Stocks Soar Despite Hawkish Rate Scare Ahead Of CPI

US equity markets surged today ahead of a week of data that could show inflation re-accelerating (CPI revisions), retail sales rebounding (high-frequency spending data), and business sentiment improving (Philly Fed forecasts). Nasdaq was the best performer while the rest of the majors were grouped extremely tightly together…

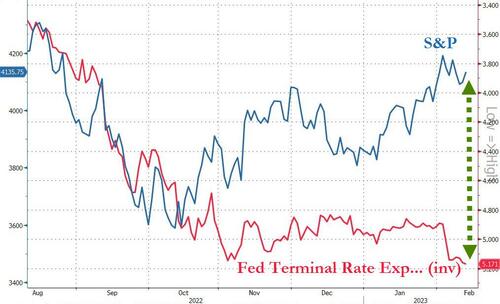

But, interestingly, short-term interest-rates actually moved (hawkishly), extending the post-payrolls repricing of an overly dovish perspective on terminal rates (higher) and rate-cuts (higher for longer)…

Source: Bloomberg

Bear in mind that relative to the market’s terminal rate expectation, the US equity market appears to be pricing in a 6-7 25bps rate-cuts (which we would suggest will only happen if the fecal matter really smashes into the rotating object)…

Source: Bloomberg

Which is interesting since, with a 3-month lead, financial conditions have started to tighten recently…

Source: Bloomberg

Notably, despite the tech gains, GOOGL continued to lag…

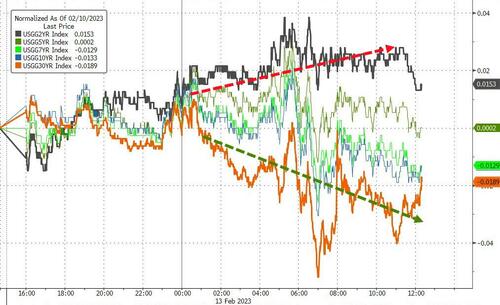

Bonds were mixed today with the long-end outperforming (10Y -2.5bps, 2Y +1.5bps). This is notable given a very heavy corporate calendar is expected to push the long-end yields higher..

Source: Bloomberg

The dollar drifted lower from the start of the European session after some strength in Asia…

Source: Bloomberg

Bitcoin slipped further, unable to hold a brief break above $22k…

Source: Bloomberg

Gold prices slipped lower (despite a weaker dollar)…

Oil prices tumbled, erasing earlier gains, after news the US will sell 26m more barrels from its strategic crude reserve…

Retail gas prices have slipped lower in recent days but wholesales prices are on the rise again, suggesting gasoline will be getting more expensive for mom-and-pop again soon…

Source: Bloomberg

Finally, the market (CPI swaps) is pricing in a small beat tomorrow (hotter than expected CPI)…

Source: Bloomberg

How will the equity market handle that?

As a reminder, the S&P is back around the same level it was at when the December CPI hit, things went downhill fast after that (but that was influenced by the FOMC) and note that stocks ramped into January’s CPI but faded after it…

We shall see this time.

Tyler Durden

Mon, 02/13/2023 – 16:01

via ZeroHedge News https://ift.tt/ZnJDfTa Tyler Durden