SPAC Mania Ends In Bankruptcies And Fire Sales

The Securities and Exchange Commission’s crackdown on SPACs, top investment banks scaling back activity in the space, and mounting macroeconomic headwinds have led to a continued freeze and the start of a possible de-SPAC bankruptcy wave.

The latest figures about the SPAC market collapse come from a recent note via Water Tower Research’s chief analyst Robert Sassoon, who told clients, “depleted SPAC trust funds, along with reduced availability of PIPE financing, have left many de-SPACs underfunded.”

“Coincident with prevailing economic headwinds, many de-SPACs are facing financial challenges that have forced some into bankruptcy,” Sassoon wrote. He continued:

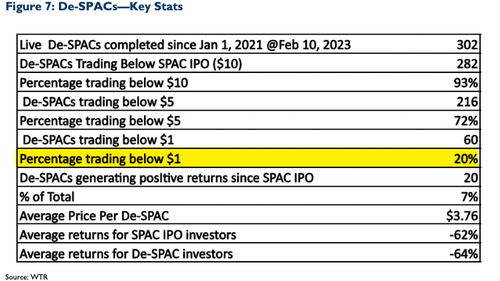

With about one-fifth of companies (55) de-SPACed since the start of 2021 currently trading at distressed levels below $1, there are strong expectations that there will be an addition to this total in the coming months. We would point out that the number of de-SPACs trading below $1 is larger in Figure 7, which includes five companies that have executed reverse stock splits that we have adjusted back to a pre-split basis in order to provide a more accurate picture of performance.

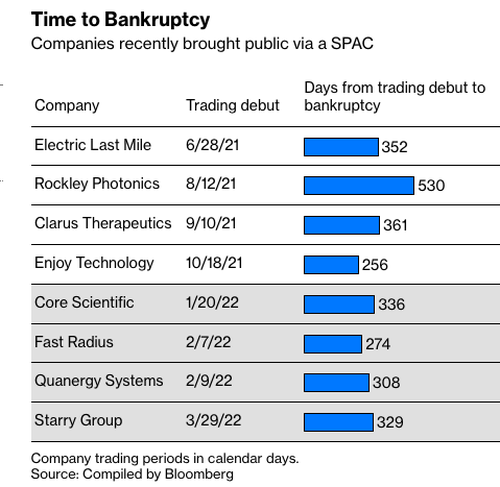

Financial lifelines are running out for companies that went public via a SPAC. Bloomberg listed eight companies that went public via mergers with “blank-check” companies only to file for bankruptcy less than a year after debuting on capital markets.

“The value destruction has been spectacular,” Dan Zwirn, co-founder of Arena Investors LP, a debt-focused investment firm, said.

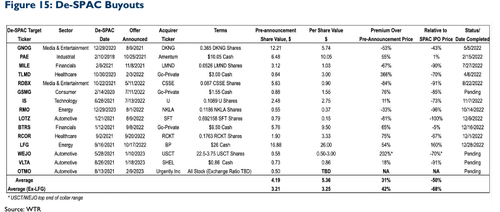

What Zwirn sees next for the de-SPAC universe is a possible bankruptcy wave. He said some of these companies would be wound down or sold for pennies on the dollar. Bloomberg data shows at least 12 that completed SPAC mergers have agreed to buyouts for much less than they were worth.

“A lot of the problems with the de-SPAC’d companies is that they’re relatively early-stage, capital-intensive companies that are more risky in general,” Usha Rodrigues, a law professor at the University of Georgia and one of the leading academic experts on SPACs, said.

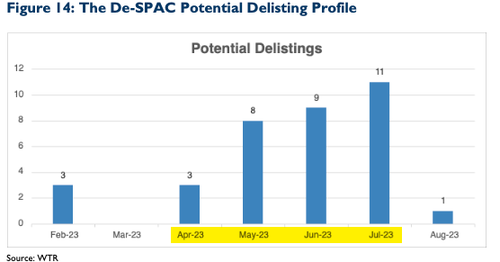

With 20% of de-SPAC’d companies trading sub-dollar, delisting from major exchanges is set to soar in the coming months, making it even harder for companies to raise money.

The good news is, as Sassoon pointed out: “The de-SPAC universe is being compressed by a raft of buyout and go-private transactions, which have been gathering momentum since last year as acquirers identify gems in the de-SPAC value wreckage.”

Still, a de-SPAC bankruptcy wave lurks as funding pipelines freeze.

Tyler Durden

Tue, 02/28/2023 – 14:30

via ZeroHedge News https://ift.tt/PiRljED Tyler Durden