner Dombrovskis have pushed back on plans for “permanent or excessive non-targeted subsidies” in response to the US green subsidies/Inflation Reduction Act, via Politico.

- IMF Article IV review of Sweden: mild recession likely, 2023 growth -0.3%. HICP expected to moderate to 6.5% in 2023. Strong employment is a positive, should somewhat offset household burden from rates/inflation

- Vestas Sees More Pain Ahead for Beleagured Wind Industry

- Sainsbury Rises After Bestway Group Buys Stake, May Add More

- Libya Says More Deals to Follow Eni’s $8 Billion Gas Investment

- Ionos Owners See IPO Proceeds Raising Up to €543 Million

FX

- DXY is firmer but somewhat mixed vs peers, with the index sub-102.00 as the JPY outperforms after hot Tokyo CPI.

- At best, USD/JPY tested but failed to move below 129.50 to the downside, and remains towards the lower-end of a 129.51-130.26 range.

- Overall, EUR, CAD and CHF are little changed awaiting impetus from the afternoon US data docket with specific developments elsewhere limited; pivoting, 1.0880, 1.3320 and 0.92 respectively.

- GBP is the main laggard for no obvious/specific reason, Cable has struggled to make any move above 1.24 stick, with EUR/GBP above 0.8800 at best though the move stalled ahead of the 0.8811 21-DMA.

Fixed Income

- Core benchmarks have continued to slip despite a limited early-doors bounce/ any positivity from another well-received US auction.

- Bunds have given up a handful of touted interim levels during their descent to a 137.09 low, with the associated yield above 2.25%, though shy of the 2.27% 11th January best.

- Gilts fell to a 104.30 trough, but remain above recent lows, while the UST decline has seemingly paused for breath above 114.15 ahead of US PCE.

Commodities

- WTI and Brent March futures have been moving higher since the European cash equity open, with the former back above USD 82/bbl (vs low USD 81.08/bbl) and the latter north of USD 88.50/bbl (vs low USD 87.55/bbl), in limited fresh newsflow.

- Gas markets are pressured as Freeport’s Texas LGN plant has received approval to restart alongside forecasts for elevated European temperatures next week.

- EU proposed a price cap on Russian premium oil products of USD 100/bbl and USD 45/bbl on discounted oil products, while EU governments are to discuss the proposals today before entry into force on February 5th.

- Strikes at TotalEnergies (TTE FP) sites have been suspended, will be proposed again on January 31st, via CGT Union.

- Spot gold is little changed in narrow sub-15/oz parameters with any potential upside capped by the firmer USD, base metals are mixed but contained overall.

Geopolitics

- Japan is to impose additional sanctions against Russian individuals and entities, while it will impose an additional export ban on military-related items to Russia as part of sanctions. according to Reuters.

US Event Calendar

- 08:30: Dec. Personal Income, est. 0.2%, prior 0.4%

- Personal Spending, est. -0.1%, prior 0.1%

- Real Personal Spending, est. -0.1%, prior 0%

- 08:30: Dec. PCE Deflator MoM, est. 0%, prior 0.1%

- PCE Deflator YoY, est. 5.0%, prior 5.5%

- PCE Core Deflator YoY, est. 4.4%, prior 4.7%

- PCE Core Deflator MoM, est. 0.3%, prior 0.2%

- 10:00: Jan. U. of Mich. Sentiment, est. 64.6, prior 64.6

- Current Conditions, est. 68.6, prior 68.6

- Expectations, est. 62.0, prior 62.0

- 1 Yr Inflation, est. 4.0%, prior 4.0%; 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- 10:00: Dec. Pending Home Sales YoY, est. -35.4%, prior -38.6%

- Dec. Pending Home Sales (MoM), est. -1.0%, prior -4.0%

- 11:00: Jan. Kansas City Fed Services Activ, prior -5

DB’s Jim Reid concludes the overnight wrap

I’m relieved to nearly make it to the end of the week in one piece. Whilst my fever has gone I’m still weak and at home there’s 2 sets of penicillin being taken, one perforated ear drum, and a wife who went to bed at just after 7pm last night. In the olden days there would be a big cross on our door. We are supposed to be going to a containment room tonight, where you get locked into a room for an hour and have to find a way out by deciphering all the clues with your team. Sounds like hard work!

Markets deciphered a lot of mixed clues yesterday and, after some cause for concerns, decided that it was easier to shrug it all off and drive equities to fresh 2023 highs. Earnings also helped the mood, to be fair. The S&P 500 closed up +1.10% (YTD highs), just as credit spreads tightened and oil prices recovered from their losses earlier in the week. We still think we are in a positive sweet spot but there was certainly stuff to worry about in the US data yesterday. It depends on whether you saw the glass half full or half empty element of it.

