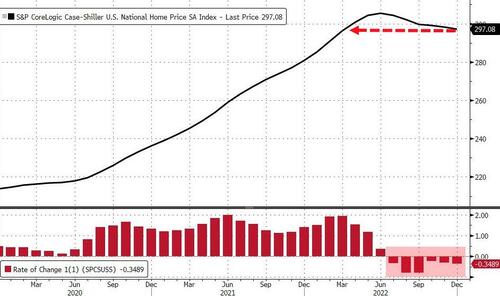

US Home Prices Tumbled For 6th Straight Month In December

National home prices fell for 6 straight months up to December (the latest data from S&P Global’s Case-Shiller index), dropping more than expected (-0.51% MoM vs -0.40% MoM exp). This slowed the annual growth of prices to the weakest since July 2020…

Source: Bloomberg

The headline national home price index is at it lowest since March 2022…

Source: Bloomberg

“The prospect of stable, or higher, interest rates means that mortgage financing remains a headwind for home prices, while economic weakness, including the possibility of a recession, may also constrain potential buyers,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“Given these prospects for a challenging macroeconomic environment, home prices may well continue to weaken.”

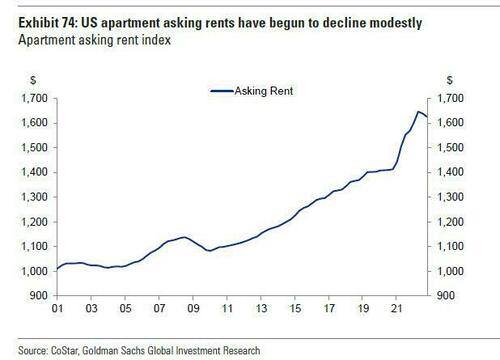

Asking rents are now tracking home prices lower…

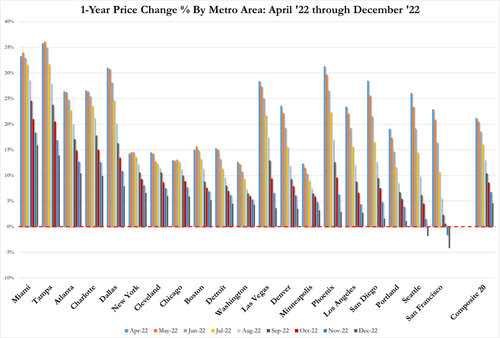

Miami, Tampa, and Atlanta reported the highest year-over-year gains among the 20 cities surveyed (although every city is seeing price growth slow)…

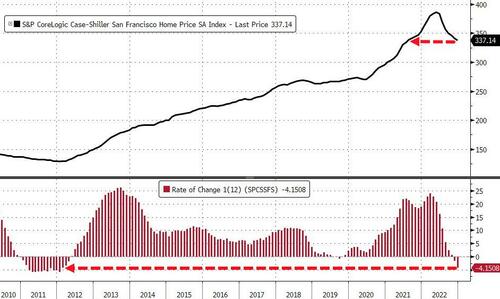

…but San Francisco prices are plummeting the fastest with prices down -4.2% YoY, the biggest annual drop since March 2012 to the lowest since July 2021…

Source: Bloomberg

Bear in mind that these prices are extremely lagged (December) which is where mortgage rates began to flatten before turning up dramatically in February…

Source: Bloomberg

Do not expect any pause in home prices yet… and besides, that is not what The Fed wants.

Tyler Durden

Tue, 02/28/2023 – 09:07

via ZeroHedge News https://ift.tt/h3CPrmy Tyler Durden