All Hail Texas Socialism

By Russell Clark of the Capital Flows and Asset Markets substack,

My big trade has been long commodities, short treasuries. Part of this was driven by political change, which continues to be supportive. Another part of this trade was assuming that we would follow a typical commodity cycle.

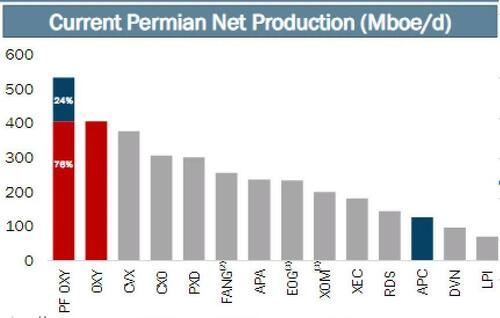

In a typical commodity cycle high prices attract capital and increased activity, this cause prices to fall and activity to fall as capital leaves, and then leaving a set up for higher prices again. In the energy space, and particularly natural gas, only the US has really seen a huge increase in activity, but even here we saw signs of capital discipline beginning to emerge. In 2019 purchase of Anadarko by Occidental was very bullish in my mind, as it further consolidate the all important Permian region. The idea is that a consolidated market would lead to more capex discipline.

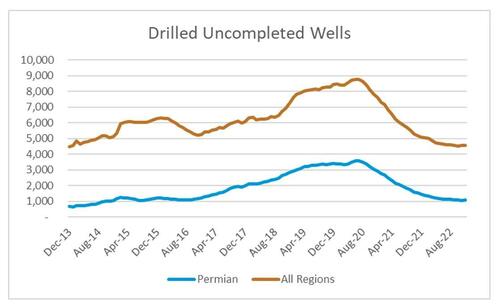

Using EIA data on Drilled Uncompleted Wells, that is exactly what we saw. Permian drillers reduced the pace of drilling, and reduced their inventory of wells. This meant that an overhang had been removed. Bullish for energy prices.

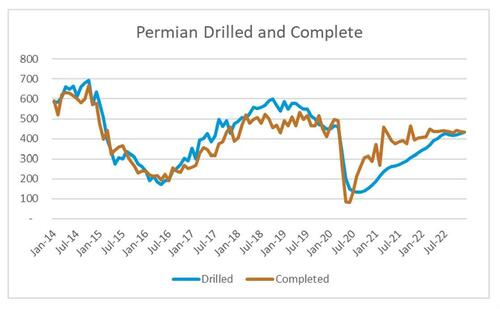

While the reduction in inventory is very positive in my view, for the oil and gas industry is has been a no brainer to raise production without increasing capex. Completed wells very quickly returned to pre-Covid levels.

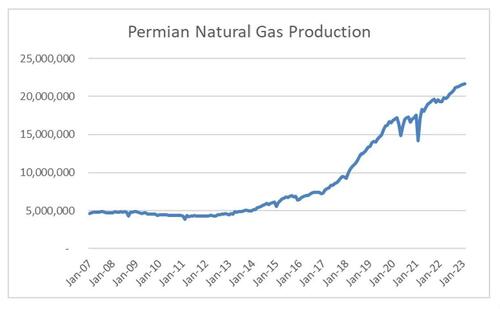

This very rapid increase in complete wells has led to Permian natural gas production rising very quickly. This increase is slower that 2017/8 period, but still surprisingly large.

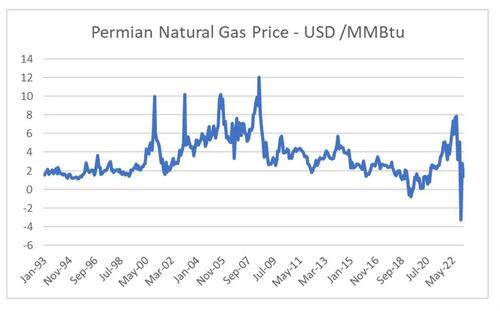

Natural gas is the most sensitive commodity to over production. It is produced as a by-product of shale oil drilling, so a high oil price can lead to over production, and even negative pricing of natural gas in the Permian region, as we saw in 2019. As theory would predict, consolidation led to a much strong natural gas price in 2022, but over the last few months, natural gas prices have collapsed again, although pricing is very volatile and heavily influenced by weather.