When it came to those data releases, an important one was the Q4 GDP release from the US, which showed the economy grew by an annualised +2.9% at the end of last year (vs. +2.6% expected). That’s certainly some distance from a recession and there was lots of focus on it being above consensus. However, a key point of caution is that 1.5pp of it was attributable to inventory growth, with net exports and the government adding 0.6pp each. Final sales to private domestic purchasers was soft and showed signs of grinding to a halt. So the details weren’t as flattering as the headline number might suggest at first glance. In the meantime though, the report also offered confirmation that inflation was slowing down, with the PCE price index that the Fed targets up by an annualised +3.2% in Q4, the slowest since Q4 2020, whilst core PCE was up +3.9%, the slowest since Q1 2021.

It wasn’t just the GDP release that aided hopes of a soft landing, however, as the weekly initial jobless claims for the week ending January 21 came down to 186k (vs. 205k expected). That’s their lowest level since April, and this isn’t just a blip either, since the 4-week moving average fell beneath 200k for the first time since May. Continuing claims were up to +1,675k (survey +1,658k) though so a bit mixed.

Net, net the market took the more positive side of the ledger though and investors moved to price in slightly more central bank rate hikes over the coming months. For instance, the rate priced in by Fed funds futures for the December meeting was up by +3.8bps to 4.47%. Similarly, the ECB rate priced for December was also up +4.7bps. That led to a noticeable rise in sovereign bond yields, with the 10yr Treasury yield up +5.3bps on the day to 3.495%, followed up by a +3.13bps move overnight in Asia to 3.53%. The US dollar (+0.19%) also advanced into the afternoon before giving back some gains toward the end of the US session. In Europe it was much the same story, with yields on 10yr bunds (+5.8bps), OATs (+7.7bps) and BTPs (+8.6bps) all posting a solid increase as we approach next week’s round of central bank meetings.

More details on that equity rally now. It was a big roundtrip for the S&P 500, which had been up +0.91% in the first 15 minutes of trading, before being down nearly -0.1% on the day just 90 minutes into trading. Once all the data was absorbed risk rallied through the rest of the day right through the European close. In Europe the STOXX 600 came down from its own intraday high of +0.76% to end at +0.42%, but it missed out on the last lag of the rally last night. On a sectoral basis, energy stocks (+3.32%) were the biggest outperformer in the S&P, aided by a +1.89% rise in Brent crude oil prices that took oil back to $87.47/bbl and then another +0.4% higher to $87.82/bbl in early trading in Asia. Megacap tech stocks were another winner, with the FANG+ index up +3.02% to its highest level since September thanks to a surge in Tesla (+10.97%) after its earnings release. However, some of the more defensive sectors like consumer staples (-0.28%) lagged behind the broader index.

Intel was down -9.7% in after-market trading following its earnings announcement. The chipmaker surprised investors by offering a negative earnings forecast for Q1’23 and the lowest quarterly revenue target since 2010. The company has pointed to poor PC sales as the main driver of the expected weakness. Visa was trading +1.1% higher in post-market trading despite seeing purchase volumes rise less than expected in Q4’22, and expectations that higher prices will slow consumer demand. Against that backdrop, US stock futures are indicating a negative start with contracts tied to the S&P 500 (-0.29%), as well as the NASDAQ 100 (-0.61%), ticking down.

Asian equity markets are struggling to gain traction this morning despite that strong tech-led handover from Wall Street overnight. Across the region, the KOSPI (+0.70%) is leading gains with the Nikkei (-0.03%) and the Hang Seng (-0.05%) slightly below the flatline. Elsewhere, markets in China are closed for the Lunar New Year.

In early morning data, Tokyo’s CPI for January came out with an upside surprise as headline inflation advanced to +4.4% year-on-year (vs. +4.0% expected), hitting a four-decade high. It followed a downwardly revised +3.9% increase in the previous month. Meanwhile, the Japanese Yen (+0.15%) is positively responding against the dollar, trading at $130.03 as the stronger inflation data reinforced market expectations that increasing quickening inflation could push the Bank of Japan to move away from its ultra-easy policy.

Looking at yesterday’s other data, US durable goods orders were up by +5.6% in December (vs. +2.5% expected), although excluding transportation they were much as expected at -0.1% (vs. -0.2% expected). Otherwise, new home sales in December came in at an annualised 616k (vs. 612k expected), with a downward revision in November’s figure to 602k (vs. 640k previously). Lastly, the Kansas City Fed’s manufacturing activity index beat expectations at -1 (vs. -8 expected), which is the first increase in that measure in 6 months.

To the day ahead now, and data releases from the US include personal income, personal spending and PCE for December, as well as December’s pending home sales and the University of Michigan’s final consumer sentiment index for January. Over in Europe, there’s also French consumer confidence for January, the Euro Area money supply for December. Lastly, earnings releases include American Express, Charter Communications and Chevron.