Small Caps Soar As Tech Tumbles – Soft-Landing Narrative Builds

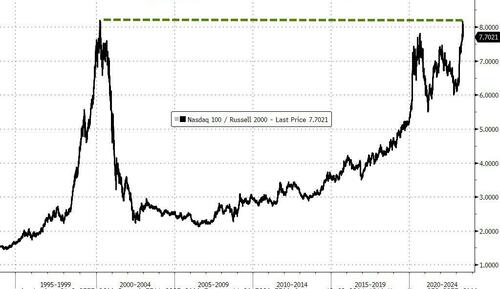

The recent escape-velocity melt-up in mega-cap tech – at the expense of almost every other asset – sent relative valuations to a remarkably coincidental level. The ratio of Nasdaq 100 to Russell 2000 hit its Feb 2000 (DotCom peak) record high last week as the blowout jobs report hit…

Source: Bloomberg

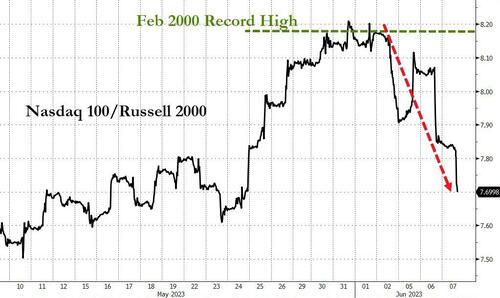

We asked at the time: “Did the QQQ/RTY trade just peak?”

5 days later, we have an answer – yes, bigly!

Source: Bloomberg

As Small Caps are up 7% while Nasdaq is down 0.5%…

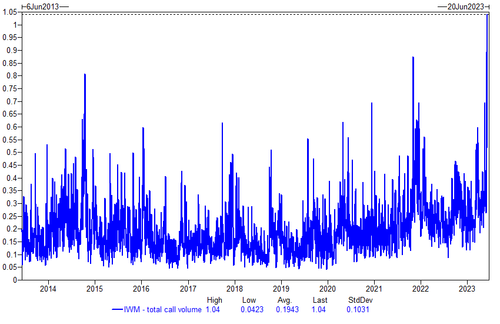

Today’s continued Small Cap outperformance follows record call volumes in IWM yesterday…

Notably, as Goldman Sachs points out, the soft-landing narrative is once again gaining traction and so-called safe-haven flows into mega-cap tech are unwinding (as shown below Goldman’s ‘Soft Landing’ basket is breaking out)…

Source: Bloomberg

IWM may highlight a general theme of “bargain shopping”, wherein those sectors & names which have struggled, finally catch a bid.

Perhaps most ominously, the recent exuberance in Nasdaq’s big names has come at a time of tightening financial conditions as ‘AI trumped The Fed’ – is that exuberant unwind about to assert itself?

Source: Bloomberg

Finally, adding more ammunition to this reversal, Goldman notes that CTAs are currently short R2K (the only index this cohort is short) and providing a tailwind for the market with one month baseline demand estimates the largest in two years.

In other words, as we noted previously, while the S&P may continue to go nowhere (and especially the equal-weighted S&P), prepare for a violent reverse rotation below the surface as the historic outperformance in tech, and crushing underperformance in small caps, is set go in the other direction.

Tyler Durden

Wed, 06/07/2023 – 12:20

via ZeroHedge News https://ift.tt/JGiHFM6 Tyler Durden