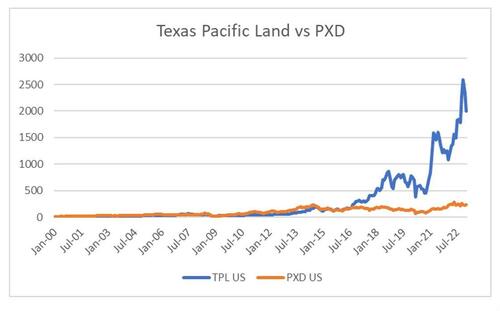

Many years ago I characterised shale drilling as a capital destruction machine. The drillers needs to constantly add new wells as their existing wells have very fast decline ratio, and this meant that drillers needed to constant buy new land. This meant you were better off buying Permian land, than buying the drillers. That is the land owners had the whip hand in any price negotiation, and capital that was given to drillers would end up in the hands of the land owner. Many oil based private equity firms did exactly that, buy buying cheap land, and getting it permit ready to sell to desperate oil drillers. The closest (but not perfect) listed proxy for this strategy was Texas Pacific Land (TPL). Comparing share price performance of TPL to leading Permian producer, Pioneer Resources (PXD) shows who is the real beneficiary of shale drilling.

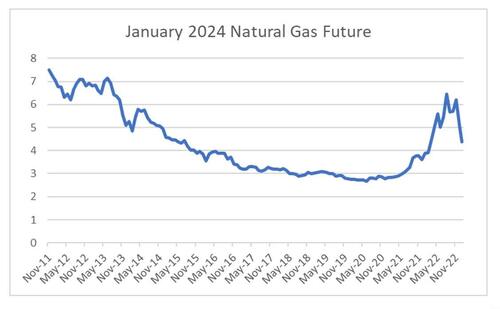

So I am left in a quandary. Falling inventory of DUC wells as well as the purchase of Anadarko by Occidental would suggest an industry that is acting to maximise returns. The surging production of natural gas, falling prices in the Permian region, and the continued outperformance of the landlord over the producers suggest that US shale producers have still have no discipline. What to do? Back in 2012, the long dated market for natural gas was already seeing a massively oversupplied market for natural gas. The January 2024 future is no longer long dated, but in early 2021 it picked up a much tighter supply going forward. That is the long dated natural gas market seems efficient to me.

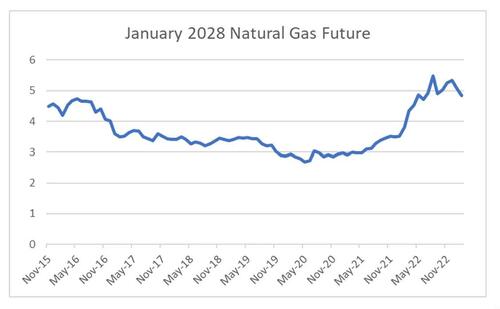

A long dated natural gas future now would be 2028. It has stalled around the USD 5 mark, after a big run up in 2022. This looks about fair to me given the fall in DUCs and better market structure. But the risk is that this enters into a bear market. For equity investors, it is noticeable that weakness in natural gas pricing has coincided with a much more upbeat stock market.

Since the GFC, US market has often been portrayed as been propped up by the Federal Reserve. I am beginning to wonder if it has not been propped up the shale industry, that is willing to pay top dollar for land, to produce natural gas at low to negative prices. Who knew the Texas oil industry were such socialists, sacrificing profits for the good of all Americans? If Permian producers continue to pursue socialist pricing for natural gas, commodity pricing in general is likely to be weaker than expected, and popular retail trades like uranium are likely to get smashed. Why build a nuclear plant, when renewables and natural gas production is likely to keep energy prices low?

Tyler Durden

Tue, 02/07/2023 – 13:41

via ZeroHedge News https://ift.tt/75CY3q4 Tyler Durden