Bank Failures & Crypto Collapse – Bitcoin Emerges As ‘North Star’

Over the last 2 weeks, the global financial system has faced its biggest crisis since the Lehman dominoes started to fall.

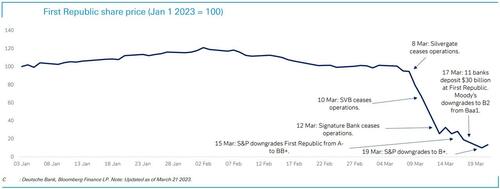

First Republic has experienced a serious confidence crisis, characterized by deposit flight that continues despite an injection of $30 billion in deposits last Friday. First Republic has been downgraded twice by S&P; and its share price has dropped by nearly 87% in March so far.

In addition, three banks have closed their doors: Silvergate Bank, Silicon Valley bank, and Signature Bank.

In that same period, Deutsche Bank notes that, although the crypto winter is far from over, Bitcoin “could be emerging as a ‘north star’.”

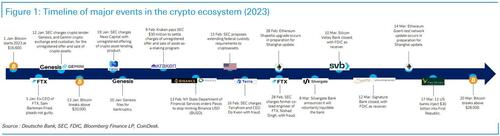

It has been a year full of major events for the crypto ecosystem.

From the beginning of 2023, the SEC has made efforts to crack down on the crypto market, charging several key players as well as proposing an extension to federal custody requirements to cryptoassets.

Regulatory summary pic.twitter.com/C7GE94KK0F

— Gabor Gurbacs (@gaborgurbacs) March 22, 2023

The effect of FTX’s bankruptcy continues to weigh on the space, with crypto lender Genesis filing for bankruptcy on January 20, and a key bank for crypto players Silvergate closing its doors on March 8. SVB has likewise collapsed, with significant ripple effects seen in the collapse of the crypto-friendly bank Signature Bank, which was previously home to the crypto central payments processing platform Signet.

First Republic is now facing liquidity issues, and Deutsche notes a flight to quality in the crypto market is likely underway, as investors rush to hold Bitcoin over other cryptocurrencies.

Bitcoin’s dominance increased by nearly 10% since the start of March.

And although Bitcoin has performed strongly, Deutsche note that jitters remain across the crypto market, noting however, that there should be little spillover into traditional financial markets.

The collapse of TerraUSD and FTX demonstrated the lack of significant feedback loops into TradFi. Lending and borrowing have mostly been contained within the crypto industry, with crypto players assuming the role of de facto banks. This interconnectedness means contagion risk within the crypto industry is significant. However, traditional banks have not embraced the crypto market due to regulatory and reputational risks: (i) crypto makes up 0.01% of exposure for banks; and (ii) it is unlikely that the crypto ecosystem holds enough stocks/bonds to move the market.

In contrast, during the 2008 financial crisis, when housing prices declined and triggered a crisis in the subprime mortgage market, significant bank exposure to the housing market saw contagion in the traditional financial system. The size of the crypto market (approximately 2.9% of the US equity market), and the paucity of linkages to TradFi means spillover risk is likely to be limited.

But Bitcoin has pushed higher, nearing $29,000 this week, and crypto is the best performing asset-class of the year…

Deutsche reiterates the potential for Bitcoin as a ‘north star’ here as the correlation with the S&P 500 has now reached its lowest level since September 2021, having tumbled even further since the collapse of Silvergate…

However, Deutsche concludes, now is the time to put up or shut up for crypto assets as they say the “end of magical thinking” has dawned and real-world practicality needs to emerge:

Though history does not repeat itself, the recent digital-assets boom has had echoes of the dot-com bubble, with all its “irrational exuberance.” Low interest rates in the late 1990s reduced borrowing costs, which enabled a surge of new internet start-ups. Entrepreneurs could capitalise on high information barriers (because the technology was still relatively new), and venture capitalists were eager to buy into novelty. Sky-high valuations then made it even easier to raise capital.

However, many of these business models were never sustainable, and they soon began to falter, especially as more established companies entered the mix. By October 2002, the Nasdaq had shed all the gains amassed during the bubble, tumbling 78% from its peak in March 2000. Though many companies failed, the underlying technology has survived, and we now use it every day.

In a similar way, we seem to have reached a point in the development of cryptocurrency, the metaverse, and NFTs, where we must move past wishful thinking and begin to ask what technological developments they might bring. The story appears similar to that of Tesla’s, as Deutsche says the “irrational exuberance” must pass and the true value-add of these developments must make itself apparent.

Digital assets and blockchain-based technologies could follow a similar pattern. As has been said by Robert Schiller on the dot-com era: “Nothing important has ever been built without ‘irrational exuberance.”

Tyler Durden

Sat, 03/25/2023 – 13:00

via ZeroHedge News https://ift.tt/kehmR9M Tyler Durden